Home revamp topic of meeting

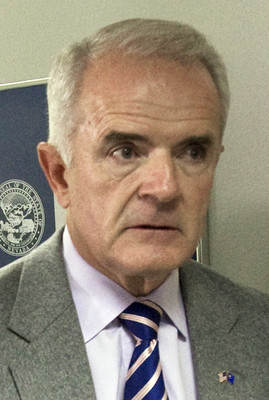

A program to buy and renovate foreclosed and deteriorated homes and sell them to middle-income residents drew the attention of Gov. Jim Gibbons and banking officials who met Monday at the Sawyer Building in Las Vegas.

"It is our effort to address the foreclosure problems that the state of Nevada has been having," Gibbons said in his Las Vegas office.

One observer applauded the effort, called the Neighborhood Stabilization Program, to deal with the collapse of the Southern Nevada housing sector, but described it as only a partial solution.

"In and of itself, it is not a (total) panacea, but it's one more tool," said Brock Davis, president of US Express Mortgage Corp.

The program could promote the sales of less attractive homes and homes that are worth far less than what is owed on them, he said. Lenders without deep pockets seem unable to sell some houses and take a big write-off on the underwater loans, he said.

Attractive foreclosed homes already are selling fast although often for less than the cost of the land and construction, Davis said. Sometimes, lenders take only one round of bids for a home, get 20 offers and sell foreclosed homes without even making a counter offer, Davis said.

The Neighborhood Stabilization Program could boost consumer confidence and reduce the inventory of foreclosed homes, Davis said.

Another official also praised the program.

"This is a positive step in the economic recovery of Southern Nevada," said Kipp Cooper, director of government affairs for the Greater Las Vegas Association of Realtors.

The program is designed "to create opportunity for working families in Southern Nevada," Cooper said.

To qualify, a family of four must make less than $76,000 in annual income. About one-quarter of the homes must be sold to people in a much lower income bracket, for example a family of four making less than $31,900.

The money will go to areas with the largest percentages of foreclosures, the highest percentage of homes previously financed with subprime loans and neighborhoods that local government officials determine are most likely to have high levels of future foreclosures, Cooper said.

The program is designed to provide about $64 million to Southern Nevada, enough money for the purchase, renovation and sale of about 1,000 homes in Southern Nevada for prices less than $220,000, he said.

One analyst, however, believes the governor and other officials have waited too long to act.

The president of Home Builders Research said local and state politicians waited two years before doing something to address the growing deterioration of neighborhoods from vacant foreclosed homes.

"Where were they? Why have they waited until now?" asked Dennis Smith.

"It's a shame local politicians have let these neighborhoods deteriorate to where some of them are going to take years to recover," he added.

Smith said local government officials should have acted a lot sooner and now must spend multiples of the dollars that would have been needed to alleviate the problem earlier.

"This housing crisis is different than anything we've ever seen," Smith said.

He suggested that Southern Nevada should have followed the examples set by Palmdale and Lancaster, Calif. The two California cities started their own programs to buy, rehabilitate and sell foreclosed homes before the federal government established the Neighborhood Stabilization Program.

Cooper, however, said he was impressed by the quick response of local officials to prepare grant applications.

This is how the program will work: Nonprofit organizations in Southern Nevada will get $9 million to purchase and renovate foreclosed or abandoned properties. The city of Henderson will kick in another $1 million for its neighborhoods.

Residents buying the homes will be required to complete a housing counseling program that will be funded through the program as well.

A qualified homebuyer will receive a federal loan of $25,000 to $50,000 that must be repaid if the home is sold within five years. After that, the amount that must be repaid gradually declines to zero after 15 years of home ownership.

The city of Las Vegas is proposing a lease-to-buy program that may benefit families who cannot afford to buy a home immediately.

Gibbons predicted the housing crisis will worsen, but a banker took a more upbeat tone.

"I'm hoping we've seen the worst of it," said Kirk Clausen, regional president of Wells Fargo Bank.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.