Nevada gaming revenue down in January

Something happened on the way to the Strip's economic recovery.

Reality set in.

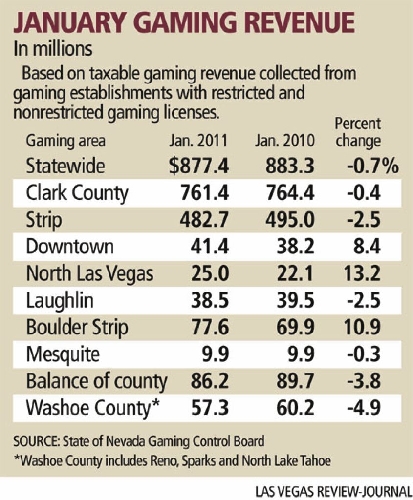

Nevada gaming revenues fell less than 1 percent in January, according to figures released Thursday by the state Gaming Control Board.

But more frustrating to gaming analysts was the 2.5 percent decline in Strip gaming revenues during the month, even with the busy New Year's Eve holiday and presence of several large conventions that helped boost visitor volume 8.6 percent.

"Despite commentary from Strip operators indicating healthy (revenue per available room) growth driven by strong convention visitation, January's core table games and slot volume decline underscores the convention segment's lower propensity to gamble," Susquehanna International Group gaming analyst Rachael Rothman told investors.

Statewide, casinos collected $877.4 million from gamblers, compared with $883.3 million collected in January 2010. The figures marked the fourth straight January that gaming revenues had declined from the previous year. Gaming revenues have also declined in three straight months starting in November.

On the Strip, casinos collected $482.7 million during the month, down from $495 million collected a year ago.

High-end baccarat play, the primary reason large Strip casinos had been able to weather the state's prolonged economic downfall, had a part in January's decline.

Revenues from baccarat were $64.8 million, a 39.7 percent decline. The amount wagered on the game was $591 million, a drop of 29.2 percent. The hold percentage was 11 percent versus almost 13 percent a year ago.

Control board senior research analyst Michael Lawton said baccarat was only part of the story. Table game volume, which was down 13 percent statewide and 15.1 percent on the Strip, saw declines in all games, including blackjack, roulette and craps.

Slot machine wagering was also off, down 2.1 percent statewide and 2.5 percent on the Strip.

Analysts said the recovery may be slowing.

"Today's Strip numbers were not good no matter which way you dissect them," Stifel Nicolaus Capital Markets gaming analyst Steven Wieczynski told investors. "High-end baccarat play has been the driver of gaming revenues over the past year and today's results suggest that segment could be slowing."

JP Morgan gaming analyst Joe Greff said the Strip revenue figures at individual properties could have also been hurt by the December opening of The Cosmopolitan of Las Vegas.

"We view these Strip results as disappointing, even adjusting for hold," Greff said. "While one can't view from aggregate results, we believe there is a big disparity in performance between relatively better-performing higher-end properties and underperforming mid-tier and lower-price-point Strip properties."

Rothman agreed with Greff's assessment.

"The result reinforces our view that the Dec. 15 opening of The Cosmopolitan will have a dilutive impact on the same-store recovery," Rothman said.

Clark County's overall gaming revenue decline, however, was less than 1 percent.

Two reporting areas, the Boulder Strip and North Las Vegas, had double-digit gaming revenue increases of 13.2 percent and 10.9 percent respectively.

Meanwhile, downtown casinos showed a gaming revenue increase of 8.4 percent.

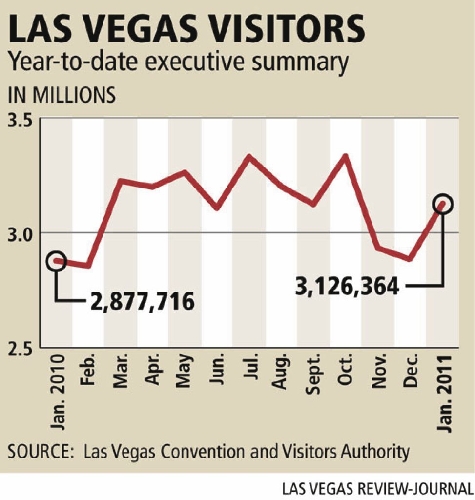

Separately, January visitor totals grew at the fastest clip in seven years, propelled by a resurgent convention sector and scheduling quirks.

The 3.1 million people who came to Las Vegas marked an 8.6 percent increase from one year ago, with two-thirds of it coming from the jump in conventions and meetings attendance. This, in turn, helped to drive improvements in other benchmarks such as midweek hotel occupancy and average room rate.

People attending conventions, typically a highly volatile number month to month, shot up 36.9 percent as events such as the International Consumer Electronics Show shook off the weak results of the previous couple of years. In addition, the World of Concrete construction show and the World Market Center's winter home furnishings market both took place in January instead of February last year. Combined, they accounted for about 100,000 people, most of the improvement in the convention segment.

Kevin Bagger, senior marketing director for the Las Vegas Convention and Visitors Authority, declined to predict whether this would lead to a subsequent drop in February numbers.

"The overall trend continues to be positive," he said.

The reinvigorated convention traffic falls in line with several nationwide surveys that showed business travel warming up after a couple of cool years.

The convention segment helped boost the number of room nights sold by 12 percent and average rates by 7.5 percent to $107.22 a night, crossing the $100 mark for the first time in two years.

Contact reporter Howard Stutz at hstutz@review

journal.com or 702-477-3871. Contact reporter Tim O'Reiley at toreiley@reviewjournal.com or 702-387-5290.

TAXES COLLECTED GROWS

State gaming taxes collected in February based on January's gaming results grew 15.3 percent.

The figure was helped because gamblers repaid past-due credit play markers.

According to the Gaming Control Board, Nevada collected $68.8 million in gaming taxes during February, compared with $59.7 million a year ago.

For the first eight months of the fiscal year, gaming tax collections are up 3.3 percent.

Mike Lawton, the control board's senior research analyst, said the marker collection helped boost January's taxable gaming revenues to $1.09 billion. Lawton said January marked the first month since April 2008 that taxable gaming revenues exceeded $1 billion.

HOWARD STUTZ/LAS VEGAS REVIEW-JOURNAL