Las Vegas foreclosure rate keeps falling

Las Vegas’ foreclosure rate was above the national average in 2019 but fell to its lowest point in years, a new report shows.

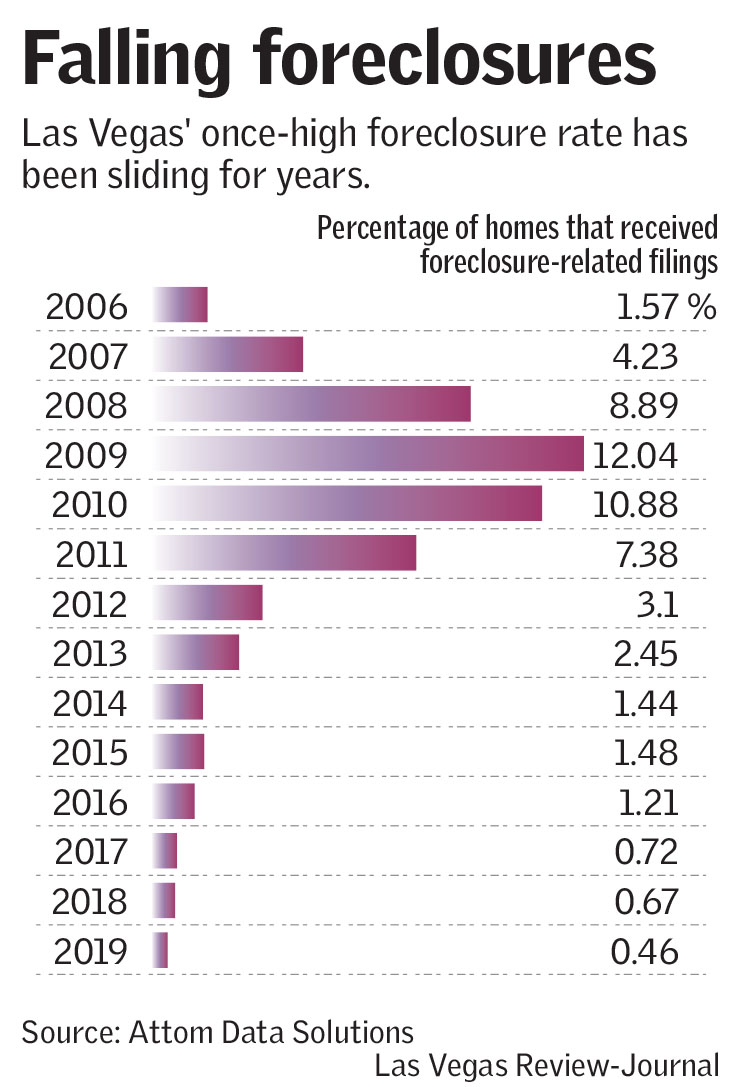

About 0.46 percent of homes in the Las Vegas area were hit with foreclosure-related filings in 2019, versus 0.36 percent nationally, according to housing tracker Attom Data Solutions.

By comparison, 0.67 percent of Las Vegas-area homes were hit with foreclosure papers in 2018, and 12 percent received them in 2009, after the housing bubble burst and the valley’s economy went into a nosedive.

Southern Nevada’s housing market cooled off last year after a heated stretch sparked affordability concerns. Prices rose at a slower pace, sales totals dipped and the tally of available listings on the resale market climbed much of the year.

But the economy overall is on solid footing, and the housing slowdown did not lead to waves of borrowers suddenly facing foreclosure.

Attom’s report showed annual foreclosure numbers since 2006, and Las Vegas’ rate last year was its lowest in that timespan. The company, based in Irvine, California, tracks default notices, scheduled auctions and bank repossessions for its report.

Brian Gordon, co-owner of Las Vegas consulting firm Applied Analysis, noted that Southern Nevada, after its wild mid-2000s real estate boom, was known as the foreclosure capital of America during the Great Recession.

The valley’s housing market has historically been one of the most volatile in the nation, he added, but it has largely shaken off the recession’s woes.

Home prices have been rising for several years, sometimes at a rapid clip, and if people are earning a decent income and can pay their mortgage, foreclosures will likely tumble, Gordon said.

With far fewer underwater borrowers out there, and not nearly as many mortgage defaults, sales of so-called distressed homes have largely faded in Las Vegas.

Purchases at foreclosure auctions and sales of foreclosed or underwater homes comprised just 3.3 percent of resales in the valley last year as of November, down from almost 73 percent in 2011, Applied Analysis previously reported.

Vivek Sah, director of UNLV’s Lied Institute for Real Estate Studies, said the sustained economic growth of the past several years, nationally and locally, has helped ease foreclosures, and low interest rates have given a boost to homebuyers.

He also said buyers and lenders are avoiding the kinds of risky loans that were all too common before the crash, when easy money inflated the real estate bubble until it burst.

“The average consumer has become much smarter now,” Sah said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.