Home resales for ’08 already near to matching ’07 level

The Las Vegas housing market is "moving along" and eating through excess inventory of foreclosures, which now account for about 80 percent of resales, a local housing analyst said Monday.

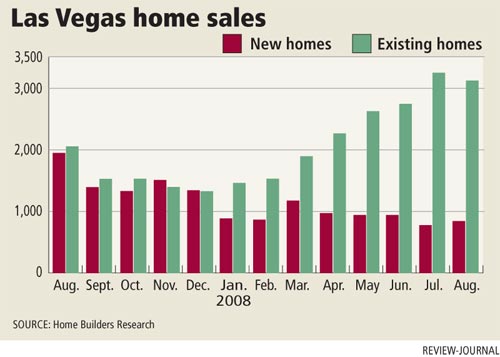

Dennis Smith of Home Builders Research reported 829 new- home sales in August and 3,051 recorded resales. New-home sales are down 48.3 percent from a year ago at 7,324 units, while existing-home sales are down only 2 percent at 18,720 through August.

Median home prices continued to slide. The new-home median was $256,000 in August, a 3.4 percent decline from the previous month and a 24 percent decline from the same month a year ago.

The resale median price dipped to $200,000, down 4.8 percent from July and down 27 percent, or $75,000, from August 2007.

"It's an amazing thing for us to think about 3,051 resale transactions in August and to realize that half of those sales were for under $200,000," Smith said

Nonetheless, housing trends have remained "pretty steady," he said. "Hopefully, the government bailout will ease the credit crunch."

The inventory of single-family home listings dropped sharply in the first week of September and pending sales on the Multiple Listing Service have been hovering around 200 since June. The resale market continues to absorb inventory of foreclosures and short sales, or homes sold for less than the mortgage owed.

New-home permits fell to 485 in August, compared with 668 in July and 802 a year ago, Larry Murphy of SalesTraq reported. Overall, permits are down 55 percent for the year at 4,216.

Murphy counted 3,218 resales in August at a median price of $200,000 and 792 new-home sales at a median of $259,847. He's seeing an increase in high-rise foreclosures, including five at SoHo Lofts and three at Panorama Towers in August.

Smith of Home Builders Research said the market hasn't gotten any worse over the last couple of months in terms of qualifying for home financing.

"Qualified buyers are still out there," Smith said. "I've talked to brokers who are very busy with foreclosures, getting them ready for sale, and I've talked to a few people investing in distressed properties. Las Vegas' housing market is not going to die and blow away. There are many respectable economists around the country that have said Las Vegas will be one of the first markets in the country to turn around, but not tomorrow."

Tim Sullivan of San Diego-based Sullivan Group real estate advisers said the good news for Las Vegas is the uptick in sales since the beginning of the year, which is a direct result of people realizing value from the presence of real estate-owned, or bank-owned homes.

"That's a motivating factor for home buyers and while it's uncertain how much lower prices will move, it is a very good indication that there is a price at which units will sell and ultimately that's what we need to find in this market," Sullivan said.

Frank Nason of Las Vegas-based Residential Resources estimated the current housing supply at 16.5 months as of Sept. 14, compared with roughly a three-year supply in September 2007. Excluding condos and townhomes and taking out pending transactions, the supply of single-family homes is down to 11.8 months, he said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.