Foreclosure wave loses steam

The nation's foreclosure hemorrhage slowed in April as both preforeclosure filings and bank repossessions declined from the previous month, Foreclosures.com reported Monday.

Lenders took possession of 74,570 homes in April, down more than 5 percent from March, the California-based online foreclosure service found. Preforeclosures dropped 7.5 percent from March.

Nevada remains the No. 1 state in the nation with 3.15 percent of households in preforeclosure, followed by Arizona (2.87 percent) and Florida (2.56 percent). Nevada was seventh with 23,264 total preforeclosure filings through the first four months of the year.

"The sky isn't falling, and the bottom of the housing market is in sight," Foreclosures.com President Alexis McGee said. "The problem with foreclosures is they go up and they go down, so it takes two or three months to see where they're going, but for now, it looks like April is headed in the right direction."

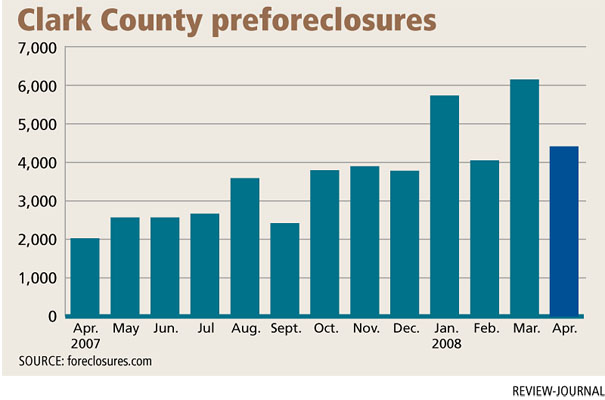

Clark County had 4,426 preforeclosures in April, more than double the 2,029 preforeclosures in the same month a year ago. The number is down from a record 6,152 preforeclosures in March.

REOs, or real estate owned by the lender through foreclosure, declined to 1,911 in April, compared with 1,937 in March.

The monthly report is based on formal notices filed against a property during the foreclosure process, which can include notice of default, notice of foreclosure auction, trustee's deeds and REOs.

The good news, McGee said, is that 17 states had fewer REO filings in April than March. The bad news is that 3.8 of every 1,000 households nationwide (288,497 REO filings) have been lost to foreclosure so far this year. Another 696,925 filings, or 9.4 of every 1,000 households, have been recorded year-to-date with 179,046 filings in April.

"The numbers tell us the economy isn't dead," McGee said.

U.S. gross domestic product was not negative as many had speculated and grew 0.6 percent in the first quarter, she noted. Positive moves by government and industry, including the evolving Federal Housing Administration reform and tax credits along with federal tax rebates, are making a difference, she said.

"We're still seeing price concessions," McGee said. "Sellers are paying a lot of things that they wouldn't normally pay and it doesn't show up in the sales price. We're seeing down payment assistance, sellers paying closing costs and points for the bank."

Thomas Love, broker and branch manager for Realty Executives in Las Vegas, said he put about a half-dozen foreclosed properties in escrow in April after closing none in March.

"We can't get them to close," Love said. "The banks are so slow to act that buyers go down the street to another bank-owned home that's a better deal, all because of the lack of action that banks take."

The inventory of bank-owned properties in Las Vegas came about by investors hoping to jump on the "appreciation train," which has virtually stopped in the lower- to middle-housing market, Love said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

OTHER APRIL STATISTICS FROM FORECLOSURES.COM

• States with the highest number of REO filings year to date: California, 70,863 filings (6.2 per 1,000 households); Florida, 24,764 (4 per 1,000); Arizona, 23,841 (12.6 per 1,000); Texas, 22,521 (3.8 per 1,000), and Michigan, 20,069 (6.7 per 1,000).

• States with the most preforeclosure filings per household year to date: Nevada, 31.5 per 1,000 households (23,264 filings); Arizona, 28.7 per 1,000 (54,059 filings); Florida, 25.6 per 1,000 (162,316 filings); California, 13.9 per 1,000 (160,044 filings), and New Jersey, 9.6 per 1,000 (28,825 filings).

• REO filings by region: Southwest, 5.4 filings per 1,000 households; Midwest, 3.9 filings per 1,000 households; Southeast, 3.8 filings per 1,000 households; and Northeast, 0.8 filings per 1,000 households.