Wynn class action lawsuit proceeds after judge approval

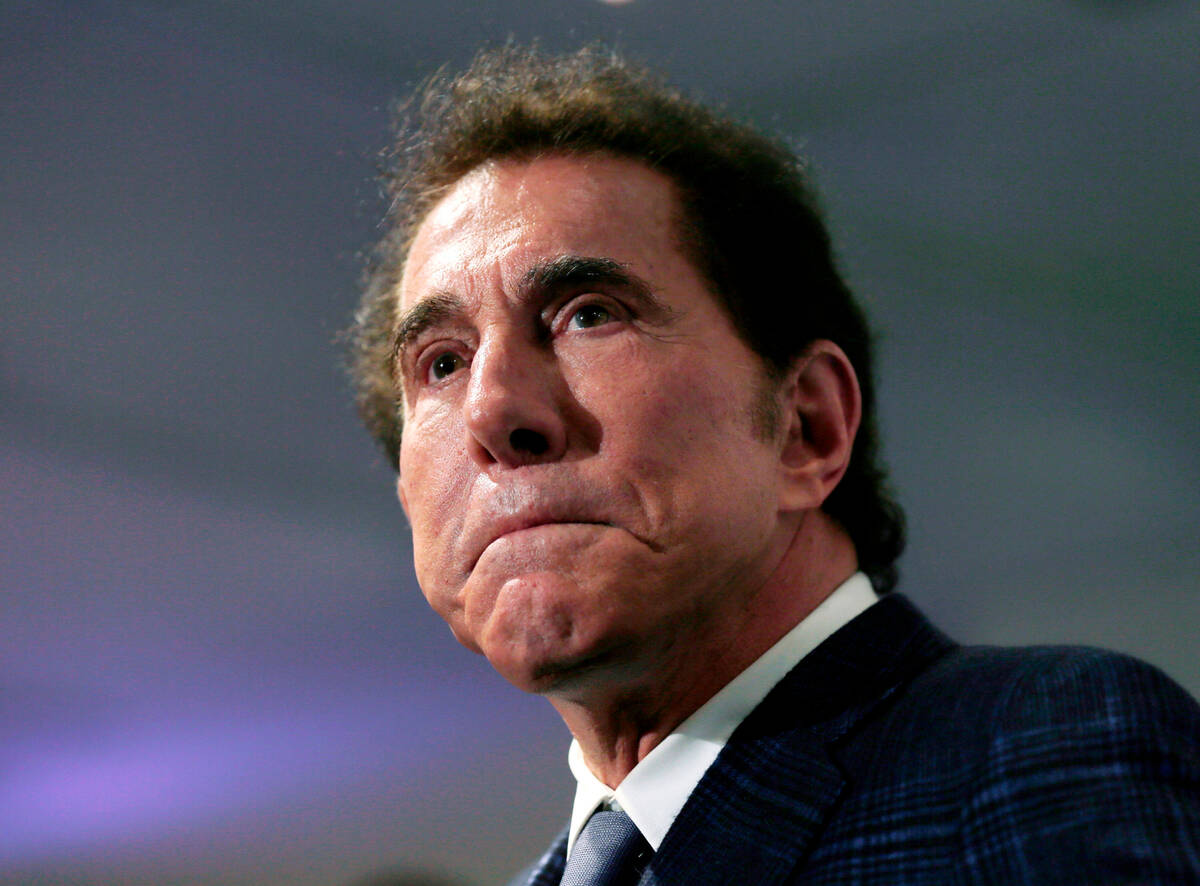

A federal judge gave the green light for a class action lawsuit to proceed against Wynn Resorts former Chairman and CEO Steve Wynn and former and current leaders of the company.

U.S. District Judge Andrew Gordon issued an order March 1 certifying the class action as part of a lawsuit initially filed as an amended complaint July 1, 2020, by John and JoAnn Ferris and Jeffrey Larsen against the company, Steve Wynn, four current and former Wynn executives and nine former and current members of the company’s board of directors.

The case stems from Wynn Resorts shareholders alleging their stock shares lost value as a result of allegations of sexual misconduct by Steve Wynn, raised in 2018, and the failure of Wynn executives to do anything about it once they were made aware of the allegations.

Steve Wynn has said he has never assaulted any employees.

Steve Wynn did not respond to a request for comment. A Wynn Resorts spokesman on Friday said the company has no comment.

Murielle Steven Walsh, an attorney representing the class from the New York office of the Pomerantz LLP law firm, said that a judge had to formally grant the motion for class certification so that attorneys can represent all investors who bought stock during the relevant period.

“Class certification is a necessary step in all class actions, and basically requires a showing that the proposed class members have similar claims and are otherwise similar enough to proceed on a class basis,” she said in an emailed statement.

This means investors who purchased Wynn’s stock from March 2016 until mid-February 2018 can now join the lawsuit to seek compensation for the loss of value of their shares.

‘Sufficient evidence’

Gordon’s ruling determined that there was “numerosity, commonality, typicality and adequacy among the affected investors.”

“There is no dispute that the defendants’ alleged misrepresentations were publicly known because they are contained in the defendants’ press releases,” according to Gordon’s order. He added that the plaintiffs “have presented sufficient evidence of reliance based on the fraud-on-the-market theory.”

Walsh said it’s unclear how many investors would become part of the class.

“I don’t have an exact number for class members included, but it will be substantial,” she stated. “Now that we are certified as a class action, class members are included in the class, unless they exclude themselves.

“Now we will be moving into merits discovery, getting documents from the defendants and third parties, and taking depositions of numerous witnesses. We don’t have a trial date set. However, I expect we will have a scheduling order for the case soon.”

$55 million in fines

The 198-page amended complaint from 2020 details Steve Wynn’s alleged sexual misconduct history that began in the 1970s and how executives at his hotels through the years failed to investigate the allegations.

Many of the allegations were reported by the Wall Street Journal in January 2018. Steve Wynn resigned as chairman and CEO within two months of the article’s publication, and he sold his company shares and completely severed his relationship with the company by May 2018.

Gaming regulators from Nevada and Massachusetts punished Wynn Resorts for failing to investigate the allegations with record fines totaling more than $55 million — $20 million in Nevada and $35 million in Massachusetts, where the company was in the process of opening Encore Boston Harbor.

Since the Nevada and Massachusetts disciplinary hearings, the company has replaced many of its executives and directors.

The former and current executives and directors named in the lawsuit: Wynn CEO Craig Billings, former CEO Matt Maddox, former General Counsel Kim Sinatra, former Chief Financial Officer Stephen Cootey; current board directors Pat Mulroy and Clark Randt and former board directors John Hagenbuch, Bob Miller, Alvin Shoemaker, Daniel Wayson, Jay Johnson, Ray Irani and J. Edward Virtue.

The lawsuit also details millions of dollars in stock share sales executives and directors made between 2014 and 2017.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.