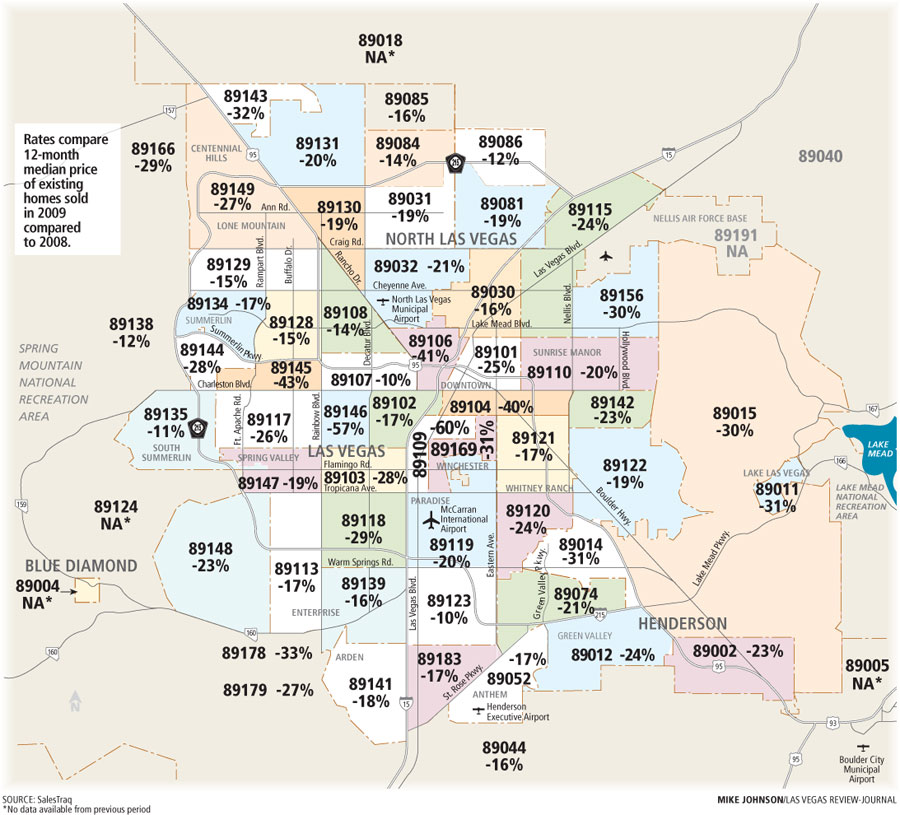

Home prices down in all ZIP codes in 2009

From affluent suburbs to inner-city neighborhoods, no part of Las Vegas was left unscathed by the precipitous drop in home values last year.

Some suffered more than others, but everybody lost ground.

The least pain was felt in ZIP codes 89107 and 89123, which saw only a 10 percent depreciation in median home prices. On the high end were ZIP codes 89109 and 89146, down 60 percent and 57 percent, respectively, Las Vegas-based SalesTraq reported.

Overall, the 12-month median price for an existing home in Las Vegas fell 38 percent in 2009 to $128,108, the firm reported. The average ZIP code drop was 23 percent and prices have fallen just 4 percent since April, bouncing between $125,000 and $120,000.

ZIP code 89107, bordering U.S. Highway 95 between Rancho Drive and Rainbow Boulevard, took the second-hardest hit in 2008 with a 50 percent decline in value. Last year's 10 percent dip brought the median home price down to $70,500.

ZIP code 89146, south of Charleston Boulevard between Rainbow and Decatur boulevards, was the only area with positive appreciation (3 percent) in 2008. The median price dropped 57 percent last year to $110,000.

"I think we're tremendously undervalued right now," SalesTraq President Larry Murphy said. "One reason I say that is because you can't replicate a home today for what you can buy it for. Nobody's going to build a home if they can't get their money out of it. That's why nobody's building."

New-home sales in Las Vegas hit a 24-year low in 2009 with 5,184 closings, a 48 percent decrease from the previous year. Residential building permits fell 32 percent to 3,766, SalesTraq reported.

Anyone who looks at a graph of where existing-home prices have gone in Las Vegas over the past 10 years can see how the market might be construed as undervalued, Murphy said. Prices peaked at $285,000 in 2006 and then dropped to $120,000 in August.

"Again, intuitively, if you look at this graph, a 10-year history of prices, you tell me if something in your gut doesn't tell you it's undervalued today," he said. "But I could be wrong. We all missed obvious signs of the bubble itself and I'm at the center of it."

Somebody must see value. Sales of existing homes jumped 57 percent to 48,075 in 2009, much of it investor-driven by deals on foreclosed homes. About three-fourths of the sales were foreclosures with a median price around $116,000 and roughly 40 percent were cash transactions.

That's another reason Murphy says homes are undervalued. Cash flow on rental homes is strongly positive, he said. A savings account or certificate of deposit on $150,000 might yield $1,500 a year, or $125 a month. Buying a house for $150,000 and renting it for $1,000 a month brings in $12,000 a year.

True, there are maintenance costs and property taxes on the rental home, but $1,500 versus $12,000: "Which do you prefer?" Murphy asked.

In the 1980s, investors were happy to break even on a rental home while deducting interest and taxes, he said. Maybe they'd make a decent profit if they held it for four or five years and then sold.

Realtor Rob Jenson said home prices are "unbelievably low." Many homes are selling for well below replacement costs in all sectors of the market.

Pricing bottoms are clear when looking at sales in specific neighborhoods, Jenson said. He sold two homes in January in The Ridges at the edge of Red Rock Canyon for $500 a square foot.

"When I look at comps (comparable sales), I look at a price that will move," he said. "One of the homes was $1 million and the other was $900,000. When I met with them, I told the million-dollar homeowner we might get $700,000 and the $900,000 home, not as upgraded, might get $650,000.

"Prices aren't coming down, they're already down and sellers are in denial. It's very hard for a seller to be objective about the price of their home because it's their last chance to get something back on their investment. Either sell it, rent it or take it off the market," Jenson said.

ZIP code 89138, which includes The Ridges, had the highest median price of $250,000, down 12 percent from $285,000 in 2008.

The lowest price was found in 89030 in North Las Vegas where the median fell from $49,000 to $42,000, or 16 percent.

Murphy thinks 2010 will be much like 2006 when home prices ended the year about where they started. The median will fluctuate between $120,000 and $125,000 this year, equal to price levels of 10 years ago, he said.

The rate of decline has slowed in Las Vegas, but the market still shows the largest slide since the housing downturn, Mountain View, Calif.-based real estate research firm Altos Research reported. The median asking price had dropped to $169,958 late last year, down 52 percent from $354,347 two years earlier.

Marta Borsanyi, principal of Newport Beach, Calif.-based Concord Group, said housing prices are bottoming out in Las Vegas, but a full recovery in the housing market won't occur until first quarter 2012. She defines full recovery as three to four new-home sales a month in each new subdivision and low single-digit home price appreciation.

The Concord Group reported the average new-home price dropped 18 percent in Las Vegas to $250,000 as of the third quarter. Only the Coachella Valley region in Southern California showed a steeper discount at 22 percent.

Housing prices have not yet stabilized in the Intermountain West region, which includes Nevada, and the aggregate rate of bank-owned properties remains high, especially in Las Vegas and Phoenix, an economic report from the Brookings Institution's Metropolitan Policy Program found.

Only Denver and Colorado Springs, Colo., registered slim year-over-year home price increases by the end of the third quarter. The region's rate of real estate-owned, or bank-owned, properties was 8.15 for every 1,000 mortgaged properties, nearly double the national rate.

REO rates in Las Vegas and Phoenix continued their upward trend, albeit at a slower rate, with 17.4 and 12.2 REOs, respectively, per 1,000 properties.

Banks foreclosed on about 26,000 homes in Las Vegas last year, and Murphy is predicting the same amount this year. The top foreclosure ZIP code was 89131 in northwest Las Vegas with 1,167 homes taken back by the bank.

Although some experts have been predicting a second wave of foreclosures for more than a year, Murphy is sticking by his 26,000 estimate.

"I don't disagree that we'll see more people get notices (of default) than last year, but the outcome will be different," the local housing analyst said.

Instead of foreclosing, banks will be doing more short sales, or deals in which homes are sold for less than the mortgage balance. A new law in Nevada requires mediation before a bank can foreclose on a home. It costs the homeowner $200, but more importantly, someone from the bank has to show up for mediation.

A growing trend that emerged last year is "strategic defaults," or people who make a financial decision to walk away from their mortgages because they owe more than their home is worth and may never recover their negative equity.

"If enough people feel hopeless in their situation, this strategic default maneuver could go viral," Murphy said. "People hear about their neighbors being gifted or forgiven $100,000 to $200,000 on their mortgage. What we risk is the whole integrity of the banking system. What if confidence is lost in the whole system?

"The only fly in the ointment to slowing down foreclosures is this loss of faith in the integrity of the system. What does your neighbor think of you getting mortgage relief? What if he says that's the thing for him to do? What if someone on Facebook or Twitter starts a campaign that June 1 is 'Don't Pay Your Mortgage Day?' Things can go viral overnight these days," he said.

One reminder: Nevada is a recourse state, which means lenders can sue for deficiency judgments on foreclosures and short sales. Homeowners could be on the hook for the difference.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

-10%

Percent drop for 89017 and 89123, the ZIP codes with the lowest depreciation rate in 2009.

-23%

Average percentage drop among all 56 ZIP codes. Prices have fallen just 4 percent since April.

-60%

Percent drop for 89109, the ZIP code with the highest depreciation rate in 2009.