Las Vegas home prices continue to fall

Las Vegas is a "wild card" when it comes to predicting where home prices are headed, a national economist said Wednesday.

As one of the nation's most undervalued housing markets, Las Vegas could potentially see a 15 percent increase in home prices over the next couple of years, said Lawrence Yun, chief economist of Washington, D.C.-based National Association of Realtors.

During a panel discussion at the Greater Las Vegas Association of Realtors office, Yun also said he would not be surprised to see prices fall another 15 percent as unemployment and foreclosure levels remain elevated.

"Comparing Las Vegas to the rest of the country ... Las Vegas is certainly different in many ways," Yun said. "Has the housing market bottomed out yet? That depends. If one looks at prices, nationwide there's been no change in two years. Las Vegas is the exception with declining prices. In terms of sales, it's very sluggish nationwide and Las Vegas has actually seen sales activity."

The median single-family home price in Las Vegas ended 2010 at $132,000, a decrease of 2.9 percent from $136,000 in December 2009, the Realtors association reported Wednesday.

Home sales slid to 3,117 in December, down 8.9 percent from the year-ago month, and finished the year at 43,877, the third-highest number on record.

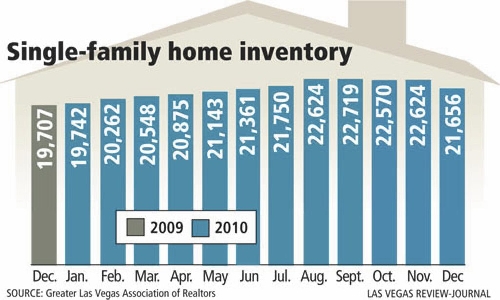

Inventory climbed 9.9 percent to 21,656 available units in December, including 12,417 without pending or contingent offers.

The median price for 890 condos and townhomes sold in December was $62,000, down 5.1 percent from December 2009.

It was good to see home sales increase 12.2 percent from the previous month, Greater Las Vegas Association of Realtors President Paul Bell said. At the same time, he knows homeowners are disappointed to hear that prices continued to decline.

At least the 3 percent decrease is better than the 33 percent and 22 percent decreases in 2008 and 2009, respectively, Bell said.

Thirty-five percent of last year's sales were homes priced under $100,000, most of them purchased by investors to be renovated and returned to the rental housing market, the Realtor said.

"We will be keenly watching for price rebounds in master-planned communities that are closer to places where people work," he said.

Meanwhile, Yun said negative factors that could affect Las Vegas home prices this year include a high rate of mortgage delinquencies and consumer pessimism from continued price declines.

"That raises the question, 'Do I go into the market now or do I wait for even lower prices?' " he said.

On the positive side, the national economy appears to be improving with more than 1 million jobs created last year. The worst of the unemployment news is past, the stock market has gained ground and large companies are "flush with cash," Yun said.

Another positive for Las Vegas is population growth, maybe not in the last few years, but over the last 10 years, he said.

"You've got retirees, baby boomers ... you see a vacant home in Cleveland and a vacant home in Vegas, believe me, the vacant home in Vegas will go," Yun said.

Las Vegas economic consultant John Restrepo said the secret to home price appreciation is "jobs, jobs, jobs." The local economy seems to be stabilizing because we're losing fewer jobs, only 2,000 a month in 2010 compared with 12,000 to 15,000 a month in 2009, he said.

"So things have gotten better. The patient is out of ICU, but not out of the hospital," Restrepo said. "We're not recovering all the jobs we lost, but it's getting better. The price of homes is down 3 percent. That's not bad compared to 2009. At least we see some light at the end of the tunnel, which is good news compared to last year. It was pretty depressing."

Foreclosures slowed to about 20,000 in Las Vegas in 2010, down from 24,000 in the previous year, as the "robo-signing" scandal led to a lender-imposed moratorium on foreclosures toward the end of the year.

That's just a temporary stoppage and will not be an issue going forward, Yun said. The fundamental reason foreclosures rose to begin with is mortgage delinquency, and those foreclosures are already in the pipeline, he said.

If buyers are hesitant and foreclosed homes linger on the market, prices will drop. If buyers absorb the foreclosure inventory quickly, prices will stabilize or get bumped up, the economist said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.