Gaming stocks end 2012 on high note

What fiscal cliff?

Gaming stocks were oblivious to investor worries that the lack of a year-end agreement in Congress to avoid wide-ranging tax increases and spending cuts would push the economy over the edge.

The sector closed out 2012 on a positive note in December.

Of the 12 gaming companies followed by Las Vegas financial adviser Applied Analysis, 11 showed marked increases in their average daily stock prices during the month.

Eight of the companies finished 2012 with a higher average daily stock price than in 2011.

Applied Analysis principal Brian Gordon told the firm's clients Monday in a research report that investors believed a compromise would likely take place in Congress concerning federal revenue enhancements and other measures.

"Uncertainty remained a dark cloud on equities, including gaming companies, but the overall impact appears to be modest throughout the month," Gordon said.

Casino operators Las Vegas Sands Corp. and Wynn Resorts Ltd., took "pre-emptive action" to protect investors by issuing special dividends in December to avoid potentially higher tax rates starting in 2013.

Gordon said the moves likely helped boost values.

Shares of Wynn Resorts and Las Vegas Sands had modest increases in their average daily stock prices in December, but other casino operators, such as Caesars Entertainment Corp., Boyd Gaming Corp. and Ameristar Casinos, showed double-digit percentage increases in their average daily share prices.

Ameristar shares were boosted on Dec. 21 when Pinnacle Entertainment announced an $869 million purchase of its Las Vegas-based rival in the regional gaming market.

Pinnacle agreed to pay Ameristar stockholders $26.50 per share, which sent Ameristar up 22 percent on an average daily basis in December.

Pinnacle, which will double in size to 18 gaming properties when the deal closes by mid-2013, had an 11 percent increase in its average daily stock price.

For all of 2012, Pinnacle's average daily share price grew 41 percent over 2011. Penn National Gaming, which owns M Resort, saw its average daily stock price increase more than 33 percent.

"Regional operators were the biggest gainers during the past 12 months," Gordon said.

MGM Resorts International saw its average daily share price increase 13.5 percent in December. Gordon said the Strip casino giant was helped by the completion of a multibillion-dollar debt refinancing transaction, which has put the company on a more solid footing from a balance sheet perspective.

Also, MGM Resorts sold 427 residential units at Veer Towers in CityCenter for $119 million during December.

"We would expect the net process from this sale to help further reduce debt and/or provide increased working capital for the gaming giant and its subsidiaries," Gordon said.

Slot machine maker Bally Technologies was the only company followed by Applied Analysis that had a decline in its average daily stock price.

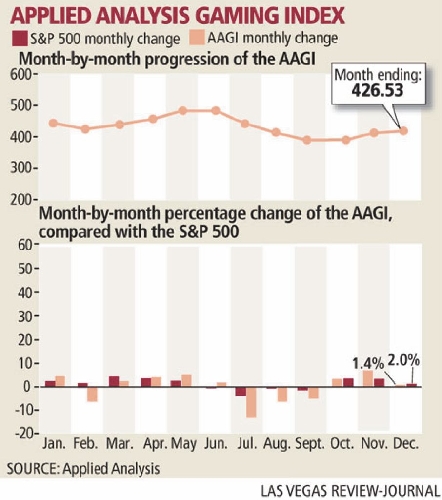

The Applied Analysis Gaming Index closed up six points in December. The index takes into account more than 300 market variables and the final closing figure of 426.53 for 2012 was essentially flat with the December 2011 closing figure.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.