Nearly 20 years later, trailblazing Palms awaits new chapter

In 2001, the Palms was making waves as Las Vegas’ newest hot spot.

The property was a trailblazer, pioneering new operational and marketing techniques. It had a partnership with an MTV’s “The Real World,” over-the-top suites with bowling alleys and basketball courts, trendy clubs where guests could rub shoulders with celebrities. And through all of the flashy amenities meant to convince tourists to venture off-Strip, it was also able to successfully draw in locals.

Nearly 20 years later, the property sits in the dark.

It is one of the few Las Vegas properties yet to reopen 14 months after orders to shut down to help curb the spread of the coronavirus. Industry watchers say the property — recently sold to the San Manuel Band of Mission Indians for $650 million — is still capable of creating future success stories.

“I think it’s a property that’s been very innovative, and I think it’s got a ton of potential,” UNLV gaming historian David Schwartz said. “In Vegas, you can never really be complacent. You have to constantly be evolving in a way the visitors want.”

‘A shot in the arm’

The Palms project was spearheaded by George Maloof, who had developed the Fiesta casino in North Las Vegas. He and a group of family members owned 88 percent of the property, while Station Casinos owned 6 percent.

Maloof had a grand vision for the West Flamingo Road property, with a focus on attracting a hybrid of locals and tourists to the off-Strip location, while also creating a space where celebrity guests would feel comfortable.

“It was unique,” Schwartz said. “The Rio had (catered to locals and tourists), but I think (the Palms) took it to another level. … They had a niche, and they were very successful.”

The property opened in November 2001, when the country was still reeling from the 9/11 attacks. Americans were hesitant to travel, which pushed tourism-dependent Las Vegas into a major economic slump.

But the timing turned out to be “fascinatingly good and bad,” according to UNLV associate professor of history Michael Green.

While tourism rates were low, the new property was able to hire about 2,500 workers — many of whom were highly qualified workers laid off from high-end Strip properties. And the Palms’ unveiling turned out to be a spectacle, with nearly 1,000 people requesting media credentials, according to a 2001 report.

“It really did feel at the time like a shot in the arm to Las Vegas and the industry,” Green said.

The 455-room property was small by Strip standards but presented a mix of upscale and value-conscious restaurants. For locals, the Palms offered a movie theater, food court and 2,200 slot machines. For tourists and celebrities, it featured fine dining from celebrity chefs including Andre Rochat and nightclubs Rain and Ghostbar. Other nightclub venues, including the Playboy Club and Moon, were added later.

The property also offered unique, high-end suites. The Hardwood suite had a basketball court, locker rooms and a scoreboard, and the Kingpin Suite had two regulation bowling lanes. Other suites had dancing poles in the showers, according to Review-Journal reporting in 2016.

“Maloof and his people were able to combine what seemed to be very different markets and make it work. They were appealing to a tourist crowd and local crowd at the same time,” Green said. “The Palms seemed different from other places. … The whole paradigm (in Las Vegas these days) has shifted from gambling being central to the foundation with a lot of other revenue streams. The Palms was part of that move.”

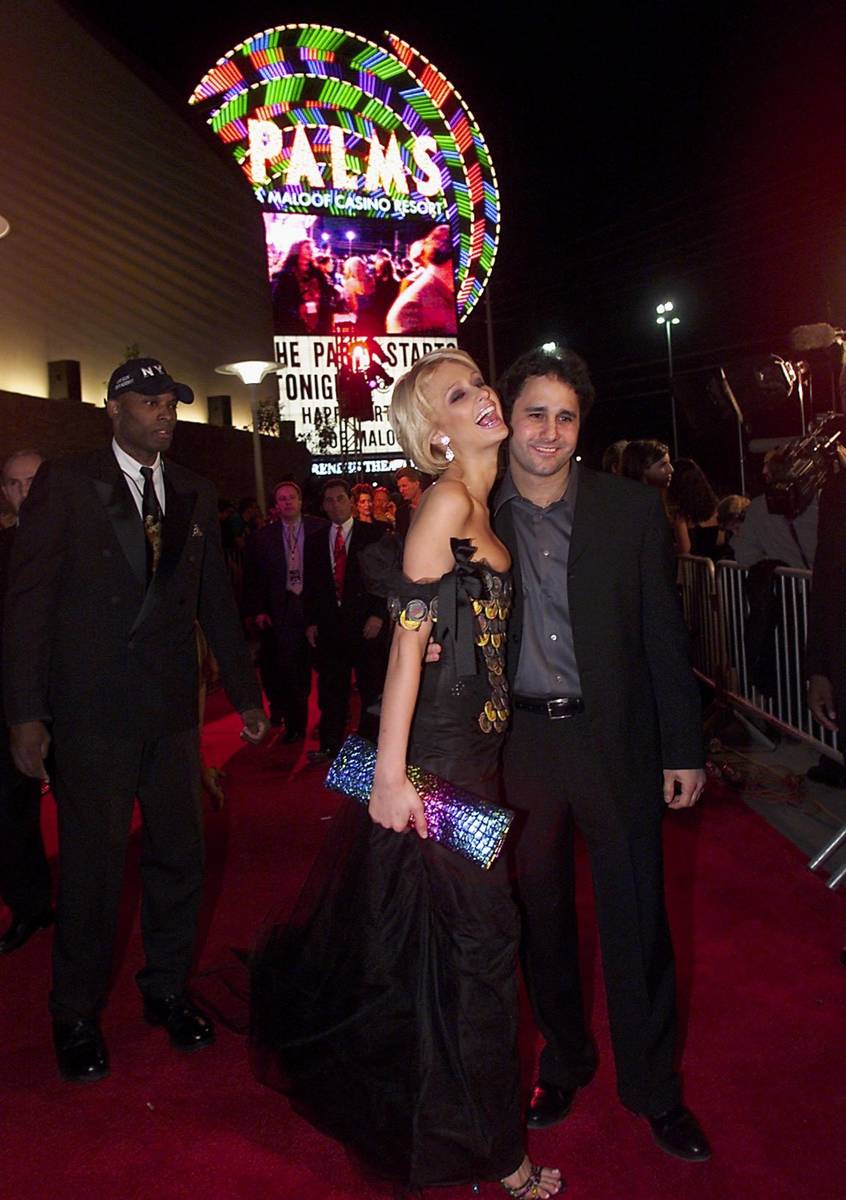

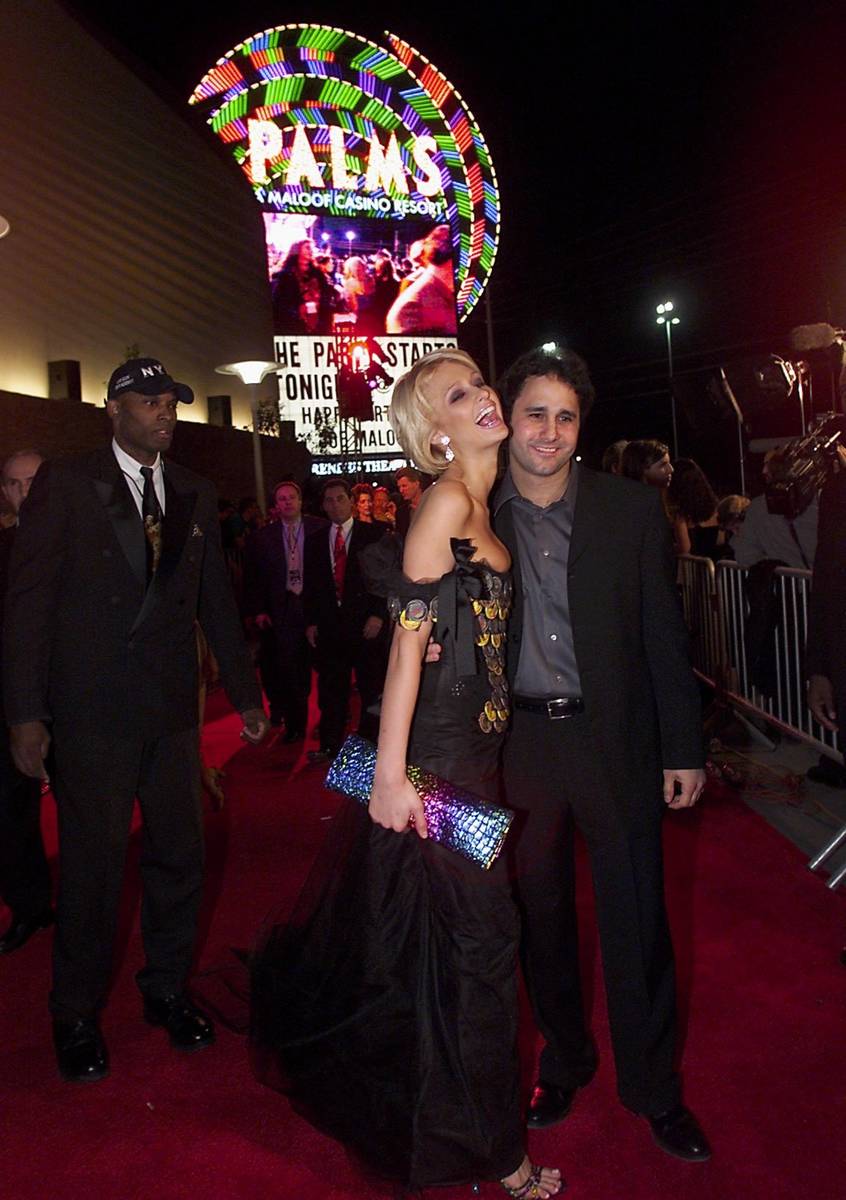

Maloof’s mission to attract celebrities seemed to go off without a hitch: Hollywood stars at the grand opening included Matt Dillon, Samuel L. Jackson, Joe Pesci, Tara Reid, Martin Sheen and Charlize Theron.

“There was a lot of stargazing going on,” Green said.

‘So damn unique’

The focus on celebrities is evident in the original design of the property, which pushed the club scene on the east side and bar and food court to the west, and provided celebrities their own private entryways to avoid the public. Maloof said he knew locals would typically frequent in the mornings through early evenings; once they cleared out, the resort could transition into a celebrity hangout.

“If you have an A-list celebrity coming to the Palms, people will want to be at the Palms. It’s that simple,” Maloof said in an interview with the Review-Journal this month.

The property’s initial success was also tied to the its partnership with the reality show “The Real World.”

The Palms hosted the 2002 season of the MTV show, which followed a group of young strangers living together in a new city. Maloof said roughly $1 million was invested to convert six hotel rooms on the 28th floor into a space where the cast would stay. Filming began about six months after the property opened.

Las Vegas-based reality shows are commonplace these days, but moving a TV crew into a hotel-casino was considered a risky move at the time.

“Nobody wanted a camera in a casino,” Maloof said. But “it worked so well for us, as far as publicity and exposure.”

When filmed had wrapped, the property would also offer stays in the “The Real World” suite — for a price. In 2002, Leonardo DiCaprio was reported to have rented the room at an estimated $7,000 per weekend night, according to Review-Journal reporting at the time.

Before the Palms opened, skeptics had been concerned that it would be competing with Gold Coast and Rio, but Maloof said in 2002 that the property made money from day one and was “so damn unique” that it didn’t have any real competition.

By 2003, Maloof had said the property was making a 20 percent annual return on its initial $270 million cost.

“It was unbelievable. I mean, the amount of people where nobody thought we would make it,” Maloof said this month. “We were off-Strip, and we started doing things nobody else had done. … It just gave us more and more exposure and then everyone else kind of figured it out because our nightclubs and restaurants were packed. … I don’t think there was ever a property like the Palms.”

Great Recession

In the mid-2000s, the Maloofs were investing heavily in the Palms. A $600 million expansion project added two additional towers, once of which would open as the Palms Place condominiums.

It was another sign of Maloof’s efforts to be ahead of the times, as he jumped on the burgeoning trend of high-rise condominiums near the Strip.

His celebrity-focused business model transferred to the new tower, with Palms Place’s initial buyers in 2008 including rapper Eminem, Kiss guitarist Paul Stanley, singer-actress Jessica Simpson and wrestler Hulk Hogan.

“Back then, to remain competitive, everybody was expanding. Taking on debt,” Maloof said.

Then came the Great Recession.

Las Vegas was among the hardest-hit markets, with unemployment rates topping 14 percent and approximately 70 percent of all mortgages in the valley underwater at one point.

By 2009, Palms had begun offering seller-backed financing to some 150 potential purchasers in the Palms Place development, an effort to jump-start sales in what the Review-Journal described as an “otherwise nonexistent high-rise condominium market.”

Many Las Vegas casino companies struggled to repay debts during the recession. Many opted to refinance, go through bankruptcy proceedings or extended their loans.

The Maloof family decided to sell.

Its ownership stake in Palms dipped to 2 percent, and private equity firms Leonard Green & Partners LP and TPG Capital assumed majority control in the hotel-casino 10 years after its opening.

“It was a tough time. Extremely tough, mentally, on me and my family,” Maloof said. “I spent my time there, all the time. It was a big part of me. … It was tough not being able to help the employees in certain circumstances.”

The property’s 10th anniversary that November was described as “understated” by the Review-Journal, especially when compared with its star-studded grand opening.

Sold off again

With fewer celebrity appearances, the Palms shifted its focus from partiers in their mid-20s to the 30- to 50-year-old crowd. A $50 million renovation project in 2012 renovated more than 400 rooms and demolished old bars, restaurants and clubs to make room for new experiences.

The former Playboy Lounge on top of the Fantasy Tower was torn out, replaced with a bar and lounge called The View. The pool saw a $600,000 renovation that added daybeds and couches. The Moon nightclub closed its doors for good after nine years of operations.

Then, in 2016, the property was sold off again, this time to Red Rock Resorts Inc. — which manages and owns a portion of Station Casinos — for $312.5 million.

The company invested $620 million to renovate the property, getting rid of venues such as N9NE Steakhouse and the rooftop Ghostbar nightclub for updated hotel rooms, new celebrity chef restaurants and a 73,000-square-foot pool club.

The pool club, Kaos, would turn out to be a financial misstep. Just seven months after its spectacular opening, Red Rock shut it down abruptly in November 2019 after reporting “challenging” expenses associated with the entertainment venue.

Red Rock CEO Frank Fertitta later blamed the competitive market from other players around the Strip and overinvesting in the venue.

Things “didn’t go exactly as planned at the Palms,” Fertitta said during Red Rock’s latest earnings call. “I think that we invested too much and too much focus on the nightlife and daylight part of the business. … It was kind of one of those things where we decided if we’re going to fail, we’re going to fail fast and move on.”

The Palms, like all Las Vegas casinos, was forced to shut down in March 2020 because of the pandemic. The property had yet to reopen its doors when Red Rock agreed this month to sell it to San Manuel.

Maloof said he hopes to see the property reopen “as soon as possible” and create more jobs in Las Vegas.

“I think it’s great that they’re coming in and taking a chance. I’m sure they’ll do well,” he said of the San Manuel tribe. “The property is in great condition. They got a great buy. I’m sure they’ll do well at that price.”

Contact Bailey Schulz at bschulz@reviewjournal.com. Follow @bailey_schulz on Twitter.