Class-action settlement with Wynn Resorts: $70M

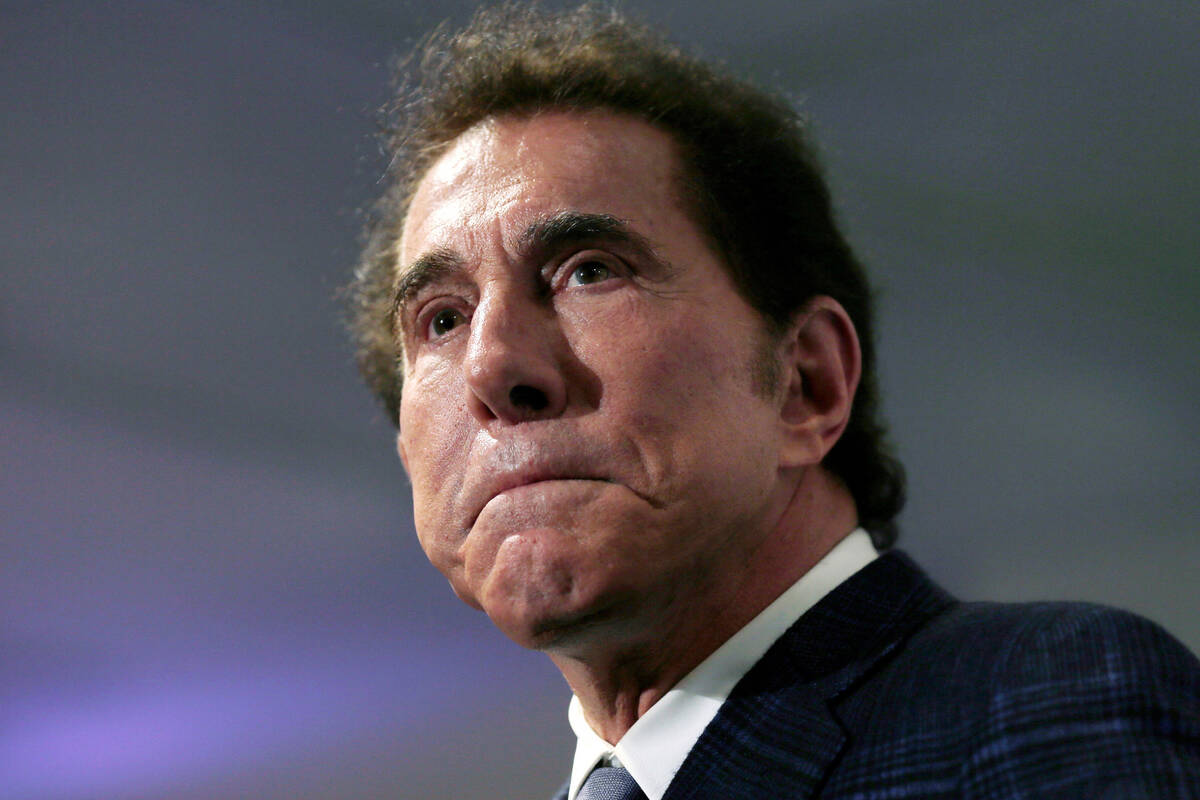

Hundreds of Wynn Resorts Ltd. shareholders will split a $70 million class-action lawsuit settlement in a case stemming from allegations the company didn’t disclose the sexual misconduct of former CEO Steve Wynn.

Wynn Resorts shareholders alleged their stock shares lost value as a result of allegations of sexual misconduct by Steve Wynn, raised in 2018, and the failure of Wynn executives to do anything about it once they were made aware of the allegations.

New York-based law firm Pomerantz LLP announced Thursday that it had filed a motion asking the U.S. District Court in Nevada to grant preliminary approval to the settlement first announced by Wynn Resorts earlier this month. At the time, the company did not disclose the settlement amount in the case brought by John and JoAnn Ferris and Jeffrey Larsen against the company, Steve Wynn, four former Wynn executives and nine former members of the company’s board of directors.

Current executives and board members initially named in the lawsuit were dismissed from it and all others who were named, including Steve Wynn, are no longer with the company.

Recovery per class member unclear

It’s unclear how much each individual shareholder will receive in the settlement.

“Each class member that files a valid proof of claim will receive their pro rata share of the net settlement fund,” a representative of the law firm said. “Attorneys will request that the court approves a fee for their services and reimbursement of some costs, which will come out of the $70 million fund. We cannot now predict what a recovery per class member will be.”

Representatives of Wynn Resorts said earlier this month that the settlement would resolve the last of the legal matters involving Steve Wynn, the former chairman and CEO who left the company in 2018.

“We are pleased to have resolved this long-standing legal matter through a settlement which we believe is advantageous for the company,” Wynn Resorts said in a Thursday email. “As is customary in such matters, our insurance has covered the majority of the $70 million settlement, with Wynn Resorts covering $9.4 million of the total.”

Loss of stock value

Attorneys for the investors said the case centered on allegedly misleading statements made by Wynn Resorts between March 28, 2016, and Feb. 12, 2018, weeks after media reports about the sexual harassment scandal were published.

Steve Wynn has said he has never assaulted or harassed any employees.

The complaint alleged defendants were aware of numerous allegations of sexual misconduct made against Wynn over the course of several decades and defendants repeatedly denied those allegations and helped to cover them up. In January 2018, an article in the Wall Street Journal reported on the alleged yearslong pattern of misconduct by Steve Wynn, eventually leading him to resign as chairman and CEO and prompting both the Nevada Gaming Control Board and the Massachusetts Gaming Commission to open investigations into the company’s handling of the allegations. Those events led to a drop in Wynn Resorts’ share price, which caused significant damage to the company’s shareholders.

Share prices spiraled from more than $200 a share in January 2018 to around $96 a share a year later. Currently, the stock is trading at around $80 a share.

“This case should serve as a warning to corporations and their officers that talk is not, in fact, cheap,” partner Murielle Steven Walsh, who led the securities class-action lawsuit, said in an emailed statement.

“Investors care about corporate integrity and accountability, and companies that are accused of making statements to cover up or deny allegations of serious misconduct by executives face a potentially steep financial reckoning.”

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on X.