Help on the way for many restaurants ravaged by pandemic

Help is on the way for many of Nevada’s restaurants devastated by the COVID-19 pandemic.

The Restaurant Revitalization Fund, part of the $1.9 trillion package signed into law last week by President Joe Biden, will provide $28.6 billion in grants for restaurants whose revenue fell in 2020 as a result of the pandemic.

The new federal program will provide grants equal to the amount of restaurants’ revenue losses, up to a maximum of $10 million per company and $5 million per location. Eligible companies cannot own more than 20 locations, and they cannot be publicly traded.

Las Vegas Valley restaurateurs and industry trade groups welcome the grants.

“Finally,” said Elizabeth Blau, whose restaurants include Honey Salt in Summerlin and Buddy V’s Ristorante at The Venetian. “We’ve just been lobbying, yelling, screaming — trying to get somebody to listen about how devastating the impact of COVID has been on our industry in particular.”

Natalie Young, owner of Downtown Las Vegas’ Eat and Old Soul, said the funding will help businesses on the brink of closing.

“It’s great that this will help the little guys,” Young said. “I think it would be nice to let restaurant owners that couldn’t get the (Paycheck Protection Program) the first two rounds to get access to this money.”

Funding comes at a crucial time

Local industry groups lauded the passage of the bill, saying the money comes at a crucial time for many independent restaurateurs. Still, restaurant owners and trade groups say that even with the new funding, it’s a long road ahead.

Alexandria Dazlich, director of government and public relations for the Nevada Restaurant Association, said that the state’s largest restaurant trade group is “pleased” that the $1.9 trillion package included the Restaurant Revitalization Fund.

“Small and independent restaurants have been ravaged by the pandemic, so this relief comes at a time where many operators have to decide between making payroll or closing their doors,” Dazlich said.

Randi Thompson, Nevada director of the National Federation of Independent Businesses, said the new funding has been a long time coming.

“This is the first restaurant-specific federal relief package, and it is long overdue,” said Thompson, adding that thousands of restaurant owners have lobbied Congress as early as April 2020 to provide relief with The Restaurants Act. “So, it’s good to see this help finally.”

Restaurants were decimated by the pandemic that led to government-ordered shutdowns and that is still keeping many diners away. As of Dec. 1, more than 110,000 U.S. restaurants were closed either temporarily or permanently, according to the National Restaurant Association. That’s 17 percent of the number of restaurants in business before the pandemic. In January, industrywide revenue was down more than 16 percent from a year earlier, the group said.

Blau said many restaurant owners across the valley are aware of the program.

“For some small operators who have had to take on incremental loans — whether from the SBA, from the bank or, frankly, from family membersor life savings — this is incredibly important and incredibly timely,” she said.

Young said she won’t apply for the new program, saying the money should go to restaurant operators who might not have received funding from the PPP.

“I feel like I’ve gotten my share from the PPP,” she said. “I’m running on really frugal margins right now because we never know what’s going to happen in the future. But there’s people that didn’t get PPP, and if those restaurant owners can get some of this money, that’s how it should be.”

Who’s qualified?

Nevada banking leaders say they haven’t received word whether this new federal program will be similar to the PPP with banks and lenders accepting and processing applications. Details of the restaurant relief fund are still being ironed out.

The SBA’s senior adviser, Michael Roth, said last week that the agency “will work tirelessly to ensure eligible borrowers will get access to this critical economic relief.”

The grant amount is determined by a restaurant’s pandemic-related revenue loss. Here’s how to calculate the amount, according to the trade group Independent Restaurant Coalition:

— Restaurants established before 2019: (2019 revenue) - (2020 revenue + PPP loans)

— Restaurants opened in 2019: (12 × 2019 revenue ÷ months open in 2019 ) - (2020 revenue + PPP loans)

— Businesses opened in 2020: Can receive funding equal to eligible expenses incurred

Certain restaurants will get priority: The U.S. Small Business Administration will prioritize awarding grants for women-, veteran-, or socially and economically disadvantaged-owned businesses. And, the fund sets aside $5 billion for the smallest restaurants, those whose annual revenue is $500,000 or less.

Restaurants, food trucks and carts, caterers, bars or lounges, taprooms and tasting rooms are eligible for the program. Funds can go to pay mortgage, rent, utilities, construction costs to accommodate outdoor seating, cleaning materials, normal food and beverage inventory, and more.

Capacity limits, community support

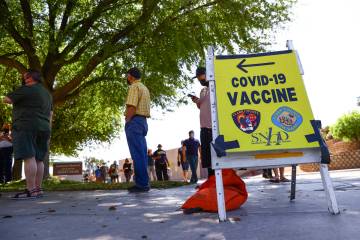

Last week, Nevada Gov. Steve Sisolak loosened COVID-19 restrictions. On Monday, a majority of businesses, including casinos and restaurants, across Nevada were allowed to bump up their capacity to 50 percent of occupancy levels.

Industry groups say that while the $28.6 billion fund will help local businesses, capacity limits will constrain a strong recovery.

“While these funds will help keep many struggling restaurants operating for a little while longer, it will not be until we can resume operating at 100 percent capacity that true recovery of the restaurant industry can begin,” said Dazlich, of the Nevada Restaurant Association.

Thompson, of NFIB, added, “Businesses can survive only so long on taxpayer bailouts. All they want is to get back to work, which will in turn generate tax revenue.”

Local valley restaurants say community members have gone above and beyond to support their business.

“People are really going out of their way to support local businesses in their neighborhoods,” said Blau. “Because we’re seeing a lot less travelers coming, the local community has spent more time supporting their local restaurants. We’re seeing that loyalty and the community coming together.”

The Review-Journal is owned by the family of Sheldon Adelson, the late CEO and chairman of Las Vegas Sands Corp. Las Vegas Sands operates The Venetian.

Contact Jonathan Ng at jng@reviewjournal.com. Follow @ByJonathanNg on Twitter. The Associated Press contributed to this report.