‘Feeding frenzy’ in Las Vegas

More than half of Las Vegas home sales in March were foreclosures or short sales, the president of Greater Las Vegas Association of Realtors said Monday.

The association reported 1,478 escrow closings for single-family homes during the month, a 34.6 percent increase from February. It was the third straight monthly increase. Sales are down 7.9 percent from the same month a year ago.

"What an increase we had in March," association President Patty Kelley said. "People are coming outside, the weather's getting warm and they've heard doom and gloom all winter long. There's some great deals out there, and they're not going to last forever."

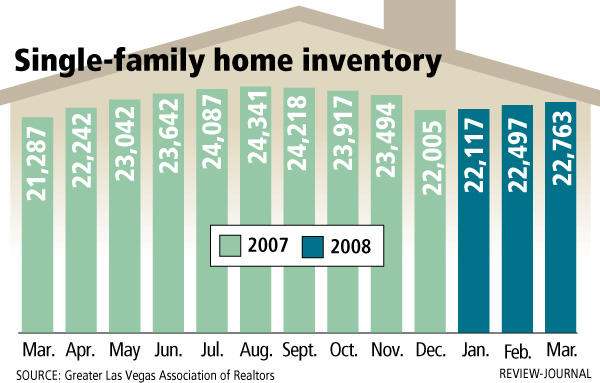

Inventory of homes listed for sale is at 22,763, up 1.2 percent from February and up 6.9 percent from March 2007.

Median prices declined 1.4 percent to $243,169 as bank-owned properties continue to sell below market value, Kelley said. Foreclosures and short sales, or homes sold for less than the mortgage owed, accounted for 773 sales in March, 52.3 percent of the total.

While home prices are still declining, down 20.3 percent from a year ago, Kelley said she doesn't expect them to go much lower because they're now selling for less than what it would cost to build that same home today.

She said foreclosure homes are getting multiple offers. It's taking longer for banks to approve sales and for buyers to close escrow.

"It's starting to become a feeding frenzy," Kelley said. "The banks, the title and escrow companies are backed up. They laid off all their people and now they don't have the staff to handle the volume. We could get foreclosures and short sales out of the inventory. We have buyers coming back, but the banks can't act fast enough."

Doug Glendinning of Las Vegas said he's losing his enthusiasm and patience three weeks after making an offer on a bank-sale home.

"With so many houses in that particular category, I don't understand how the bank can drag its feet on accepting or rejecting or asking for a counter(offer)," Glendinning said. "I'm not concerned with their decision, just how can they sit there and not make one? No one can explain this to me in any common-sense terms."

Distressed property sales are among the greatest opportunities in Las Vegas right now, Jeremy Aguero of Applied Analysis said.

"Sharks are swimming around the blood," he said at an economic forum last week.

Jeff Adams of FreeReal EstateMentoring.com said the current market is a real estate investor's "dream come true."

"With the subprime meltdown going on right now and foreclosures up over 700 percent nationwide, there is a huge opportunity out there to pick up properties at 50 (cents) to 60 cents on the dollar," he said.

Realtor Steve Hawks of ReMax Platinum said he just received notice from the bank about a 2,480-square-foot home in Seven Hills going on the market for $334,000, compared with its 2002 sales price of $565,000.

For condos and townhomes, there were 198 sales in March, a 19.3 percent increase from the previous month and a 41.9 percent decline from a year ago. The median price was $163,000, down 18.5 percent from a year ago.

Total sales volume for March was $451 million, a 25.4 percent decline from a year ago.

Association statistics are based on data collected through the MLS and do not necessarily account for newly homes sold by local builders and other transactions not involving a Realtor.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.