FORECLOSURE WOES RISE

Foreclosures have nearly tripled in Clark County through September, and the number coming down the pike is growing, a California-based online foreclosure source reported.

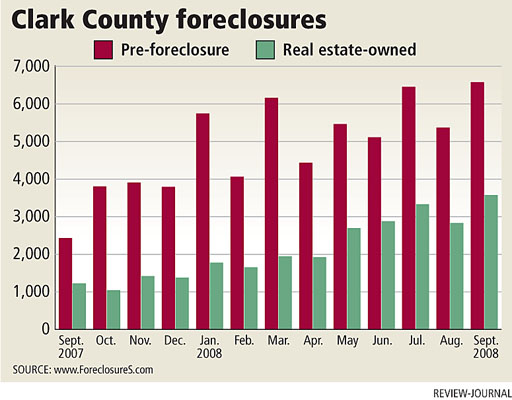

Foreclosures.com counted 3,563 real estate-owned properties in Clark County taken back by lenders in September, bringing the year-to-date total to 22,543. That's up from 7,704 in the same period a year ago.

Clark County preforeclosures, which include notices of default and auctions before actual foreclosure, numbered 6,565 in September, compared with 5,360 in the previous month. The total through September stands at 49,364, already shattering last year's total of 33,953.

It's the first comprehensive look at foreclosure numbers in the wake of the nation's financial markets fiasco and congressional bailout. The analysis shows the foreclosure tidal wave is unabated.

Nationwide, foreclosures rose 6.6 percent for the month, 25.8 percent for the third quarter and 82.6 percent from a year ago. Banks have kicked nearly three-quarters of a million owners out of their homes this year, including more than 107,500 in September, Foreclosures.com reported.

Nevada continues to lead the nation with 77.8 preforeclosure filings for every 1,000 households, an increase of 115 percent from a year ago. Arizona is next with 74.6 filings, followed by Florida (64.2) and California (31.5).

"Overall, looking at it right now, over 9 percent of households in Las Vegas are in foreclosure," Foreclosures.com President Alexis McGee said Friday. "That's not good because the national average is 2 percent. That's the bad news."

Foreclosures remain on track to surpass 1 million by the end of the year, and preforeclosures could end up near a record 2 million, she predicted.

The numbers aren't all glum. Preforeclosure filings dropped 2.4 percent in September, led by double-digit declines in California (38.6 percent), Michigan (36.2 percent) and Texas (13.1 percent).

"Looking at Las Vegas, they're definitely up and down," McGee said. "They're up in July, down in August, up again in September. There's really no trend there. It's kind of odd. It's in a range."

The decline in preforeclosures is great news as the nation's financial markets struggle to regroup in the wake of the credit market meltdown, McGee said. Especially in California, the drop in part is the result of new laws that require mortgage lenders to give financially strapped homeowners extra time to work things out before a foreclosure notice is filed.

"That means in another month or so, preforeclosure filings probably will spike again because tens of thousands of overextended homeowners remain in financial trouble with their mortgages," she said.

Las Vegas will probably see a slowdown in defaults and foreclosures in the short term with the introduction of new government bailout programs, Steve Hawks of ReMax Platinum said.

It will keep people in their homes for a while, but the long-term trend will most likely be an increase in defaults and foreclosures, he said.

"The good news is that activity has picked up for now," Hawks said. "The bad news is many homeowners are seeing their equity and, for some, their nest egg wiped out."

Some homeowners who owe more than their home is worth may qualify for help. For example, if they live in the house, did not misrepresent their income on their original loan and can qualify for a loan at 95 percent of the current home value, they might be able to stay in their home, Hawks said.

But a large percentage of original loans were done without income verification. If the homeowner cannot qualify for one of these programs, they're probably "dead in the water," he said.

"One thing is certain, the people buying now at 50 percent less than their neighbors is obviously going to cause more foreclosures, short sales or writedowns as current homeowners upside down by 50 percent see the time and cost of recovery as just too far off," Hawks said.

Foreclosure sales continue to weigh heavily on home prices in markets with the largest price declines, according to Radar Logic's Residential Property Index. The New York-based company tracks 25 metropolitan statistical areas, including Las Vegas, where the median existing home price dropped to $195,000 in September.

Radar Logic Chief Executive Officer Michael Feder sees two processes at work in the nation's housing markets.

"On one hand, there is the traditional market process in which sellers and buyers negotiate a price and sellers frequently prefer to wait rather than significantly reduce their asking price," he said. "On the other hand, there is the foreclosure sale process in which homeowners, banks and other financial institutions are motivated to sell quickly, so they discount their prices to effect a transaction.

"What we are seeing now is a situation in which the latter process is driving prices down in markets with relatively high concentrations of foreclosures, while the traditional process is the primary driver of MSA-level prices in markets with lower rates of foreclosure," Feder said.

Tim Kelly, REO specialist for Brodkin Group, said thousands of real-estate owned properties are coming down the pipeline as some 250 notices of default are filed daily in Clark County.

"It will be kind of like a small avalanche," he said. "But no one really knows for sure and hopefully the new bailout plan will help."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.