Buyers chasing homes in Las Vegas as prices continue falling

Las Vegas housing prices remained flat in November, while single-family home sales went into their seasonal slump at 3,117 closings, up 42.8 percent from the same month a year ago, the Greater Las Vegas Association of Realtors reported Tuesday.

"Home sales and activity traditionally slow down around the holidays, so we may see similar trends in the next month or two," Realtors association President Sue Naumann said.

With 726 condo and townhouse sales, the number of units sold in November was 3,843, compared with 4,385 in October and 2,757 in November 2008.

The single-family median home price has dropped 24.7 percent from a year ago to $140,000. That's an increase of 0.6 percent from $139,100 in October. Condo prices are down 25 percent from a year ago at $68,000.

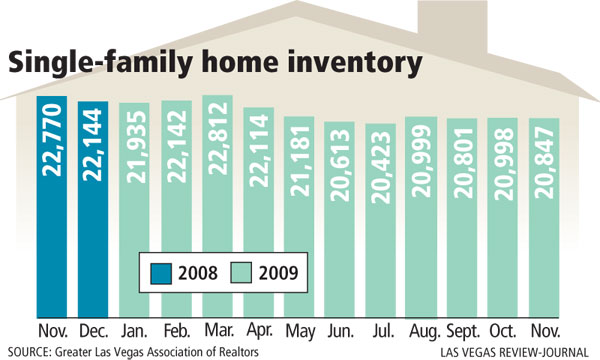

The inventory of homes for sale fell 8.4 percent from a year ago to 20,847 in November, though only 8,385 units are available without an offer. The others are in contract, or are contingent or pending on some other action.

Naumann said she has a first-time homebuyer waiting approval of a short sale -- where a home is sold for less than the mortgage balance -- and another short sale in the works. She's also showing condos to a cash buyer, probably in the range of $125,000.

"There are a lot of buyers looking to take advantage of this market," she said. "But there are other buyers out there, and that's their competition."

Naumann said 41 percent of homes are being purchased with cash, about the same as October, an indication that investors have returned to the market. Bank-owned properties accounted for 61 percent of November sales, she said.

Real estate broker Deirdre Felgar of Realty America said she's about at "wits' end" dealing with the banks. They received government bailout money and were allowed to value foreclosure properties on future market values so they won't be out of federal compliance, she said.

Now they don't want to list properties for sale and realize the losses.

"Prices fell so low last year when banks dumped thousands of properties on the market ... they caused prices to tumble to 1997 or 1998 prices," Felgar said. "This caused virtually everyone who purchased in the last 10 years to have a negative value on their property, making it impossible for them to sell because their homes are worth less than the mortgage."

Banks are not putting enough homes on the market to keep up with demand, she said.

Buyers find a home they like at a price they can afford, only to discover they're up against 20 to 25 competing offers. Banks will take up to 30 days to approve the sale, usually selecting a cash buyer over someone who needs financing.

Felgar said she had out-of-town clients fly into Las Vegas, put in 16 offers with $40,000 to $60,000 down and only two were accepted. "That's ridiculous and unfair to the public," she said.

David Brownell of Keller Williams Realty said he's seeing an interesting shift from foreclosures to short sales as a higher percentage of total sales. Also, foreclosures and short sales comprised 80 percent of November sales, compared with 90 percent in January.

"There may be hope for private sellers," Brownell said. "Or perhaps more of them have had their past-prices spirit broken and they have finally awakened to the actual market conditions."

Statistics from the Greater Las Vegas Association of Realtors are based on data collected from the Multiple Listing Service and do not necessarily account for sale by owners, homebuilders and transactions not involving a Realtor.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.