High-fives in order for casinos reopening, but can demand be sustained?

If it were socially acceptable, Southern Nevada casino operators would be high-fiving each other for the joyous reopening of Clark County’s more than 200 licensed properties Thursday.

Now comes the hard part — sustaining and growing the momentum.

Union Gaming analyst John DeCree, who has an advantage over many of his peers by being based in Las Vegas, made the rounds Thursday and provided investors with more than 40 pictures from a tour of Strip, downtown and locals properties as well as some thoughts about what he saw.

“We experienced hotel check-in lines at almost every Strip casino we visited, and particularly full lines at Bellagio and Flamingo,” DeCree said in his report. “Caesars Palace had the most active gaming floor throughout the day. As expected, parking lots and porte cocheres showed an overwhelming number of California drive-in customers.”

DeCree said it appeared operators accurately forecast the demand.

“Our overall take is that there appears to be enough demand to meet the limited supply on the Strip,” he said. “At a few properties, like Caesars Palace and New York-New York, it appeared demand was greater than expected based on gaming position utilization, staffing levels, and discussions with hotel employees.”

How operators got it right was the result of experience from a decade ago when the industry attempted to recover from the Great Recession. They also learned from the tragic 1 October, experience.

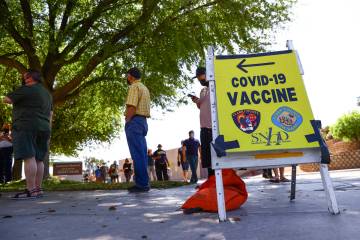

Greg Chase, founder and CEO of Experience Strategy Associates in Las Vegas, said operators that were transparent in showing the public how they were going to keep customers safe from the coronavirus were rewarded with higher-than-expected bookings.

“After 1 October, you saw an increased security presence and second-party and third-party security brought in just to have the visual perception that there’s more bodies and more people watching,” Chase said recently. “We also changed uniform colors to bright green polo shirts and bright yellow polo shirts and you saw that pick up across the industry simply for someone in the public environment, when scanning their surroundings, could quickly see and feel that presence in their midst.”

Chase said the brands that demonstrated their COVID-19 protection protocols stood out.

“Delta Air Lines did a remarkable job showing videos of how they’re steam cleaning their planes,” he said. “The more you can do to visualize it so that the consumer can see the effort, the more it helps speed up the recovery.”

Josh Swissman, founding partner of The Strategy Organization in Las Vegas, explained how the gradual opening of properties by the two companies with the most Strip presence, Caesars Entertainment Corp. and MGM Resorts International, helped them maintain rates.

“In the recession, it was a totally different business model,” Swissman said. “In the recession, both of those companies had all of their properties open. In ’09, every property was open and there was an overabundance of supply and much less demand. When there’s that imbalance there, price gets reduced dramatically and that’s exactly what you saw happen in 2009 and 2010. We’ve seen the curves of rate growth after those years. It took years to get out of that cycle.”

While some properties will have some price breaks in their rates, they’re being selective in how they do it. MGM, Caesars and The Cosmopolitan of Las Vegas suspended paid parking. Sahara got rid of its resort fee for reservations made by the end of the month.

MGM and Caesars were able to evaluate where the demand was coming from and set reopenings accordingly. Caesars reopened Harrah’s Las Vegas on Friday and MGM plans to reopen Excalibur this week to accommodate demand from value-seekers.

But Swissman thinks there may be some discounting for midweek visits as properties attempt to recover some losses from the decimated meetings and conventions industry.

“Weekends are busier than the weekdays, particularly with the absence of any group business right now,” he said. “And those rooms are going to be just as available on a Wednesday as they are on a Saturday. There just aren’t going to be as many people to rent those rooms on a Wednesday. I predict there’s going to be some interesting promotional activity around trying to stimulate some more midweek volume, at least for the short term.”

If and when midweek volume comes back, operators can virtually high-five each other once again.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.