Las Vegas home prices take dive

Las Vegas housing analyst Dennis Smith is looking for any hint of good news regarding the slumping market. He found it in month-to-month sales comparisons.

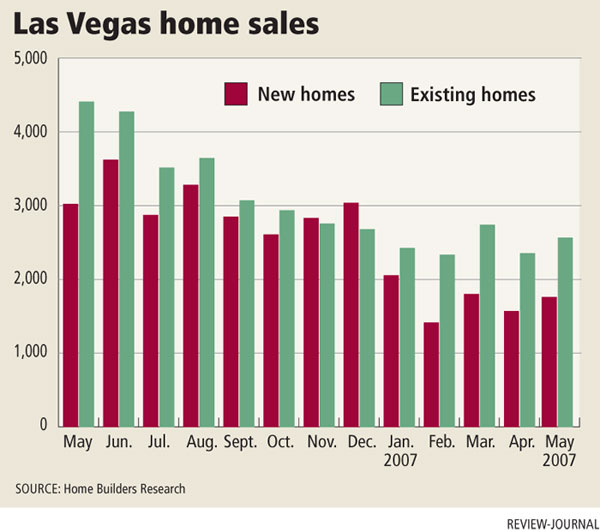

While new home sales are down 43.8 percent for the year and median prices have slipped 4.4 percent, May showed some upward momentum from April.

The number of new single-family home sales rose 11.7 percent to 1,751 in May, as the median price dropped 3 percent from the previous month to $308,874.

"Part of the good news is prices went down," said Smith, president of Home Builders Research. "That's odd to say that, but people have to realize they have to meet the market demand."

He counted 2,587 existing home sales in May. That's up from 2,353 sales in April, but far below the 4,406 recorded resales in May 2006. The median resale price dipped 3.8 percent from a year ago and 2.5 percent from April to $278,000.

Given the market conditions, it might indicate that sellers, particularly investors, are finally facing reality and pricing their homes so they'll sell, Smith said. He hopes prices continue to decline, which should in turn reduce the inventory of resale listings for the good of the housing market in the long term.

Kurt Lehman of Realty One Group said home prices must fall further before sales rebound, but he doesn't know when the bottom is coming.

"Hey, maybe we're already pretty close. The number of houses selling per month is really the key to what's happening," he said. "Still, a house that someone could buy five years ago for $175,000 now is one of thousands of average resale homes that needs carpet, paint, has no exceptional landscaping and the asking price is $320,000 when most people can't afford it, especially with the tightening of underwriting by most lenders. It's going to be an economic problem until more (people) are making a lot more money and aren't afraid of buying into what appears to be a sinking home value market."

The underlying economic fundamentals remain strong in Las Vegas, but people are taking a little longer to jump into the housing market after moving here, real estate consultant Ron Rulof of Team Power Marketing said.

"I've been trying to get down to the bottom of this and figure out what people are thinking. They're still coming into town, but they see a little turmoil from what they've been reading so they're sitting on the sideline," Rulof said. "When I first came to Las Vegas, I rented for six to eight months before I bought a home, even though I could've bought. You want to settle in. What you have in a nutshell, because of market conditions, is they're spending a little more time renting."

Smith said the Las Vegas housing market fits the definition of a recession, but how long it lasts is the great unknown.

"Six months? A year? Two or more years? Unfortunately, nobody has that answer. In our opinion, those that continue to say by early 2008 are basing it on hopes instead of facts," he said.

If there was a historical model to evaluate the current demand trend, it would be much easier to project a timeline for the turnaround, Smith said.

However, Las Vegas is unique. It has a booming hotel and gaming industry that is projected to produce significant job growth over the next three to five years, maybe longer, and new jobs result in more housing demand, he said.

Housing in Las VegasMore Information

SURVEY: OPTIMISM REMAINING HIGH

NEW YORK -- Slumping home sales and drooping prices haven't diminished homeowner optimism about their own nest egg's value, a recent survey shows.

The survey by Boston Consulting Group showed 55 percent of Americans believe they could sell their house for more money now than a year ago, down slightly from the 59 percent who felt that last summer.

Nearly three-quarters think they could sell their homes within the next six months at a price they set, and 63 percent think that real estate is a good or excellent investment.

The positive sentiment comes in spite of housing data that shows a downturn in real estate. Last month, the National Association of Realtors said sales of existing homes dropped by 2.6 percent in April to a seasonally adjusted annual rate of 5.99 million units, the slowest sales pace in nearly four years.

The median price of a home fell to $220,900, a 0.8 percent decline from the median price a year ago. The trade group is expected to report May's existing home sales Monday.

"Americans believe their homes are still their best investment. They're positive about their homes' value and believe in a bounce-back in residential real estate overall," said Boston Consulting senior partner Michael Silverstein. "Talk of declining average values of homes is not forcing a cutback in spending. It's just not translated into the American psyche."

Instead, the survey showed that 69 percent of homeowners said they're likely to make renovations or improvements to their homes in the next year, and more than two-thirds said the current housing market has no effect on their spending.

Only 27 percent said they're likely to purchase a house in the next five years.

Boston Consulting polled 1,007 adult Americans in a telephone survey from May 31 to June 3. The survey has a sampling error margin of plus or minus 3 percentage points.

THE ASSOCIATED PRESS