Pay gap widens between casino CEOs, average casino workers

The pay gap between Nevada casino companies’ average workers and their CEOs is growing wider.

The pay ratio between chief executives and median employees increased at four of the six largest public Nevada-based casino operators during the pandemic. CEOs’ total compensation came in anywhere from 66 to 591 times that of a median employee in the company in 2020, according to some calculations.

The heightened difference came during one of the roughest years for the gaming and hospitality industries in recent history, during which a global pandemic forced operators to shutter properties for months and resulted in thousands of workers being furloughed or laid off.

It’s important to note that ratios can’t be compared equally across companies, because each can take a different approach to calculating a median employee’s earnings.

MGM Resorts International: 394-to-1

MGM Resort International determined that CEO and president Bill Hornbuckle had more than $14 million in total compensation in 2020. In 2019, former CEO Jim Murren — who left the position in March 2020 — had a total compensation of $13.1 million, according to filings with the U.S. Securities and Exchange Commission.

Meanwhile, the median MGM employee made about $35,526, down from $38,954 the year prior.

The company in October had about 60,820 employees, including more than 11,000 who were furloughed at that time. MGM had nearly 76,000 employees in October 2017, according to a filing with the SEC.

The company considered its median employee in 2020 to be a full-time, permanent employee who was on furlough a portion of last year, and used 2019 cash compensations in its calculations.

The 2020 ratio was calculated at 394-to-1 in 2020, compared with 337-to-1 in 2019.

Hornbuckle officially moved into the role of CEO in July, after holding the title of acting CEO and president following Murren’s departure.

The company allowed Hornbuckle to trade his 2020 base salary for company shares after casinos were ordered to shut down in March of 2020. The salary trade-off was meant to help the company in “maintaining and bolstering its liquidity position” and “enable it to continue to fund its obligations for the foreseeable future,” according to an SEC filing.

Hornbuckle’s base salary — $1.2 million — was lower than Murren’s $2 million base salary in 2019, but accounted for just 8 percent of his total compensation. Hornbuckle earned $11.9 million in stock awards, $825,000 through a non-equity incentive plan and $45,595 through various other means.

Meanwhile, Murren had a total compensation of $36.2 million in 2020, which included a $450,549 base salary, $4 million bonus, $10.9 million in stock awards and $20.9 million from other forms of compensation — including termination-related benefits.

MGM’s compensation committee changed the pay mix for executives — including Hornbuckle — last year, resulting in less cash payments by lowering base salaries and target cash bonus opportunities while increasing long-term equity incentives. The new terms went into effect in April 2020.

Spokespeople for MGM declined to comment.

Caesars Entertainment Inc.: 555-to-1

Caesars Entertainment Inc. CEO Tom Reeg had $13.7 million in total compensation in 2020, compared with $8.9 million in 2019 when he was head of Eldorado Resorts Inc.

Eldorado acquired Caesars Entertainment Corp. in July, and Reeg remained head of the combined company.

The median Eldorado employee’s compensation was $31,173 in 2019, while the median worker at Caesars earned $24,653 in 2020. The company had roughly 55,700 employees as of Dec. 31, with less than 5 percent located outside the U.S.

The CEO-to-median employee ratio jumped from 285-to-1 at Eldorado in 2019 to 555-to-1 at Caesars in 2020.

The ratio increased “due to various reasons,” according to an SEC filing, including a “substantial portion of employees being furloughed in 2020 and working less on average than in recent years.”

Reeg’s compensation in 2020 included a $1.7 million base salary, nearly $12 million in stock awards and more than $25,000 through other means.

Caesars spokespeople did not return a request for comment.

Wynn Resorts Ltd.: 591-to-1

The pay ratio between Wynn Resorts Ltd.’s CEO and a median worker with a cost of living adjustment jumped from 303-to-1 in 2019 to 591-to-1 last year, according to filings with the SEC.

The gap widened after CEO Matt Maddox’s salary jumped 77 percent from $13.9 million to $24.6 million, most of which was in company stock. Meanwhile, the median worker’s compensation fell 9 percent from $45,706 to $41,551 using cost of living adjustments.

The company also calculated a median worker’s compensation without a cost of living adjustment. In this scenario, the median worker made $34,104 in 2020, resulting in a ratio of 721-to-1.

The company considered the median employee to be a full-time, hourly worker in Las Vegas.

Wynn paid all employees full compensation through casino closures last year, but still came out of 2020 with fewer employees. As of Dec. 31, the company had about 27,500 employees with nearly half working in Macao, compared with 30,000 at the end of 2019.

According to SEC filings, the company’s ratio jumped between 2019 and 2020 after the company’s compensation committee awarded Maddox restricted shares as they extended his employment agreement.

But the ratio doesn’t accurately represent Maddox’s actions in 2020, according to spokesman Michael Weaver, because it does not reflect the 140,000 shares — equal to about 80 percent of Maddox’s 2020 stock award — that he forfeited.

Maddox’s forfeited shares provided a grant to a broad group of 400 managers during the height of the pandemic, but “accounting rules do not allow us to take the forfeiture into account, which as of (Monday’s) stock price would be worth $17.5 million,” Weaver said.

Maddox’s forfeiture was valued at least $6.4 million at grant date, which would bring his total compensation down to roughly $18.2 million. The pay ratio would in turn fall to 437-to-1 with a cost of living adjustment and 533-to-1 without a cost of living adjustment.

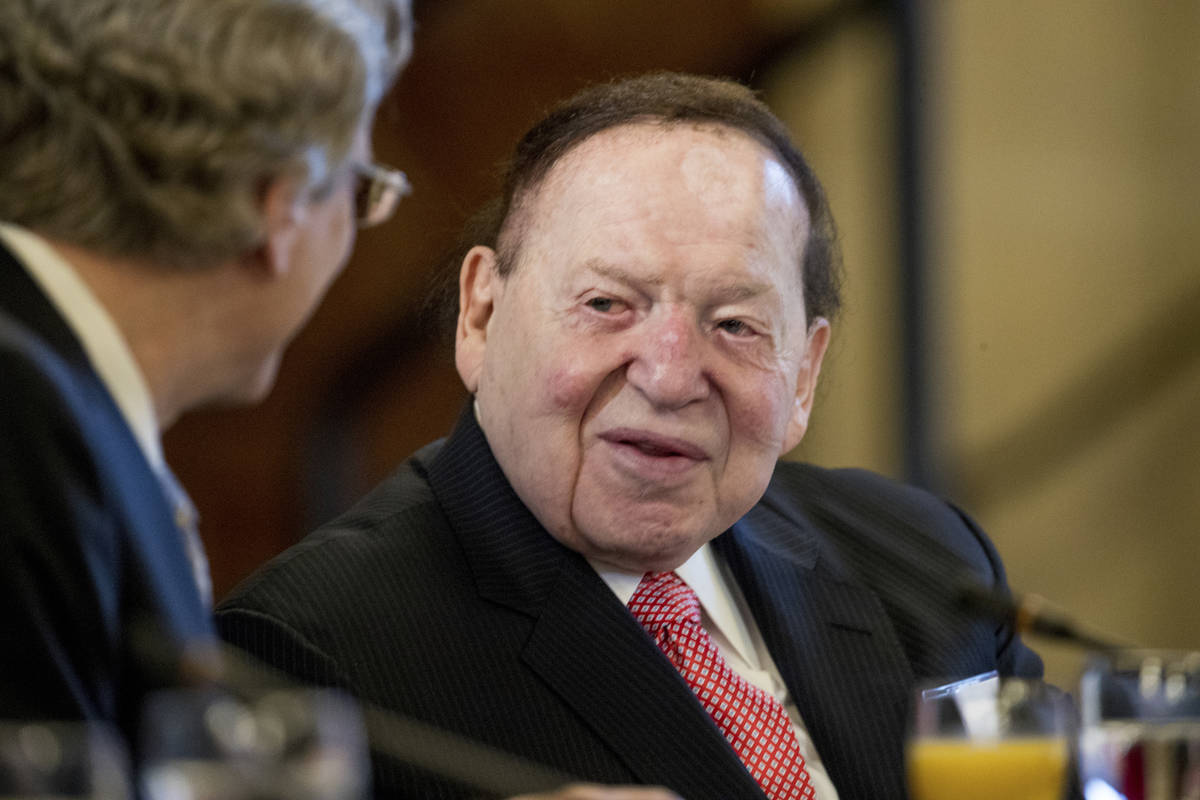

Las Vegas Sands Corp.: 265-to-1

Sheldon Adelson, the former Las Vegas Sands Corp. chairman and CEO who died of non-Hodgkin lymphoma in January, received a total compensation of $11.3 million last year, down from $24.7 million in 2019. In that same time frame, the median employee’s annual total compensation went up from $42,228 to $42,809.

The company’s pay ratio dropped from 584-to-1 in 2019 to 265-to-1 in 2020.

For Sands, the “median employee” was considered to be a full-time worker in Las Vegas. The company had about 46,200 employees at the end of last year, 44,780 of which were part-time or full-time workers and 19 percent of which worked in the U.S. The company had nearly 50,000 employees the year prior.

Adelson’s compensation in 2020 included a $5 million base salary, unchanged from 2019; $1 million in option awards; and $5.3 million classified as “all other compensation,” which included insurance, security and medical support devices.

A Sands spokesman did not return a request for comment.

Boyd Gaming Corp.: 106-to-1

Boyd Gaming Corp.’s ratio fell from 304-to-1 in to 106-to-1 between 2019 and 2020.

CEO Keith Smith’s total compensation fell nearly 70 percent from $9.6 million in 2019 to just under $3 million in 2020. Meanwhile, the earnings for a median employee dropped 12 percent from $31,728 to $27,975.

The company had nearly 14,300 full- and part-time employees as of Dec. 31, compared with 24,300 the year prior.

A Boyd spokesman did not return a request for comment.

Red Rock Resorts Inc.: 66-to-1

Red Rock Resorts Inc.’s CEO-to-median employee salary ratio in 2020 was 66-to-1, compared with 63-to-1 the year prior.

Chairman and CEO Frank Fertitta III’s total 2020 compensation was $2.4 million in 2020, up from the the nearly $2 million he made the year prior. Meanwhile, the median worker earned $36,904 compared with $31,003 the year prior.

The company had about 7,600 employees as of Dec. 31, down 44 percent from 13,500 the year prior.

Fertitta opted to forego the remainder of his 2020 salary in April 2020, cutting his total annual salary nearly in half to $538,462 for the year. But the CEO was awarded a $750,000 bonus in 2020, whereas he did not earn a bonus the prior two years. Other means of compensation awarded him an additional $1.2 million.

A Red Rock spokesman did not return a request for comment.

MGM Resorts closed down 3.9 percent Thursday at $40.39 on the New York Stock Exchange. Caesars shares closed down 3.1 percent at $99.47 on the Nasdaq, Wynn shares closed down 1 percent at $129.03 on the Nasdaq, Sands shares closed down 1 percent at $61.15 on the New York Stock Exchange, Boyd shares closed down 2.8 percent at $66.51 on the New York Stock Exchange and Red Rock shares closed down 3.8 percent at $37.33 on the Nasdaq.

The Review-Journal is owned by the family of Sheldon Adelson, the late chairman and CEO of Las Vegas Sands Corp.

Contact Bailey Schulz at bschulz@reviewjournal.com. Follow @bailey_schulz on Twitter.

Rise of CEO compensation

CEO compensation has grown much faster than profits and stock prices over the years, according to findings from the Economic Policy Institute.

According to the EPI's latest report on American executive compensation, released in August, CEO pay at top U.S. firms grew 1,167 percent between 1978 to 2019, outpacing the S&P stock market's 741 percent growth as well as the top 0.1 percent earnings growth of 337 percent.

Meanwhile, the typical worker's compensation grew just 13.7 percent in that time frame, according to the report from the progressive think tank.

The report also found that CEOs at the top 350 firms in the country made 320 times that of a typical worker in 2019, compared to just 61 times that of a typical worker in 1989.

Other research backs EPI's findings showing the gap between CEO pay and a typical worker is rising.

Carola Frydman, a finance professor at the Kellogg School of Management, has researched historical U.S. CEO pay going back to the 1930s. Her research found that the difference between CEO pay and that of a typical worker has been on the rise for decades, after experiencing a dip between the early 1940s and 1970.

"That is a period … that has become the outlier," she said. "Since then, (the ratio) started to increase. First slowly, and then much more rapidly. Especially in the 1990s, when you focus on some of the largest firms in the economy. … But the pay of the typical worker in the economy remained much more stable."

According to EPI's research, CEO compensation jumped 14 percent from 2018 to 2019. Lawrence Mishel, a distinguished fellow at the Economic Policy Institute, said the increased CEO pay seen at various casino companies last year was largely due to the stock market's rapid recovery over the course of the pandemic, since a majority of executive compensation comes from cashing out stock options or stock grants.

Between March 20 — a low point for the stock market during the pandemic — and Wednesday, the S&P 500 jumped 81 percent from $2,304.92 to $4,183.18.

Dayna Harris, a partner at Farient Advisors with over 20 years of experience providing advice on executive and board compensation, said that examining pay ratios can get "complicated," since there are many underlying factors that affect the number.

MGM Resorts International, for instance, had a new CEO in March of 2020. Wynn Resorts Ltd.'s CEO entered a renewed employment agreement in 2020, and Caesars Entertainment Inc. got a new CEO after its predecessor was acquired by Eldorado Resorts Inc. in July 2020.

It's difficult to compare the U.S. Securities and Exchange Commission-required ratios to prior years — especially since they've only required in companies' annual proxy statements since 2018 — but Harris added that generally, these numbers go down after times of economic hardships.

"Hotels, I would expect to be down because they got hit," she said. "When an industry's hard hit, you do see pay go down…. The target may not go down, but your actual bonuses, they'll drop. If you start to look at the value of the equity, it will be dropping."

Frydman said it's unclear why CEO compensation has taken off sharply in recent decades. Some argue that it's the effect of executives essentially setting their own pay in a market that lacks competition. Others say executive pay nowadays tracks closer to performance.

What Frydman does know with certainty is that there was a shift in executive pay structure in the 1990s and mid-2000s, with companies moving toward to equity-based pay for executives.

"A lot of the growth in the 1990s was due to stock option compensation. And more recently, restricted stock has become a very common way to compensate executives, she said. "We see the effects of that."