Lower prices help homes sell

WASHINGTON -- Sales of previously occupied homes jumped unexpectedly in February by the largest amount in nearly six years as first-time buyers took advantage of deep discounts on foreclosures and other distressed properties.

Economists said sales, while still at levels not seen since 1997, may finally be coming back to life after declining sharply following the stock market plunge last autumn.

Prices, however, are expected to keep falling well into the year. Tens of thousands of homes remain tied up in the foreclosure process and are not yet for sale. Plus, as the recession deepens and job losses mount, many buyers are likely to stay on the sidelines.

"The four-letter word in the housing market is 'jobs,'" said Nicolas Retsinas, director of Harvard University's Joint Center for Housing Studies. "If you're worried about having a job tomorrow, you're not likely to buy a home now."

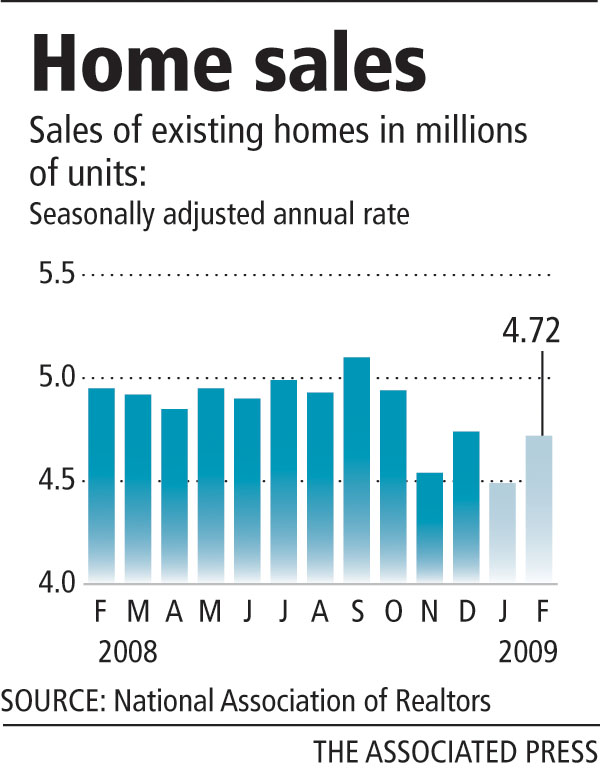

The National Association of Realtors said Monday that sales of existing homes grew 5.1 percent to an annual rate of 4.72 million last month, from 4.49 million units in January.

It was the largest monthly sales jump since July 2003, with first-time buyers accounting for about half of all transactions. Sales had been expected to dip to an annual pace of 4.45 million units, Thomson Reuters reported. The results, which came after a steep decline in January, mean that sales activity has returned to December's levels, but still remains lower than most of last year.

"If January was a disaster for housing, February may be the rebound month," Naroff Economic Advisors President Joel Naroff wrote.

In Las Vegas, one of the nation's hardest-hit housing markets, existing-home sales have surged from a year ago.

Home Builders Research reported 2,606 resales in February, up slightly from 2,536 in January. For the first two months of the year, sales of existing homes increased 70 percent from a year ago.

Although the number of home closings has been strong relative to other statistics, the number of new listings coming on the market is more than keeping pace, housing analyst Dennis Smith of Home Builders Research said.

New listings in February show a continued softening trend in prices, he said. The median price of a home in Las Vegas was $145,000 in February, down 38.3 percent from a year ago.

Potential foreclosures from the resetting of adjustable-rate mortgages are perceived to be "hanging over the housing industry like a dark cloud," Smith said. However, those numbers may be overstated.

"Most of these loans that are now resetting are bringing owners a lower payment than what they had before the reset," he said.

Las Vegas last month had the highest foreclosure rate among metropolitan areas with populations of 200,000 or more, Irvine, Calif.-based RealtyTrac Inc. reported earlier this month. One in 60 housing units in the area received a foreclosure filing, more than seven times the national average

The sales figures don't yet reflect the new $8,000 tax credit designed to lure even more first-time buyers into the market. That should buoy early summer sales, but how much will depend on the overall condition of the U.S. economy.

The median sales price plunged to $165,400, down 15.5 percent from $195,800 a year earlier. That was the second-largest drop on record and prices are now off 28 percent from their peak in July 2006.

However, seller asking prices are starting to rise in places like San Diego and Orange County, Calif., where declines have been severe, said Lawrence Yun, chief economist for the Realtors. That could be an early sign that prices are stabilizing in the most distressed parts of the country.

Review Journal writer Hubble Smith and Bloomberg News contributed to this report.