Home sales down, resale prices sink to 1996 level

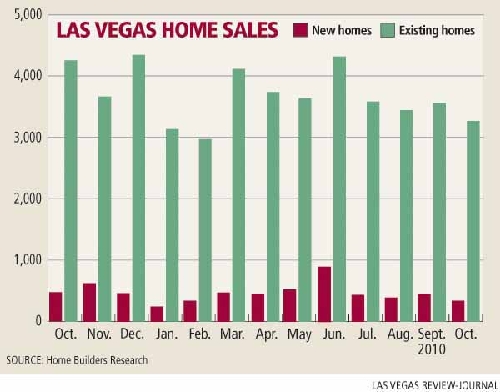

Sales of new and existing homes fell in October from year-ago levels and the median resale price sank to its lowest point since 1996, Home Builders Research reported Tuesday.

Some of the decline is to be expected as the housing market slips into its seasonal "holiday funk," Home Builders Research President Dennis Smith said.

One month doesn't establish a trend, but it certainly bears watching, the housing analyst said.

The research firm showed 324 new-home sales in October, compared with 471 in the same month a year ago, bringing the year-to-date total to 4,568, a 10 percent increase. The median new-home price rose 3.4 percent to $212,498.

There were 3,266 sales of existing homes in October, down from 4,254 a year ago. The median price fell $6,000, or 4.8 percent, to $119,000.

Smith said the inventory of foreclosures and short sales has increased and buyers may be waiting to see if prices decline further.

"It's an impossible thing to call if prices will go down enough to make the wait worthwhile," he said. "It's certainly not going to change overnight. The system is locked up. To expect numbers to change drastically over a matter of months is unrealistic."

Builders are taking every step they can in offering incentives to compete with resales, especially since the price gap has widened to more than $90,000, Smith said.

Some critics point to the surplus of housing inventory in Las Vegas and suggest that no more new homes be built until prices rebound. Builders pulled 280 new-home permits in October, pushing the total to 4,081 for the year, up 27 percent.

But Smith said it's wrong for people to point fingers at homebuilders for the negativity that permeates the market because of foreclosures and weak real estate prices.

"Those that suggest that the new-home industry take a powder are letting their emotions rule their thinking," he said. "Unemployment and lack of job growth is the core for the other factors that are weighing down our housing market."

Las Vegas-based SalesTraq reported 448 new-home closings in October, a

3.4 percent decrease from a year ago, and a median new-home price of $213,418, up 1.2 percent. The firm counted 4,300 resales at a median price of $118,000, down 1.7 percent from a year ago.

There were 971 short sales, or lender-approved sales for less than the principal mortgage balance, at median price of $124,900; 507 auction sales at $97,500; 1,595 real estate-owned, or bank-owned, sales at $117,000; and 1,227 nondistressed sales at $124,000.

SalesTraq President Larry Murphy said distressed-home sales are responsible for driving prices down and he doesn't expect those to slow for some time, given the steady stream of bank repossessions month after month.

He counted 2,195 repossessions in October, a 5 percent decrease from a year ago. So far this year, banks have taken back 19,032 homes in Las Vegas. With an estimated 16 percent of borrowers late on their house payments, there could be an another 50,000 foreclosures entering the pipeline.

Prices can't recover until distressed sales are a thing of the past and new-home construction can't recover until the nearly 80 percent of vacant homes on the MLS are sold, Murphy said.

"Regarding the bottom being found, I'd say we've definitely found one bottom," he said. "Could there be another? Possibly."

Mortgage delinquency rates and loans in foreclosure decreased in the third quarter, but foreclosure starts increased for all loan types and the foreclosure rate for prime fixed loans set a record high, the Mortgage Bankers Association reported.

The combined percentage of loans in foreclosure or at least one payment past due was 13.8 percent, down from nearly 14 percent in the previous quarter.

"Most often, homeowners fall behind on their mortgages because their income has dropped due to unemployment or other causes," said Michael Fratantoni, vice president of research and economics for the bankers association. "As we anticipate that the unemployment rate will be little changed over the next year, we also expect only modest improvements in the delinquency rate."

Home Builders Research's Smith said high unemployment and lack of financing are two major factors holding back housing sales.

Job security will lead to more discretionary spending by consumers and get the Las Vegas economy moving in the right direction, he said. Banks have shut off the spigot that was flowing so freely just a few years ago.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.