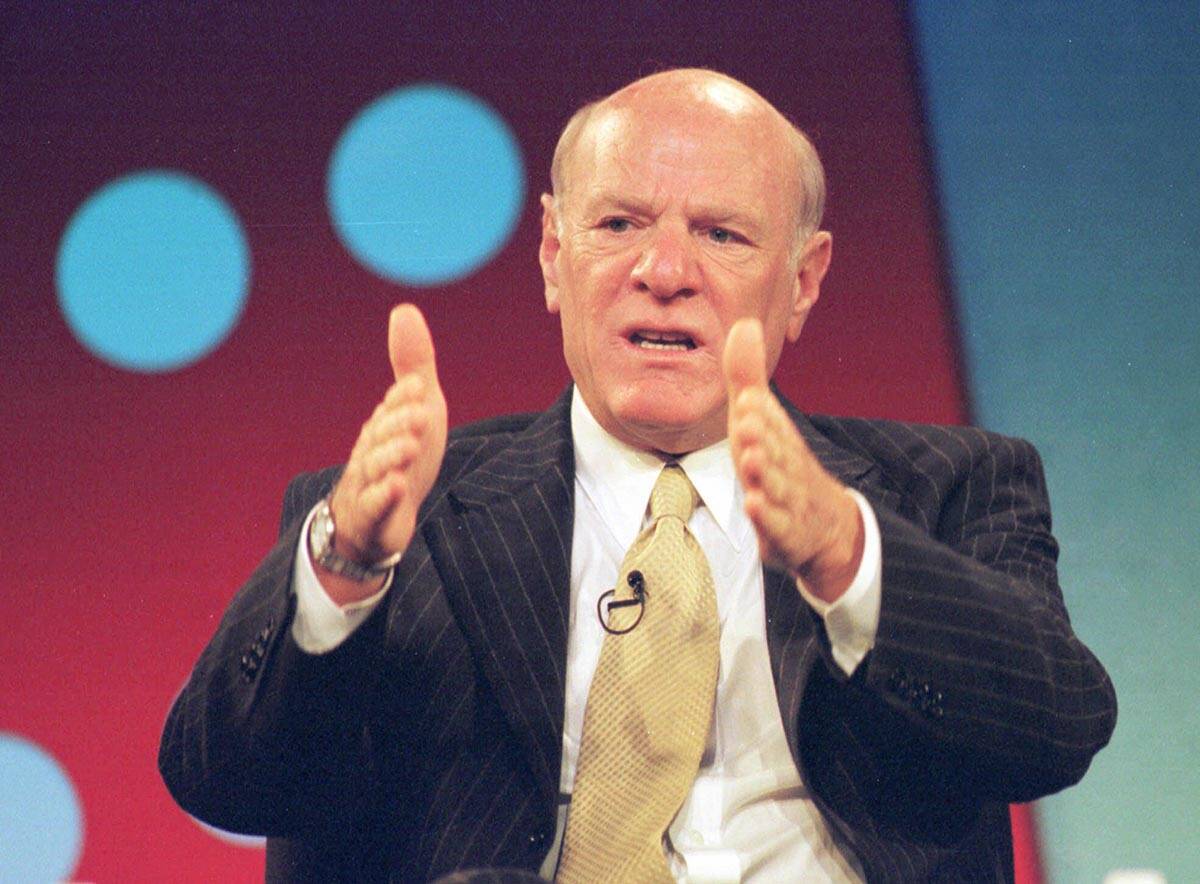

Gaming Commission approves conditional licensing for Barry Diller

The Nevada Gaming Commission on Thursday approved the licensing of IAC-InterActiveCorp, a holding company for dozens of media and internet companies, and the suitability of its CEO, Joseph Levin, as a beneficial owner of MGM Resorts International.

But commissioners stopped short of giving full approval to media mogul Barry Diller, an IAC director and a 14 percent owner of MGM shares.

Following a nearly two-hour hearing, commissioners voted 4-1 to approve a two-year conditional licensing for Diller.

Commissioners stressed that they had no problems with Diller’s integrity or suitability for licensing.

But they balked at approving unconditional licensing because the Securities and Exchange Commission hasn’t made any statements on an insider-trading investigation involving Diller, his stepson-in-law Alexander von Furstenberg and film studio executive and producer David Geffen.

Diller and Levin have said there are no plans for IAC companies to capitalize on the MGM investment.

The Wall Street Journal in March published a story that the SEC was looking into allegations that Diller, von Furstenberg and Geffen bought options to purchase shares of video game company Activision Blizzard. Shortly after the stock purchase, Activision Blizzard was bought out by Microsoft Corp., making company shares more valuable, prompting an insider-trading investigation.

The Journal’s story appeared after the Nevada Gaming Control Board recommended approval of Diller as a beneficial owner of MGM, but before the Gaming Commission considered final approval of the matter.

Commission Chairwoman Jennifer Togliatti said in March that because the disclosure of the SEC investigation of Diller occurred after the Control Board recommended approval of his licensing, she felt it would be best for the matter to be referred back to the board before final consideration.

Diller, who appeared in person before commissioners Thursday, said he’s received no indication of any kind of investigation underway and denied any impropriety in his stock trades.

Diller, von Furstenberg and Geffen acquired their Activision shares on the Friday before the Martin Luther King Day three-day weekend. The disclosure that Microsoft was acquiring Activision occurred before the market opened the following Tuesday.

Diller said it was a lucky stock purchase and that he knew nothing of the Activision takeover. The timing of the deal was a coincidence, he said.

Commissioners praised Diller for his business acumen. He has participated in numerous media deals and was the founder of Fox Broadcasting Company and USA Broadcasting.

“It’s a wonderful fit (with MGM),” Commissioner Steven Cohen said during the hearing. “You and Mr. Levin bring great things to the table.”

The conditioned licensing means Diller can proceed as a director for MGM, but would need to return for reconsideration by regulators within two years. Commissioners noted that Diller, who self-reported the insider-trading allegations, could request a new hearing before the two years are up if he receives new information.

The lone vote against the conditional licensing came from Commissioner Ogonna Brown who proposed approval of an unconditioned license.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.