Home sales up; prices down from 2010

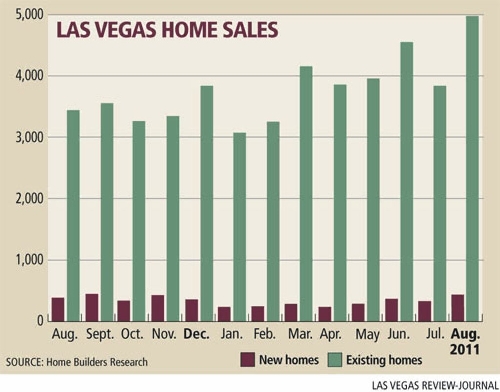

Sales of both new and existing homes in Las Vegas increased in August compared with July, a housing research firm reported Friday. Prices, though, remained flat compared with July and fell from a year ago.

Home Builders Research counted 381 new-home sales in August, compared with 316 in July. In August 2010, there were 401 new-home sales.

For the year, new-home sales are down

38 percent at 2,383 and on pace for about 3,600 in 2011, the lowest total since the firm began tracking the market in 1988.

The median price for a new home was $198,605, almost unchanged from July and a 9.7 percent decrease from a year ago.

There were 15 high-rise condominium closings during the month, including 13 at Allure on Sahara Avenue near the Strip. The condo tower has sold

61 units this year at an average price of $260,000.

Home Builders Research reported 4,938 existing-home sales in August, the largest monthly total since summer 2005. Resales have surged 10 percent through August with 31,547 recorded transactions.

"I think we'll probably see big numbers on resales for the rest of the year," Home Builders Research President Dennis Smith, president said. "It'll be interesting to see what happens with banks releasing foreclosures. I know some investors that are wanting to buy more foreclosures."

Smith said he's amazed at the sheer amount of resale activity. If the numbers hold up, he's looking at 47,300 resale transactions this year, which would beat last year's total of 42,673. Resales peaked at 64,168 in 2004, Home Builders Research said.

The median resale price slipped to $107,000 in August, a loss of $15,000, or

12 percent, from the same month year ago. They're down $8,000 from the beginning of the year.

"It's impossible at this point in time to pinpoint when resale prices will begin to rise at a steady pace in Las Vegas," Smith said. "There are too many distressed properties and troubled homeowners that are not being counted. Should an underwater mortgage be viewed as a distressed property?"

CoreLogic, a Santa Ana, Calif., real estate research firm, shows 60 percent of Las Vegas homeowners with a mortgage are "underwater," owing more on their mortgage than their home is worth. The next-highest state is Arizona at 49 percent.

Home Builders Research sorted through 338 new home permits in August, bringing the year-to-date total to 2,649, a 25.8 percent decrease from a year ago.

Most builders are still cutting prices trying to find that "sweet spot" in positioning their products, Smith said. They have to compete with the excess supply of existing homes and also contend with other builders, yet allow for profit margins. That's a very narrow line to navigate, he said.

Larger banks such as Bank of America are getting better at approving short sales and loan modifications and appear more willing to negotiate settlements than smaller banks, Smith said.

"I'm encouraged that banks are starting to move on these properties," he said. "There's enough demand from investors and people wanting to buy foreclosures. It should not be an issue and should not drive down prices."

Smith said he's seeing more being written about affordable housing in Las Vegas. Research analysts from around the country are touting indexes that show Las Vegas as one of the nation's most affordable housing markets.

"If that's a surprise to anyone, they've been under a rock for some time," Smith said. "The affordability of homes in Southern Nevada will indeed eventually help stimulate the housing market. But, the number of distressed properties has to recede before we can legitimately suggest a growth period is imminent."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.