Damage to LV housing mounts

Business has been good for Harley Marks and Greg Ozuna, two former car salesmen who started American Home Services in Las Vegas a few months ago to clean out foreclosed homes.

From all indications, it's going to get better.

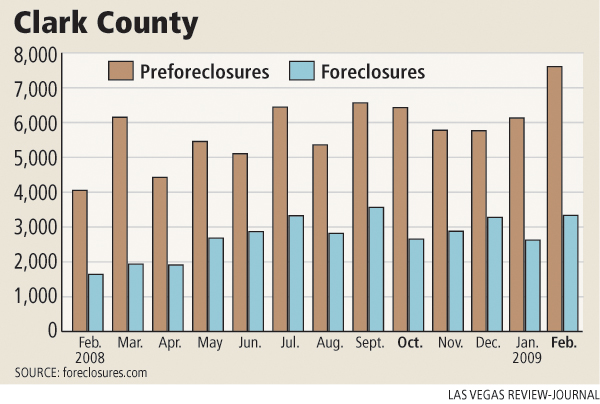

After a slight downtick to start the year, home foreclosures in Las Vegas jumped to 3,286 in February, double the amount from the same month a year ago, Foreclosures.com reported Wednesday.

"It's unfortunate for the community," said Marks, whose company is contracted by real estate agents to secure foreclosed homes and remove furniture and trash. "It's almost a numbing feeling after months of looking at these homes."

Foreclosures.com showed Las Vegas with a 25.9 percent increase from January's 2,609 completed foreclosures. The first two months put Las Vegas on track to easily break last year's record 31,416 foreclosures.

Preforeclosures, or the filing process that starts with a notice of default, increased to 7,635 in February, compared with 6,050 in January and 4,051 in February 2008.

The U.S. Foreclosure Index increased 67 percent in February, indicating that the foreclosure crisis is far from over, said Alexis McGee, president of the Sacramento, Calif.-based foreclosure information company.

Despite efforts by the government and many banks, hopeful signs from the last quarter of 2008 and January didn't follow through in February, McGee said. Many homeowners are in trouble and rising unemployment threatens to intensify the problem, she said.

President Barack Obama's Making Home Affordable Program may quell the wave of foreclosures, McGee said. Guidelines recently came down from the administration on loan modifications and refinancing, urging banks to lower interest rates and write down mortgage principals, she said.

"That's going to be a big help," McGee said. "I think it's going to slow things down."

Both Fannie Mae and Freddie Mac have extended their suspensions of foreclosure evictions through March. They've also instructed loan servicers not to complete foreclosure sales on any homes that may be eligible for the loan modification program.

Real estate-owned, or bank-owned, properties accounted for 64 percent of January's existing-home sales in Las Vegas, or 1,751 homes, said Larry Murphy, president of Las Vegas-based SalesTraq.

Meanwhile, the banks took back 2,356 homes during the month, a 37 percent increase from a year ago. Until foreclosure sales and bank repossessions reach equilibrium, median home prices in Las Vegas will continue to fall, Murphy said.

The median sales price of a bank-owned home was $139,000 in January, compared with $170,000 for the remaining homes, SalesTraq reported.

"It's so confusing. Everybody thinks of foreclosure and it means different things to different people," Murphy said. "Is that a notice of default, a home actually taken over by the bank or an REO that the bank got rid of? It's all tied to one word -- foreclosure -- because that's how the public thinks."

Fannie Mae and Freddie Mac placed a moratorium on foreclosures from November through January, which helped to slow foreclosures during that period. Several banks followed suit, but their moratoriums have expired or are about to expire.

Mark Stark, owner and broker at Prudential Americana in Las Vegas, said foreclosure numbers are not stable because banks hold back on releasing their REO inventory during some months.

"You've got to let them keep coming to figure out if they're slowing or increasing," he said. "There's so much going on with the holidays and TARP (Troubled Asset Relief Program). My point is that statistics don't give you valuable information."

The Federal Housing Administration raised its loan limit in Las Vegas back to $400,000 after lowering it to $287,000, and that should help the market, Stark said. Lower interest rates are a "plus," he said, as well as the $8,000 tax break for first-time home buyers.

"What's the plan to absorb the (foreclosure) inventory that's hit the market? You've got to help people buy these," Stark said.

McGee of Foreclosures.com said the latest delinquency numbers from the Mortgage Bankers Association "speak volumes" about what's to come.

The association reported that the delinquency rate for mortgage loans rose to a seasonally adjusted record rate of 7.88 percent of all loans outstanding as of the fourth quarter 2008. Association numbers also show that foreclosure inventory jumped sharply in the quarter, while the number of loans entering foreclosure was relatively unchanged due partly to foreclosure moratoriums.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.