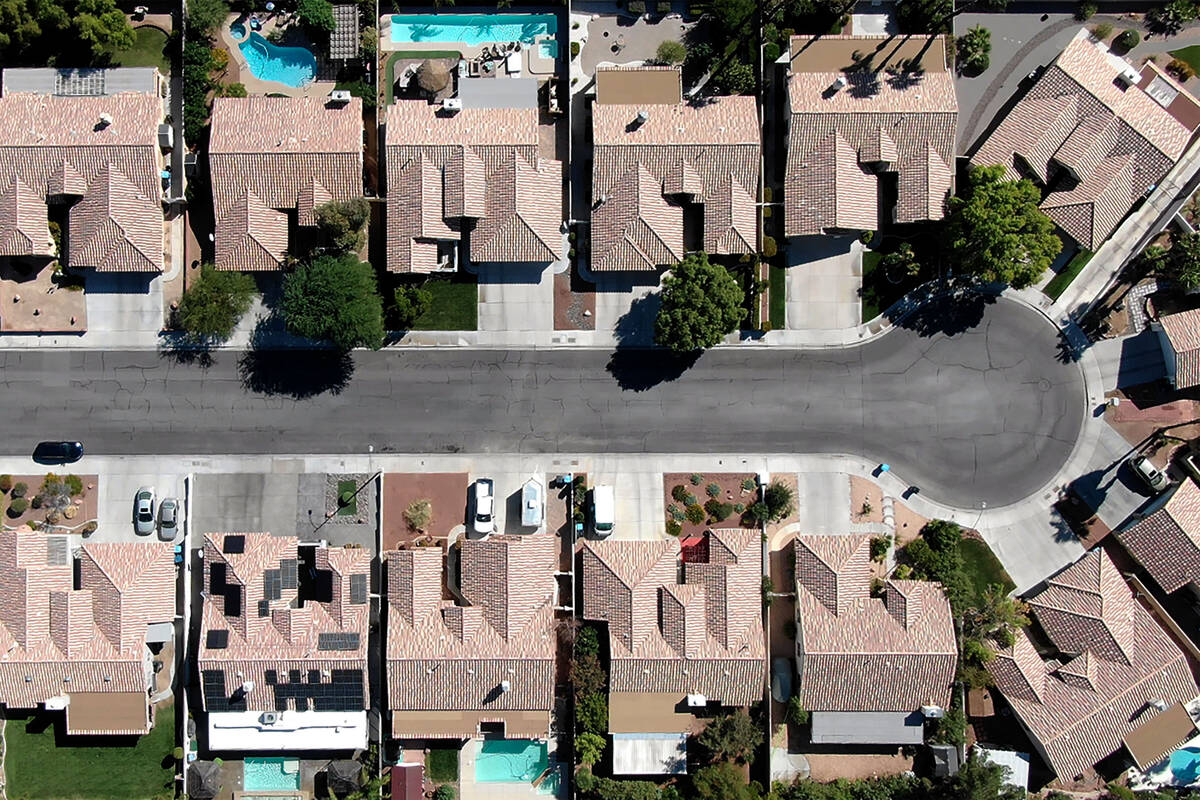

Home prices across US grow at ‘blazing speed’; Las Vegas even faster

Las Vegas’ skyrocketing home prices rose faster than the tapering but still rapid national average in October, a new report shows, another sign that the valley’s housing frenzy is nowhere close to flaming out.

Southern Nevada house prices were up 25.5 percent year over year in October, compared with the U.S. rate of 19.1 percent, according to the S&P CoreLogic Case-Shiller index released Tuesday by S&P Dow Jones Indices.

All 20 metro areas in the report posted double-digit annual price gains. Leading the pack was Phoenix, where home prices catapulted 32.3 percent from a year earlier.

Craig Lazzara, managing director at S&P Dow Jones, said in a news release that U.S. home prices rose “substantially” in October “but at a decelerating rate.”

Still, the nationwide price jump was the fourth highest in the 34 years covered by the firm’s data, he said, noting the three biggest gains were logged in the three months immediately preceding October.

All told, the report reflects “a world-class Olympic sprinter who is just past their prime — no longer setting records but still moving with blazing speed,” Kwame Donaldson, senior economist with listing site Zillow, said in a statement.

Southern Nevada’s housing market accelerated this year with rapid sales and record-high prices, fueled largely by rock-bottom mortgage rates that have let buyers stretch their budgets. The frenzy has looked largely the same as in other U.S. cities, marked by tight inventory, multiple offers and sellers firmly in control as people try to buy a place amid low borrowing costs.

On the resale side, buyers have showered Las Vegas-area homes with offers and routinely paid over the asking price, and median sales prices have been setting all-time highs practically every month.

Homebuilders in Southern Nevada also have put buyers on waiting lists, regularly raised prices and in some cases drawn names to determine who gets to purchase a place.

In November, a typically slower time of year for housing, the median sales price of previously owned single-family homes — the bulk of the market — was $420,000, up 2.4 percent from the previous record, set in October, and 21.7 percent from November of last year, trade association Las Vegas Realtors reported.

Sales totals also climbed as buyers snapped up 3,273 houses last month, up 6.4 percent from October and 7.8 percent from November 2020.

With new construction, buyers paid a median price of $444,677 last month for newly built homes in Southern Nevada, up 11.5 percent from a year earlier, according to Las Vegas-based Home Builders Research.

This marked the sixth time in 2021 that the monthly median closing price set an all-time high, the firm said.

Frank Nothaft, chief economist with housing tracker CoreLogic, told the Review-Journal this month that he expects mortgage rates to gradually rise, and if that happens, U.S. sales activity and price growth would gradually slow.

He also figured this would happen in 2023.

“I think that’s how long it takes to get back to some degree of a normal housing market,” he said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.