Las Vegas home prices show small annual increase

Las Vegas home prices experienced their first year-over-year increase since 2007, the Greater Las Vegas Association of Realtors reported Monday.

The median price of a single-family home rose to $142,000 in April, up 0.2 percent from a year ago and up 4.4 percent from March. It's the first annual increase since prices hit $310,000 in February 2007.

"We don't want to make too much of this just yet, but this is obviously good news for homeowners who want to see prices appreciate," Realtors association President Rick Shelton said.

One factor that may have driven up prices in April is the federal tax credit, which added an incentive to buy before the April 30 deadline. Prices have been fairly stable for about a year now, bottoming out at $134,915 in January.

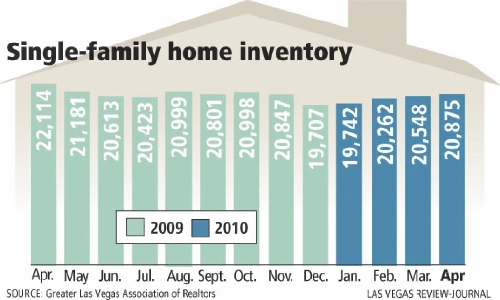

Sales declined 7.7 percent from a year ago to 2,951 in April, and inventory of homes for sale fell 5.6 percent to 20,875 units. Only 7,207 units are available without offers.

Realtor Rick Brenkus of Keller Williams said he's surprised at the drop in sales, blaming it on lack of inventory on the market. As banks release more foreclosures and approve more short sales, or homes sold for less than the mortgage balance, monthly sales figures will increase, he said.

One of Keller Williams' offices had its best month for written sales contract volume in four years, Brenkus said.

"There are many factors and the tax credit is one of them, but the competitive pricing out there right now is another factor," he said. "With interest rates where they're at, they're not going to stay there, so with or without the tax credit, now's a good time to buy."

Short sales accounted for 27 percent of home sales in April, compared with 22 percent two months earlier, the Realtors association reported. Real estate-owned, or bank-owned, homes decreased to 43 percent of total sales, compared with 53 percent in February.

Prices on real estate-owned homes climbed to $131,756, up 4 percent from $126,372 in March, Robin Camacho of Realty One Group said. Private-party prices dropped to $198,025 from $209,498, but the overall dollar volume exceeded the total from REOs.

"We haven't seen this in several years," Camacho said. "With fewer buyers in the market, the competition isn't as fierce as it was at this time last year. Instead of competing with 30 offers on each house, we're seeing three offers."

Frank Nason of Residential Resources said people are willing to pay more for houses when they're getting an $8,000 tax credit and other incentives. Even if they've already filed their 2009 income taxes, they can file an amended return and get the money back this year, he said.

The number of resale transactions may drop as a result of the tax credit expiration, but prices won't drop much, if any, Nason said.

"I do think new-home sales are going to get hit because there's still a big difference between bank-owned pricing and new-home pricing. I don't know how many people are willing to pay a premium for a new home," he said. "I believe it will be months before the market really gives us a reliable indication of which direction it is going after all the government intervention."

Residential Resources showed 12,501 short-sale listings as of last weekend, or 60.6 percent of total inventory; 4,814 normal listings, or 23.3 percent; and 3,306 REOs, or 16 percent.

Realtors sold 787 condominiums and townhomes in April, an 8.3 percent increase from a year ago. Median price was $70,000, up 8.5 percent.

Sixty-eight percent of single-family homes sold within 60 days, compared with 60 percent a year ago. Also, 43.3 percent of homes were purchased with cash.

Statistics from the Greater Las Vegas Association of Realtors are based on data collected from the Multiple Listing Service and do not necessarily account for sales by owners, homebuilders and transactions not involving a Realtor.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.