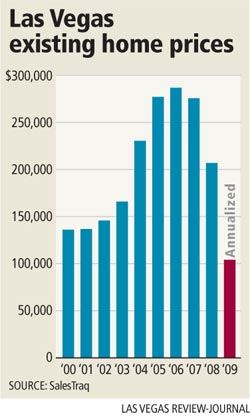

Could the median price for existing homes in Las Vegas fall to $100,000?

The $100,000 median-priced home -- written off as extinct in Las Vegas just a couple of years ago -- could return by the end of this year, a local housing analyst said Thursday.

If the 16 percent first-quarter depreciation rate continues for the next three quarters, that's where the median price will be for existing homes, Larry Murphy of Las Vegas-based SalesTraq said at his Crystal Ball housing seminar.

"I'm not going to say it's going to happen. That's not my prediction. I'm just saying it's conceivable," he said. "In 2007, I would have thought what happened in 2008 was inconceivable, but there it was in black and white. Home values went down 33 percent. I've learned to never say never and I know that anything is conceivable."

It wasn't long ago that Murphy thought the $200,000 home might become extinct.

SalesTraq showed the first-quarter resale median price at $140,000, down 16 percent from a year ago. The "worst-case scenario" for new-home median prices by the end of the year would be $150,000, down from the first-quarter median price of $220,000.

"Before builders drop their price that much, they'll stop building," Murphy said. "I talked to some builders and they told me they don't need any more practice building houses. They already know how to do that."

Murphy said the recession looks like it will be "wider and deeper" than expected, so he's revising his projection of new-home sales this year to under 5,000, less than half of 2008 new-home sales. The number of subdivisions actively selling new homes has dropped from a high of 585 to about 300, he said.

Foreclosures will continue to affect home values in Las Vegas, although Murphy noted some inconsistency in the reporting of foreclosure numbers from various sources and confusion over the definition of a foreclosure.

SalesTraq reported ZIP code 89031 in North Las Vegas as the area with the highest number of foreclosures, 333, in the first quarter, followed by 89110 (239), 89032 (226), 89108 (216) and 89148 (214).

Murphy found a speck of positive news when he counted a higher number of bank-owned dispositions, or foreclosure sales, than acquisitions in March, an indication that the foreclosure inventory could begin to decline.While median home prices continue to decline, along with price per square foot, overall sales have increased and a greater percentage of real estate-owned, or bank-owned, and short sales under contract seem to be positive indicators for the market, Frank Nason of Residential Resources said.

"Especially considering the hammering the local economy appears to be taking on jobs," he said.

Bank-owned properties accounted for about 40 percent of homes on the Multiple Listing Service and 78 percent of closings in March, Nason said. Short-sale properties accounted for 34 percent of listings and 6.9 percent of closings.

Average sales price for REO homes was $155,206, or $76.63 a square foot, and the median sales price was $139,900, or $77.16 a square foot.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.