2011 may be worst year for new-home sales in Las Vegas

With two months remaining in the year, it looks like 2011 could be the worst year on record for new-home sales in Las Vegas, the latest figures from Home Builders Research show.

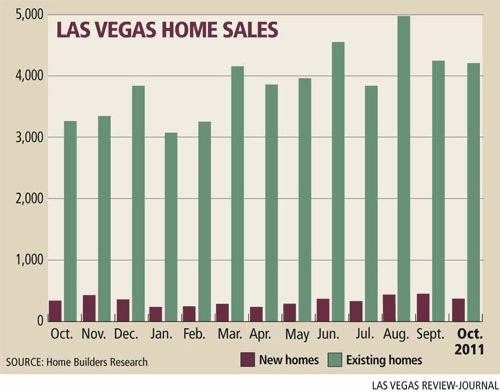

Las Vegas homebuilders recorded 367 new-home sales in October, bringing the year's total to 3,155, a 31 percent decrease from a year ago, the firm reported Friday.

Even if new-home sales end up near 4,000, the count will still be less than half of the roughly 8,700 sales in 1988 and 1989, Home Builders Research President Dennis Smith said.

The median price has bounced up and down since January, falling 7.6 percent from a year ago to $196,360 in October.

"The most recent housing numbers certainly suggest we are still many months from what we would consider being the end of our area's housing recession," Smith said.

New-home permits, an indication of future housing construction, hit an 11-month-low at 196 in October, and are down 24 percent from a year ago at 3,098.

"To those people who say you shouldn't be building any new homes, you can't just shut down an industry as important as housing," Smith said. "That's like saying we should close the banks because they're not working with anybody. The market will take care of it and it has. Builders are only building what they're selling. Inventories are not that bad."

Existing-home sales continue to show strength as bargain-prices, foreclosures and short sales dominate the market. Smith counted 4,205 resales in October at a median price of $110,000, down $9,000, or 7.6 percent, from a year ago.

The resale inventory has remained fairly constant and represents about a six-month supply.

Residential Resources of Las Vegas found that 48 percent of single-family home sales in October were real estate-owned, or bank-owned, properties, and 26 percent were short sales, or lender-approved sales for less than the principal mortgage balance.

The government has implemented several programs to help underwater homeowners, or those with negative equity, but after more than two years, little has been accomplished.

Recent changes to the Home Affordable Refinance Program announced by President Barack Obama during his Nov. 1 trip to Las Vegas appear to more of a "political ploy" than an asserted attempt at helping homeowners in Las Vegas, Phoenix and other parts of the country, Smith said.

Any quantifiable results from the program are at least six months out, Smith said.

"It'll be interesting to see if there's a difference in how they treat those who are over 125 percent and those who are under," he said of HARP's benchmark for underwater mortgages. "This program could work much better if it could be regionalized so the hardest-hit areas like Las Vegas would get more help."

The national average for underwater mortgages in major metroplitan areas is 25 percent, but it's closer to 60 percent to 70 percent in Las Vegas, according to sources such as CoreLogic and Zillow.com.

Mark Baker, mortgage broker with Sierra Pacific Mortgage in Las Vegas, said HARP's impact on Las Vegas could be huge, especially the limiting of loan level price adjustments to the point they're almost negligible. The rate would increase just one-eighth of a percentage point, from the current 4.25 percent to 4.375 percent, he said.

Homeowners who purchased around 2006 with a 30-year rate above 6 percent and 20 percent down are still upside down, Baker said.

"They can't do anything, they're stuck. That same borrower can come to the lender and get a 20-year loan at 4 percent and their payment drops dramatically and they cut five years off their mortgage," Baker said. "Now it becomes a win-win for a consumer who's $50,000 upside down, but he likes his home and he can't rent anything for less than what he's paying for mortgage."

Contact reporter Hubble Smith at

hsmith@reviewjournal.com

or 702-383-0491.