Local business branches out

For years, politicians and business leaders have repeated the mantra that Las Vegas needed to diversify its economy.

Although the twin axles of casinos and real estate development fueled the city's rise from a desert village to an international destination, community leaders at least theoretically understood the potential pain if one or both of them faltered. Efforts to pull in new industries have ranged from luring door builders from California to biotechnology companies from New Jersey.

Yet, now that hard times have hammered the two economic drivers, which together have regularly accounted for at least 40 percent of Clark County's job base, unemployment has soared to 11.3 percent in May, the highest level in more than three decades and nearly two points above the national average. With the state's economy still "extremely weak," according to Department of Employment, Training and Rehabilitation chief economist William Anderson, the prospects for near-term improvement look bleak.

Where are the shock absorbers that were supposed to prevent such a sharp downturn? Functioning just as they should have, said Somer Hollingsworth, executive director of the Nevada Development Authority, the area's chief business recruiter since the 1950s.

"I would hate to think how bad this downturn would have been had it happened 10 years ago," he said. "The diversified economy has outgrown the resorts by leaps and bounds."

Likewise, North Las Vegas economic development director Mike Majewski said the creation of nonconstruction and nongaming jobs has outpaced almost every other region in the country. However, he noted, "When a casino opens, the sheer size overshadows the rest of it."

But other observers have seen only marginal progress.

"We're still an economy driven by one industry," said Keith Schwer, the director of the Center for Business and Economic Research at the University of Nevada, Las Vegas. "As far as diversification goes, we still have a ways to go."

Throughout the 1990s, leisure and hospitality accounted for about one-third of total employment, peaking at 35 percent in 1994. In the past decade, the share has dropped a few points but still has remained around 30 percent since 2005.

Construction has fluctuated more, in keeping with the industry's boom-bust nature, but has stayed near 10 percent.

This has sparked a renewed interest in attracting or nurturing new industries, to help insulate the economy against swings in discretionary spending, the lifeblood of gaming, and provide a broader tax base for state and local budgets now under severe strain.

"I hear a lot more talk about (diversification)," said Arnold Lopez III, NV Energy's economic development executive for Southern Nevada. "There is an awareness that if the times are tough on the single straw you are drinking from, you need to find more straws."

The thrust remains familiar, pushing a business-friendly regulatory regime and light taxation to industries highlighted by alternative energy, various aspects of medicine, technology and boutique manufacturing. The state provides little in the way of lavish incentives that many rivals do.

Further, the often-expressed gospel until recently that Las Vegas was "recession proof" and that tourism and conventions were nearly invincible helped push diversification to the back burner. Michael Skaggs, executive director of the Nevada Commission on Economic Development, recently calculated that various groups statewide spent about $400 million promoting the visitor industry but less than $10 million on everything else. His agency's near $6 million budget will take about a one-fourth cut this year.

"Until you feel the pain of diversification, it doesn't become real," Lopez said. "And when times get better, we think the problem has gone away."

The Reno area, for example, has pushed diversification more seriously than Las Vegas out of necessity. As Indian casinos opened in central and northern California, they began to siphon away a substantial amount of the clientele that did not want to put on tire chains to reach Reno casinos in the winter, said Robert Uithoven, a member of the Nevada Economic Development Advisory Board, a part of Las Vegas-based Public Company Management Corp.

"We (in Reno) did it because we were forced into it," Uithoven said. "We didn't have the gaming industry that kept right on booming like in Southern Nevada."

Although the overall goal of diversification is shared almost unanimously, the routes to get there vary significantly within the valley.

The city of Las Vegas, with little open land, has decided to focus on medical-oriented industries that would complement the Nevada Cancer Institute and the Lou Ruvo Center for Brain Health.

North Las Vegas has pursued industrial and logistical tenants for hundreds of open acres, such as a distribution center for Amazon.com, employing about 300 people, and a shop to refurbish the wheel assemblies for General Electric locomotives.

Henderson has pushed in the past for private higher-education institutions, due to a lack of open land, but expects to jump into the industrial arena again once it gains title to about 500 acres near the Henderson Executive Airport from the Bureau of Land Management.

The main industry targets include:

•Renewable energy, Mainly solar but also wind and geothermal

As oil prices surged last year and the political climate in Washington, D.C., changed, renewable energy emerged a favored object of diversification.

"I would not have taken this job if it weren't for the huge potential for renewables," Skaggs said.

Already, large-scale solar plants have started rising or gone into operation in the desert. With huge swaths of the state controlled by the federal government, economic development officials view renewable energy as a way to generate output on land that would otherwise remain off-limits.

But Skaggs recognizes that solar electricity-generating plants barely advance diversification. The Australian company Ausra, for example, completed a plant last year in Bakersfield, Calif., that took only seven months to construct and employed 150 people at the peak of construction. When it started producing energy last October, the payroll dropped to seven.

Skaggs hopes that the plants will draw with them the factories, engineering and research and development laboratories that bring larger and steadier payrolls. For example, Ausra opened a factory in Las Vegas last year to build solar hardware, initially employing about 50 people.

However, many other states have the same idea. Last year, the German company Schott AG announced plans to construct a photovoltaic cell factory in Albuquerque, N.M., a facility Hollingsworth said Las Vegas competed for but lost partly to New Mexico's generous financial incentives. By contrast, Nevada can offer only limited tax abatements and bond financing, which factors in the largely unsuccessful attempt to establish a biotechnology industry in the state.

"Schott Solar's decision to create clean-tech jobs in New Mexico demonstrates that our state is at the forefront of the clean energy revolution," New Mexico Gov. Bill Richardson said then.

Lopez of NV Energy envisions an even larger definition of solar energy, one that would involve studying the effects of the sun on things like building materials or colors. He acknowledges that few others have taken up his concept.

•Medicine, mainly research-intensive biotechnology

Although a high priority for a number of years, very little has happened. The Nevada Development Authority has eliminated the position on its staff that once concentrated on biotechnology recruiting, turning over the work to a committee.

Committee Chairman John Laub, who also heads the Nevada Biotechnology and Bioscience Consortium, has started to shift tactics by approaching biotech companies more from the business than scientific angle. In addition, he hopes for better results by trying to extend the city's established strengths in other sectors.

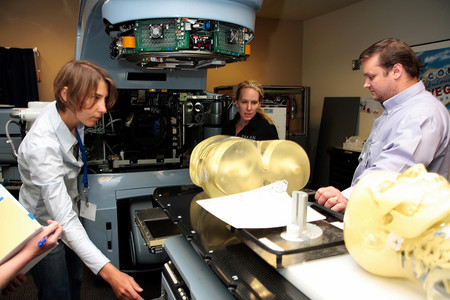

Varian Medical Systems' five-building campus, employing about 250 people, fits the template he hopes others will follow. Not only has Palo Alto, Calif.-based Varian installed a factory for equipment to screen cargo at ports and border crossings, it also has a technical help desk and training center for professionals on the company's medical equipment. This capitalizes on the hospitality industry and the growing concentration of call centers.

But this has not always worked as planned. Touro University placed a medical school in Henderson, part of the city's previous push for higher education.

Although New York-based Touro has expanded its campus since it opened in 2004, "It has been a challenge to establish very strong relations with the public and private sector," said Dr. Mitchell Forman, dean of the College of Osteopathy.

In particular, the school has been able to establish a residency programs for its students only with Valley Hospital Medical Center, crimping the ability to recruit students and keep them in the state. Typically, Forman said, doctors will set up their practices within 50 miles of where they served their residencies.

Henderson has also looked for medical practices, such as for the treatment of glaucoma, city economic development manager Bob Cooper said.

North Las Vegas will seek practices to complement the Veterans Administration hospital now under construction on the city's north side.

•Technology

Here, the region recently scored a coup when Red Digital Cinema announced plans to build an 80-acre campus in the valley's southwest corner. Red Digital Cinema, based in Lake Forest, Calif., builds digital movie cameras with an image quality that competes with film.

Based on plans approved by county commissioners last month, Red Digital Cinema plans to establish not only a research and development laboratory but also a soundstage and living quarters for visiting industry artists and executives. To Hollingsworth, this marks an extension of the city's pervasive entertainment industry with electronics that he has long coveted.

•General commercial

Now that is has annexed the Apex Industrial Park, where nothing has happened for two decades, North Las Vegas will try to attract a variety of industries to the site. With 21,000 acres, it has by far more land than any other location in the valley.

The types of industries sought do not fit simple categories. Some people have pushed for manufacturing; others believe logistics and distribution offer greater promise.

As in other categories, extensions of current industries also play a role. A couple of years ago, Shoes for Crews decided to put a call center and Western regional office in Las Vegas after a hurricane decommissioned its West Palm Beach, Fla., head office for about a week. Further, said executive director for Nevada sales Greg Woodford, the company opened a store to tap into one of its major markets, casino workers who want the company's shoes with slip-resistant soles.

Even with all these strategies in place, UNLV's Schwer cautions, it could take years to yield payoffs while political pressures demand quarterly results. For example, he cites the World Market Center's semiannual furniture shows as a logical yet novel extension of the city's hotel industry.

"It is critically important to innovate," he said, culminating in what he termed the "next great leap forward" in line with the construction of Hoover Dam and the legalization of gambling.

"I suspect that efforts to bring plastic processing plants from California are not it (a leap forward)," he said. "They can go away when conditions change just as easily as they came."

Contact reporter Tim O'Reiley at toreiley@lvbusinesspress.com or 702-387-5290.