Las Vegas home sales climb

Home sales in Las Vegas increased to 3,175 in March, up 32.8 percent from the previous month and up 6.5 percent from the same month a year ago, the Greater Las Vegas Association of Realtors reported Wednesday.

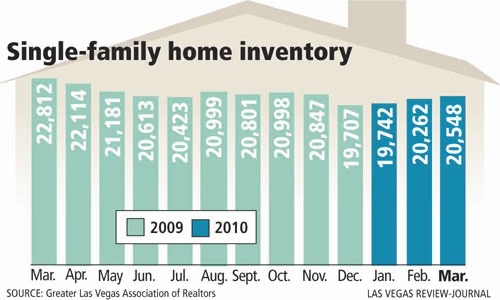

Inventory of homes for sale declined 9.9 percent from a year ago to 20,548 and median home price dropped 8.7 percent to $136,000.

Realtors association President Rick Shelton attributed the jump in sales to buyers rushing to take advantage of the federal tax credit that expires April 30, combined with growing consumer belief that home prices in Southern Nevada are likely to increase in the future.

"From the resale side, I believe the market is precisely where it needs to be," Shelton said. "We're entering the second phase of our healing process. I think we're seeing trend lines indicating some level of stability."

Housing analyst Dennis Smith of Home Builders Research said he would have liked to see more new-home sales generated by the tax credit.

The new-home market is holding its own in terms of sales and permits, but prices are being held down by the appraisal process, he said. Appraisers are being pressured by lenders to bring in "low-ball appraisals."

What the banks don't understand is that Las Vegas is no longer a declining market, Smith said.

"It's important for the (sales) numbers to be there so underwriters will recognize what the market really is instead of what they think it is," said Smith, who has tracked the Las Vegas housing market since 1987. "I can guarantee there'd be more sales figures if the appraisal industry was just consistent."

Realtors are seeing a dramatic spike in short sales, or homes sold for less than the mortgage owed. Short sales now comprise about 25 percent of Las Vegas home sales, compared with 8 percent a year ago, Robin Camacho of Realty One Group said.

Foreclosures, meanwhile, have dropped from about 80 percent of sales to 50 percent.

"I don't know if short sales will eclipse foreclosures, but they're going to be a big part of the market for the next few years," Camacho said.

The Home Affordable Foreclosure Alternative program implemented Monday could go a long way toward increasing short sales in Las Vegas, real estate industry experts said.

The median home price grew 0.2 percent in March from the previous month and should continue to climb throughout the year, especially if the short-sale trend continues, said Devin Reiss, past president of the Realtors association. Short-sale prices are typically higher than foreclosures.

"This year is going to be better than last year and I believe next year will be better than this year. It's a slow recovery," he said.

Sales of condos and townhomes increased 34.8 percent from a year ago to 814 in March, while the median price dropped 3.3 percent to $68,200.

Total value of real estate transactions in March increased 3.4 percent from a year ago to $533.3 million for single-family homes. Condo and townhome sales increased 38.1 percent to $75.7 million.

Statistics from the Greater Las Vegas Association of Realtors are based on data collected from the Multiple Listing Service and do not necessarily account for sales by owners, homebuilders and transactions not involving a Realtor.

Smith said he doesn't expect to see the "double-dip" in home prices that some national experts are predicting.

"My question is what is their definition of a double-dip recession. I don't think we'll see a drawn-out situation," he said. "Our sales figures will drop a little after the end of the tax credit, but it won't continue over to next year."

Single-family home inventory

Mar. 2009 22,812

Apr. 22,114

May 21,181

Jun. 20,613

Jul. 20,423

Aug. 20,999

Sept. 20,801

Oct. 20,998

Nov. 20,847

Dec. 19,707

Jan. 2010 19,742

Feb. 20,262

Mar. 20,548

SOURCE: Greater las veas association of realtors

las vegas review-Journal

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.