Las Vegas new-home sales report gloomy

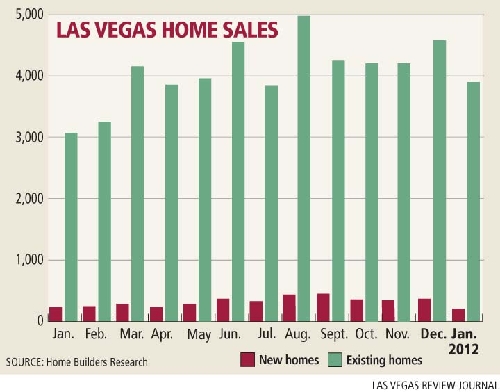

Rising optimism among national home builders has yet to spread to Las Vegas, where new-home sales totaled just 216 in January, down from 237 in the same month a year ago and the lowest level on record, Home Builders Research reported Monday.

The report comes on the heels of the National Association of Home Builders-Wells Fargo home builders' sentiment index increasing for the fifth straight month.

New-home building permits in Las Vegas fell to 222 in January, 10 fewer than a year ago and 158 fewer than two years ago.

The home-building industry remains stagnant in Las Vegas because of many factors working against the housing market, said Dennis Smith, president of Home Builders Research, who has been tracking the Las Vegas market since 1988.

"What's holding back the new-home market is excess inventory in the resale segment," Smith said.

With an estimated 200,000 homes in Las Vegas "underwater," or worth less than the principal mortgage balance, builders are reluctant to resume construction because many of the existing homes could go into foreclosure and swamp the market.

Consumers also might not be able to afford move-in costs associated with buying a new home, including higher down payments and mortgage insurance premiums for those with damaged credit scores, he said.

"Another factor is the insecure job market. Yes, we're creating jobs in hospitality. That's great, but we're not creating jobs that instantly improve consumer demand for housing," Smith said.

Although permits and sales are down, net sales per subdivision are averaging 0.5 to 0.6 a week over the last three weeks, about the same pace as last summer. More people are expressing interest in buying a new home, but they're having trouble qualifying for financing, Smith said.

The new-home median price is holding steady in Las Vegas, slipping less than 1 percent from a year ago at $207,000, according to Home Builders Research. The price has been hovering around the $200,000 mark for about three years, with small increases in some communities.

Las Vegas-based SalesTraq reported 4,434 existing home sales in January at a median price of $100,000, an 8.3 percent decrease from a year ago and the lowest price since the 1990s.

"It could go up next month, but I've got to tell you, I don't see anything acting as a catalyst for change, especially the junky-funky, hokey-pokey $25 billion settlement with the banks," housing analyst Larry Murphy of SalesTraq said.

That doesn't affect homes financed by Fannie Mae, Freddie Mac and the Federal Housing Authority, which is about 60 percent of the Las Vegas market, Murphy said.

"They (banks) almost choke and gag when they say the words 'principal reduction,'" he said. "They say in some cases there may be principal reduction of $34,000. How much are people in Las Vegas upside down? About twice that."

The robo-signing settlement is the latest -- and potentially the largest -- piece in the U.S. housing policy puzzle, said Jed Kolko, chief economist of the Trulia.com online listing service. Partly punishment for wrongdoing, it is also an attempt by the government to help the housing market, he said.

Smith, of Home Builders Research, said the settlement may be a step in the right direction, at least to make banks abide by the rules. Although banks are expected to release more foreclosures onto the market later this year, it will probably be at a pace that will not overwhelm the market, he said.

"The problem is so large and so widespread, the only fix is to let the free-market system work," Smith said.

The gap between new and existing median home prices will stay around $100,000 as foreclosures and short sales continue to apply downward pricing pressure on both and new and resales, he said.

Although new-home sales are down on a monthly basis, there's still a market for consumers who want a quality product delivered in a reasonable period of time, real estate consultant Jeff Galindo said.

"What new builders continue to offer is flexibility and the opportunity to purchase now and be able to move your family here when you want," he said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.