Housing rebound? How about 2011?

Nobody needed sunglasses Friday at Las Vegas Housing Outlook 2009.

That's because any ray of hope for the local housing market is at least two years away, housing analyst Dennis Smith of Home Builders Research said.

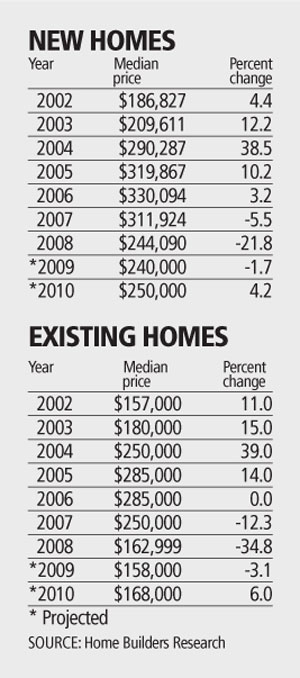

He predicts a 1.7 percent decline in new-home prices this year to $240,000 and a 3.1 percent decline in resale median prices to $158,000. That will be welcome relief from 21.8 percent and 34.8 percent declines, respectively, in 2008.

New-home prices should turn up 4.2 percent in 2010 and resale prices should gain 6 percent, Smith said.

Appraiser Scott Dugan said it will be five years before Las Vegas registers any real appreciation in housing values.

He sees a wave of 3,000 to 4,000 new foreclosures hitting the market when the 90-day moratorium by Freddie Mac and Fannie Mae expires at the end of January. That's going to push prices down an additional 10 percent, Dugan said.

Richard Plaster, president of Las Vegas-based Signature Homes, said he doesn't know if he'll make Smith's cut of pulling a minimum of five building permits a year to be included in Home Builders Research reports.

The best-case recovery scenario for his business is two years and the worst-case is 10 to 20 years, Plaster told a crowd of about 300 real estate-related professionals at the Gold Coast.

Smith counted 8,994 new-home closings in 2008, down from 15,584 in 2007. Sales averaged 975 sales a month in the first half of last year and fell to 787 a month in the final six months.

"I've been here since 1988 and that's the lowest annual number of new-home sales I've ever counted," Smith said. "There's not much good news to talk about except where we think it's going to go. It's going to be very soft in the first half of the year, very soft. No permits, no starts, no closings."

He projects traditional new-home sales will slip to 6,500 in 2009 before bouncing back to 7,250 in 2010 and 8,500 in 2011.

Resale closings were one bright spot for Las Vegas, increasing to 30,491 in 2008, compared with 24,838 the previous year. They're expected to increase again to 32,000 this year, though about three-fourths of the sales are foreclosures.

Most of Smith's charts and graphs showed downward trends.

New-home permits fell to 6,110 in 2008, closing out the year with a dismal 168 in December, from 14,510 in 2007. They're going to bottom out at about 5,000 this year before rising to 6,500 in 2010 and 9,000 in 2011, Smith said.

"I don't think those numbers are going to change much for six months, maybe longer. I don't think there's enough demand out there. Builders aren't going to build houses for less than they cost," he said.

The number of home builders in the Las Vegas market has been whittled down to 38 from a peak of 179 in 1996.

Builders are a resilient group and they're not going to "dry up and blow away," Smith said. They'll come to Las Vegas from other parts of the country and those that have gone into "hibernation" will reappear, he said.

"We know they're going to be here because a lot of the investor groups that are buying (residential) lots here are connected with a builder or knows somebody who's a builder," he said.

Final mapped lots for single-family homes came down to 3,400 in 2008 from 11,315 the prior year.

Net sales per subdivision plummeted to 0.1 a week at the end of the year from a high of 1.6 in March 2006. "Can it get much lower?" Smith asked.

Plaster said housing speculation led to excess building starting in 2001 that was out of line with employment growth in Las Vegas.

"We probably should shut down as an industry. We probably don't need the housing," he said.

The futures market points to housing prices declining not by 5 percent, but by 15 percent, and suggests we won't come out of the bottom until 2011, Plaster said.

Richard Lee of First American Title noted that 62 percent of homes available on the Multiple Listing Service are vacant.

"It's amateur investors that got us into this, those guys who read 'Rich Dad, Poor Dad' and didn't finish it," Lee said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.