Gaming stocks take beating

If this were a fight, it would be stopped on cuts.

The average daily stock price of nine of the 10 publicly traded gaming companies charted by a Las Vegas financial adviser recorded double-digit declines in July, continuing a slide that began in March. Some casino operators and slot machine manufacturers saw their stock prices reach historic lows during the month.

Boyd Gaming Corp., whose average daily stock price was down almost 35 percent from July to June, and MGM Mirage, which had a drop of more than 33 percent, posted the largest declines.

"Investors are concerned. There is a lack of confidence in the market," said Brian Gordon, a partner in Applied Analysis, which compiles the average daily stock prices for an index covering the gaming industry.

Gordon said investors were hit with a slew of bad news during July: Gaming revenues in May recorded their sharpest decline in 24 years while two companies with significant holdings in Las Vegas and Macau posted mixed results. Meanwhile, casino giant MGM Mirage said this week that the last piece of financing for the $9.2 billion CityCenter development had not yet been completed.

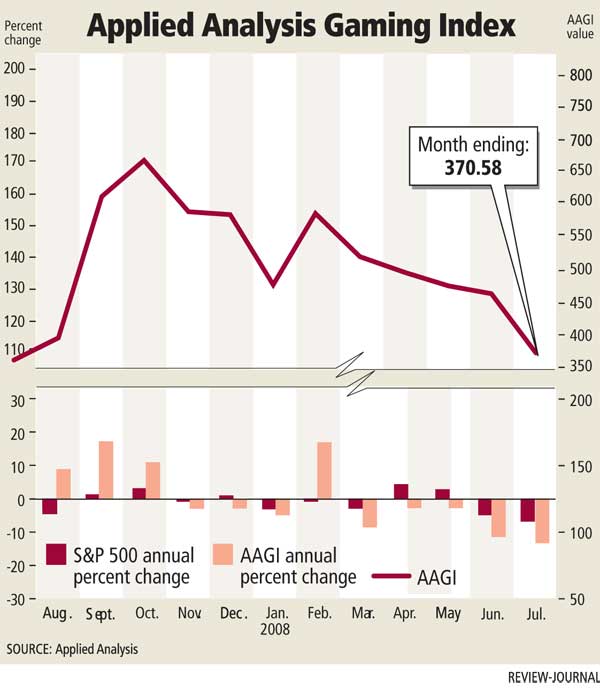

The sour stock market helped send the Applied Analysis Gaming Index down 58.54 points to 370.58 in July, its lowest figure since September 2006.

"You're talking about some companies giving back two years worth of value," Gordon said. "Low levels of consumer confidence have spilled over into concern on the part of investors."

MGM Mirage reports its second-quarter earnings Tuesday, but the results may not be enough to win back investors. The casino operator, which owns 10 Strip resorts, is trading down almost 66 percent from a year ago, dropping to a low of $21.65 on July 15, its lowest price since 2005.

"Probably, an improvement in the national economic climate would be one of the first signals investors would latch on to," Gordon said.

Investors will probably be watching results reported from MGM Mirage's MGM Grand Macau, which opened in December. Wynn Resorts' earnings in the second quarter were saved by Wynn Macau, which had a 50.3 percent increase in net revenues and a 67.5 percent jump in cash flow, offsetting declines in both line items at Wynn Las Vegas.

Las Vegas Sands Corp., which reported earnings Wednesday, had an 84.1 percent jump in revenues during the quarter, but had a net loss of $8.8 million because of costs associated with opening casinos in Las Vegas and Macau and corporate expenses. Still, the company's Venetian Macau reported revenue figures above expectations.

Wynn Resorts, which announced an increase to its previously announced stock repurchase program, had the lowest month decline in average daily price of any of the 10 companies in the index, a drop of 6.4 percent. The average daily share price of Las Vegas Sands was down 28.8 percent in the month.

Still, some Wall Street analysts see a silver lining.

Jefferies & Co. gaming analyst Larry Klatzkin said some of the major casino operators gained in value during the last few days of July. Also, several casino operators have indicated July's gaming action has been better than in previous months.

Klatzkin said Las Vegas Sands, despite its decline, may still be a good bargain.

"We remain extremely positive on Las Vegas Sands going forward and would be buyers of the stock," Klatzkin said in a note to investors Thursday. "Our long-term thesis on Las Vegas Sands remains unchanged. Las Vegas Sands remains a growth company with the potential to enter new markets."

Regional casino operators have also seen their average daily stock prices decline, including Ameristar Casinos (down 25 percent) and Pinnacle Entertainment (off 21 percent). Both Las Vegas-based companies will report second-quarter results next week.

Wachovia Securities gaming analyst Brian McGill said some regional casino locations, such as the Gulf Coast of Mississippi, have experienced a spike in tourism during the month.

"The first half of the month of July was particularly strong in many regions," McGill said in a note to investors. "Through the first three weeks of the month, many regional operators had suggested they were ahead of the pace of the previous year. While this is an encouraging sign for operators, most do not have the visibility to know if it can continue into August and beyond."

Slot machine makers weren't immune to the declines in July stock prices. Industry giant International Game Technology saw its average daily share price fall 25 percent compared with June while Bally Technologies was off almost 28 percent.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.