Las Vegas-based Pinnacle Entertainment to acquire rival Ameristar Casinos for $869 million

Regional casino operator Pinnacle Entertainment announced Friday it agreed to acquire rival Ameristar Casinos for $869 million in a merger between two Las Vegas-based companies.

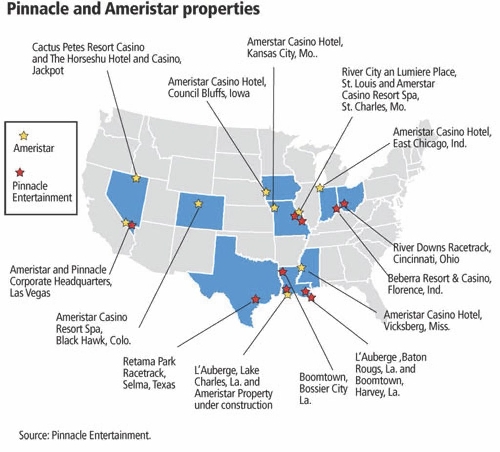

The deal, which is subject to regulatory approval in nine states, would more than double the size of Pinnacle Entertainment, giving the company 17 gaming properties plus one resort now under development. As part of the deal, Pinnacle will acquire Ameristar's two casinos in the Northern Nevada community of Jackpot near the state's border with Idaho.

The transaction is expected to close in mid-2013. At the close of the deal Pinnacle would operate more than 5,000 hotel rooms, 23,500 slot machines, 640 table games and employ almost 16,000 workers.

Pinnacle said the combined company would have generated revenue of $2.4 billion and cash flow of $689 million for the 12 months that ended Sept. 30.

The merger places Pinnacle in direct competition with regional casino rivals Penn National Gaming Corp. and Boyd Gaming Corp.

"We can rattle off a host of potential outcomes stemming from this transaction, but our net takeaway is that the deal makes plenty of sense for Pinnacle as it stands at present," Deutsche Bank gaming analyst Carlo Santarelli told investors.

The transaction's details were announced before the stock markets opened Friday. Shares of Pinnacle jumped $2.85, or 21.35 percent, to close at $16.20 on the New York Stock Exchange.

Under the transaction, Pinnacle agreed to pay $26.50 for each share of Ameristar, a 20 percent premium to the company's closing price on Thursday. Including debt of $1.9 billion and

$116 million in cash on hand as of Sept. 30, Pinnacle said the total enterprise value of Ameristar is $2.8 billion.

Shares of Ameristar, traded on the Nasdaq Global Select Market, rose $4.43, or 20.07 percent, to close at $26.50, the price of the buyout.

Pinnacle now owns nine casinos in Louisiana, Missouri and Indiana and racetracks in Ohio and Texas. Through the acquisition, Pinnacle would acquire Ameristar's eight properties in Missouri, Iowa, Colorado, Mississippi, Indiana and Northern Nevada.

Pinnacle Chief Executive Officer Anthony Sanfilippo said the transaction helps diversify the casino operator, adding new markets such as Colorado and Iowa and an expanded customer base.

The merger also makes Pinnacle a controlling player in two markets, Louisiana and Missouri. Analysts said the deal will have to survive federal antitrust scrutiny.

"From my standpoint, the combination of the two companies made sense for quite a while," Sanfilippo said following a conference call with analysts to discuss the deal.

He said the combined company would keep all three casinos in St. Louis - Pinnacle's Lumiere Place and River City and the Ameristar hotel-casino in suburban St. Charles.

"They serve three different markets," Sanfilippo said.

Pinnacle will add a fourth Missouri casino through Ameristar Kansas City.

In Louisiana, Pinnacle now operates four casinos, including the L'Auberge properties in Lake Charles and Baton Rouge. Sanfilippo said Pinnacle would complete the construction of Ameristar's $500 million resort in Lake Charles, which broke ground last summer.

The site - which was originally owned by Pinnacle - is next to the L'Auberge Lake Charles resort.

"This allows us to build a complete integrated resort destination," Sanfilippo said.

Analysts praised the deal, saying Ameristar had been on the sales block ever since the death of company founder Craig Neilsen in 2006. Ameristar had to work through probate matters concerning Neilsen's majority ownership stake in Ameristar, which was transferred to his charitable foundation. The foundation sold its stock in the company in 2011.

In 2009, former Pinnacle CEO Dan Lee said the company had bought a large stake in Ameristar with the idea of acquiring the casino operator, but abandoned the plan.

"Given the limited overlap of properties between Pinnacle and Ameristar, on paper, this deal makes total sense," Stifel Nicolaus Capital Markets gaming analyst Steven Wieczynski told investors. "With regional gaming markets coming under pressure given additional competition, coupled with the number of gamblers in the U.S. declining, we believe it makes total sense for certain regional gaming operators to team up in order to eliminate duplicate costs, especially on the promotional and marketing side."

The transaction was approved by the boards of directors of both companies. Sanfilippo said the combined companies would realize some $40 million in annual cost savings once the transaction closes.

J.P. Morgan gaming analyst Joe Greff said it was unlikely that another bidder would emerge for Ameristar. MGM Resorts International is focused on reducing its leverage while Penn National recently announced plans to spin off a separate real estate investment trust.

"To us, the deal makes strategic sense as well, providing for geographic diversity and increased scale, which should allow for reasonable cost savings and synergies," Greff said.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.

Follow @howardstutz on Twitter.