Gaming sector rebounds in September

What changed?

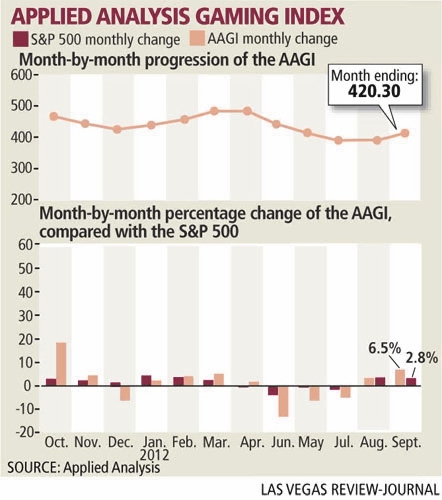

After four straight monthly declines, the gaming sector as a whole rallied back in September.

Eleven of the 12 casino operators and gaming equipment manufacturers followed by Las Vegas-based financial consultant Applied Analysis experienced increases in their average daily stock prices during the month.

Some companies saw their first increases since April.

The Applied Analysis Gaming Index grew almost 26 points to 420.30.

"Gaming sector stock improvements appear to be fueled more by speculation than a resurgence in fundamentals," Applied Analysis principal Brian Gordon told the firm's clients in a report Friday.

Casino giant Caesars Entertainment Corp. was the lone company to experience a decline in its average daily stock price in September. Shares of the casino operator were down more than 12 percent on an average daily basis compared with August.

SANDS, BOYD BENEFIT

Boyd Gaming Corp. recorded the largest increase, up almost 11 percent in its average daily stock price, while Las Vegas Sands Corp. was up 10 percent.

"Increased investor interest was clear for Las Vegas Sands, which recently obtained an increased price target by selected analysts," Gordon said.

He added that Las Vegas Sands spurred investors' interest by announcing plans for a $2.5 billion Paris-themed hotel-casino project in Macau and the decision to build a $20 billion integrated resort destination in Madrid that could include 36,000 hotel rooms, six casinos and multiple golf courses.

Slot machine manufacturers also experienced increases to their average daily share prices during September. Slot machine giant International Game Technology had the largest jump, up 9 percent.

GLOBAL GAMING EXPO COMING

The annual Global Gaming Expo in Las Vegas begins next week with equipment makers showing off their latest product developments during a three-day trade show.

Deutsche Bank gaming analyst Carlo Santarelli said the idea that manufacturing stocks experience a bump in price associated with G2E might be an urban myth.

"Over the years, it has often been said that owning the supplier stocks into G2E was the prudent trade," Santarelli said. "Looking back, we find this concept to be, for the most part, a misnomer."

Santarelli said since 2002, the stock prices IGT, Bally Technologies, WMS Industries and Shuffle Master have combined for an increase of 1.2 percent in trading five days before the show, a decline of 1.6 percent during the show, and a decline of 0.3 percent the five trading days after the show.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.