Home sales, median prices rise

The Las Vegas housing market showed a slight uptick in September after losing ground in August, the Greater Las Vegas Association of Realtors reported Friday.

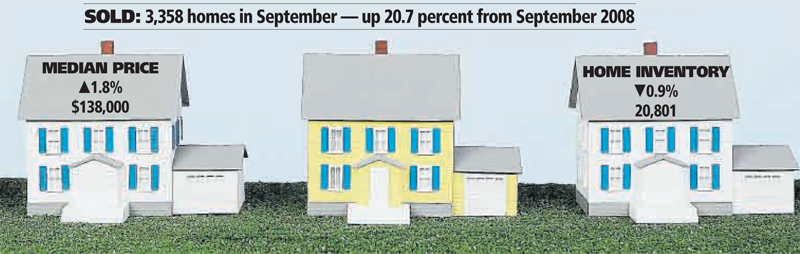

Realtors sold 3,358 homes during the month, a 4 percent increase from August and 20.7 percent increase from the same month a year ago.

The median price for a single-family home rose 1.8 percent to $138,000, a gain of $2,500, though it remains down 29.2 percent from a year ago. Condominium and townhome prices dipped to $65,720, down about $500 from August.

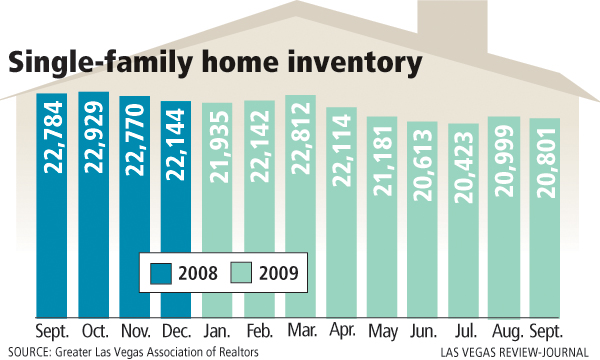

Inventory declined 0.9 percent to 20,801 in September. Excluding contingent and pending sales, the inventory fell to less than a three-month supply with 7,909 units available without offers.

Two groups of buyers are driving home sales today, Realtors association President Sue Naumann said. First-time homebuyers are rushing to capitalize on the $8,000 tax credit and cash-talking investors are snapping up most of the lower-end deals. Investors, who were partly to blame for the run-up in Las Vegas home prices, now account for about 44 percent of monthly sales.

Bank-owned properties continue to play a huge role in the local housing market. Nearly 80 percent of sales were foreclosures at one time, but that percentage is declining, Naumann said.

"I don't know if it's banks holding back or if it's the president's workout plan," she said. "I think a lot of people are able to file to have a modification and that's why we're seeing less of them. I think there are other options for people who have the wherewithal to pay their mortgage, but not at the interest and terms of their loan."

Surprisingly, the avalanche of foreclosures predicted to hit Las Vegas has failed to materialize, said Larry Murphy, president of SalesTraq, a Las Vegas-based housing research firm.

The number of actual foreclosures dropped to 1,944 in August, down 21 percent from July and the second straight monthly decline. Also, the number of bank-owned dispositions exceeded the number of acquisitions for the sixth consecutive month, SalesTraq reported.

There's still a lot of pain left for homes in the $300,000 to $400,000 range, said Mark Baker, mortgage broker for Meridias Capital in Las Vegas. He's taken two new loans recently in which the bank had the property for more than two years and just now put it in escrow for sale.

"With the REO agents I've been talking to, the inventory is growing with the banks, but they are not releasing it to the agents," Baker said. "One of them just told me that it will not be until the first of the year (that) we start to see some more inventory. The interesting thing is going to be what the government replaces the $8,000 tax credit with. I bet it will be bigger and better and next year is going to be a frenzy."

The government has extended the tax credit for military personnel serving overseas.

Home prices won't return to peak levels of 2006 for at least another decade, probably not until 2020, Moody's Economy.com housing analyst Celia Chen said in September.

"The correction will be not only deep, but also lengthy," Chen said, noting that it took 20 years for home prices to return to their peak after the Great Depression.

Standard & Poor's Case-Shiller housing price index will fall 40 percent from the 2006 peak with housing bottoming out in second quarter 2010 before rebounding, she said.

Condo and townhome sales rose to 859 in September, up 6 percent from 810 in August and more than double the 386 sales in September 2008. Inventory of attached units for sale dropped 6 percent to 5,180 in September.

Total value of local real estate transactions tracked through the Multiple Listing Service during September increased 6 percent to nearly $564 million for single-family homes.

Realtor statistics are based on data collected through the Multiple Listing Service and do not account for homes sold by owners, newly constructed homes and other transactions not involving a Realtor.

The Realtors group revised its inventory statistics in August to take out homes that have contract offers on them. These homes are pending or contingent upon some other action such as bank approval on short sales, or homes sold for less than the mortgage balance owed.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.