Firm ranks Nevada No. 2 nationwide for foreclosures in ‘13

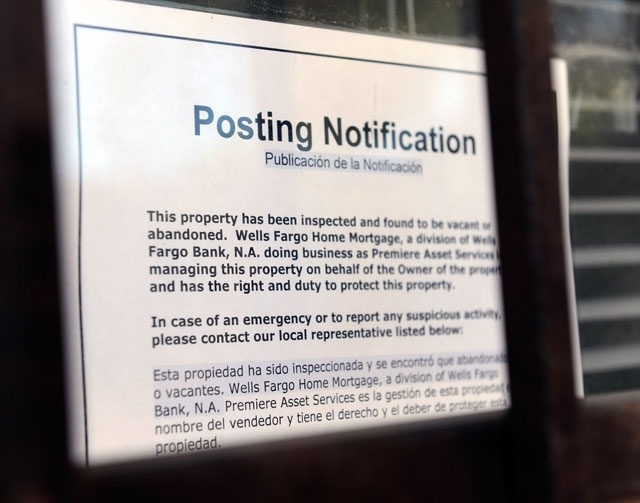

Another year, another high foreclosure rate for Nevada.

New numbers from Irvine, Calif., real estate research firm RealtyTrac ranked Nevada among the top five for foreclosure activity in 2013.

Statewide, 2.16 percent of homes, or one in every 46 homes, had foreclosure filings against them in the year, for a total of about 25,000 properties. Nevada ranked No. 2 behind Florida, at 3 percent, or one in every 33 homes. Rounding out the top five were Illinois (1.9 percent), Maryland (1.6 percent) and Ohio (1.5 percent).

Las Vegas landed at No. 9 among cities, with 2.45 percent of homes in the foreclosure process in 2013.

Despite its overall high rank, Nevada saw a drop of 20.9 percent in foreclosure activity from 2012 to 2013. Though the decline was steep, foreclosures fell considerably more in other states. California’s rate dropped 57.4 percent, while Arizona’s dipped 54.1 percent. The U.S. averaged a decline of 25.9 percent.

Even with 2013’s foreclosure slide, local experts say the carnage may not be over.

“For those of us who work in the industry every day, we still think the bottom could fall out,” said Tim Kelly Kiernan, broker-owner of Kelly Realty Group at Re/Max Extreme. “Depending on who you believe, we have tens of thousands of homes vacant, unoccupied or six months late on their mortgage payment. Common sense indicates that those are future foreclosures. I’m not being a pessimist, but some of us think there could be another downturn.”

RealtyTrac’s numbers did show that Nevada banks did continue to foreclose despite a drop in overall activity. Notices of default, or first-time foreclosure filings, were up 21 percent in the state from 2012 to 2013, even with changes in Nevada law that put new limits on banks looking to file. Nationally, first-time notices dropped 33 percent in the same period. Some of that state gain likely came from a record September, when banks filed more than 3,000 notices of default a month ahead of stricter new regulations.

But if you compare 2013 to 2011, when the first state law that tightened default restrictions on banks took effect, foreclosure starts were off 56 percent.

Foreclosure activity could go either way in 2014, Kiernan said. The state’s share of mortgaged homeowners who owe more than their home is worth dropped from more than 70 percent in 2012 to around 40 percent in 2013, and that means more people can avoid foreclosure through a short or traditional sale, he said.

But he added that you can’t ignore those thousands of empty homes.

“Our concern is, if banks start unloading foreclosures, then housing inventory will increase, and home prices will drop substantially.”

For a read on how things will shake out, look at what happens with notices of default through June, Kiernan said. If notices remain steady in the first half of the year, especially in April and May, then it’s less likely they’ll pick up later in the year, because foreclosure activity often slows in the third and fourth quarters. And that would mean a steady 2014 on the foreclosure front — also not necessarily a good thing, Kiernan said.

“There are thousands of people who have gone two, three, four, five years without making a mortgage payment,” he said. “I don’t understand how banks could not collect a mortgage payment for three or four years and be OK with that. And as a Realtor, I think we could get back to a normal market if we get through that (foreclosed) inventory.”

Contact reporter Jennifer Robison at jrobison@reviewjournal.com. Follow @J_Robison1 on Twitter.

BY THE NUMBERS

▶ 2.45 percent: homes in Las Vegas that had foreclosure filings against them in 2013, ninth in the nation

▶ 25,000: homes in Nevada that had foreclosure filings against them in 2013

▶ 2.16 percent: homes in Nevada that had foreclosure filings against them in 2013, second in the nation

▶ 20.9 percent: decrease in foreclosure filings in Nevada from 2012 to 2013