Bank-owned homes gobbled up

Headlines scream almost daily about soaring foreclosures, that more than 1 million homes were lost to foreclosure in 2008 and the number is expected to top 1.2 million this year.

The good news in Las Vegas is that bargain-hunting buyers are chomping through the foreclosure inventory at a faster pace than other parts of the nation.

Existing-home sales increased 77 percent in the first quarter to 9,122, and roughly two-thirds of those sales were bank-owned properties, said Larry Murphy, president of SalesTraq, a Las Vegas-based research firm.

He counted 2,376 bank-owned dispositions in March, compared with 1,846 acquisitions, leaving bank-owned inventory at 15,954 properties. It's the first time dispositions have outnumbered acquisitions since Murphy started keeping track.

"It could be a fluke," he said. "I'm curious to see if it happens twice."

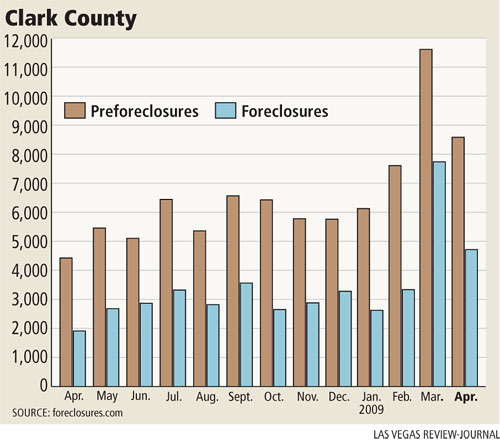

Clark County had 4,863 foreclosures for April, down 37.2 percent from 7,747 in March, but up 154 percent from 1,911 in the same month a year ago, Sacramento, Calif-based Foreclosures.com reported.

Preforeclosure filings, which start with a notice of default, dropped to 8,639 in April from a record 11,593 in March. There were 4,426 Clark County preforeclosure filings in April 2008.

Banks have also become more sophisticated and savvy with REO pricing, Murphy said. They'll list a foreclosure at below-market value to create competitive bidding between interested parties, bringing in multiple offers and getting a better price in the final analysis, Murphy said.

The median price of a foreclosure sale in March was $127,500, compared with $149,900 for homes that were not bank-owned, SalesTraq reported.

"The multiple bids for homes under $200,000 are here for a while," Steve Hawks of Platinum Real Estate Professionals said. "The homes under $200,000 are in short supply, and then you have investors competing with first-time homebuyers to make it even more competitive."

As for bidding wars, buyers don't want to overbid on a foreclosure home because it might not appraise high enough for the loan, Hawks said.

"The cash buyer can bid as high as they want, so in this market, the edge goes to the investor with cash," he said. "Don't count the builders out. Frustrated buyers can take heart that builders have retooled and are building smaller homes, which will increase supply for first-time homebuyers."

Banks need cash and their bulging portfolios of "hidden" foreclosure inventory are one way to help them get it, said Alexis McGee, president of Foreclosures.com. If they price the homes right, it could translate to incredible deals for consumers on bank-owned foreclosure inventory, she said.

"This isn't a pipe dream amid a recession with 8.9 percent national unemployment and foreclosures at all-time highs," McGee said. "Now is the time for homebuyers and investors to press capital-hungry banks to unload their phantom REO inventory."

The "phantom" inventory is lender-repossessed properties that are not showing up for sale on the Multiple Listing Service. Only about 30 percent of REOs are listed on the MLS, McGee said.

"This is a staggering low number," she said. "That leaves 70 percent of lender-owned REOs that no one knows about potentially available for sale."

The number of REO listings in Las Vegas had been declining since February, when certain foreclosure moratoriums were enacted by Fannie Mae and Freddie Mac, as well as by some of the large lenders, Frank Nason of Residential Resources said.

He saw a 5 percent drop in the first week of May from the previous week, the largest weekly drop since he's been tracking the statistics.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.