LV foreclosures double

Foreclosures have doubled in Las Vegas from a year ago and the next wave of adjustable-rate mortgage resets could deepen the misery for an already severely depressed housing market, experts in the housing industry said.

About 1.5 million loans, representing more than 40 percent of the outstanding stock of subprime ARMs, are scheduled to reset this year, according to the Federal Reserve.

The interest rate on a typical subprime ARM will increase from just above 8 percent to about 9.25 percent, raising homeowners' monthly payment by more than 10 percent to $1,500 on average.

Mississippi, Arizona and Nevada are among states that have seen triple-digit increases in real estate-owned properties, or homes that have been repossessed by the lender, Alexis McGee of Sacramento, Calif.-based Foreclosures.com said.

Nearly half a million homes, or six out of every 1,000 households nationwide, went into foreclosure in the first half of the year. California led the nation with 116,857 foreclosures, or 10.2 out of every 1,000 households.

On a per-household basis, Nevada was No. 3 in the nation with 20.3 foreclosures for every 1,000 households, a 167 percent increase from a year ago, according to Foreclosures.com.

"If the trend continues, we could see 1 million properties lost to foreclosure across the country by year-end," McGee said.

Southern Nevada had 1,266 new foreclosures in July, or 41 a day, Las Vegas-based research firm Applied Analysis reported. That's up 61.9 percent from 782 in the same month a year ago.

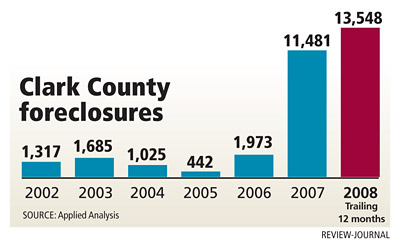

For the past 12 months, foreclosures reached a record 13,548 homes, nearly double the figure reported for the 12 months ended July 2007. The number of preforeclosures, or those in the foreclosure process, also remained high at 5,175 units.

It can take four to six months for a home to go through the foreclosure process, from notice of default to notice of trustee sale to final eviction and bank repossession.

Residential fundamentals continue to show moderation, Applied Analysis principal Brian Gordon said. While overall inventory has declined and existing-home sales have increased, downward pressure on pricing may persist, he said.

"Consumers waiting on the sidelines may find themselves trying to time the market at its absolute low point," Gordon said. "This timing element and continued uncertainty will likely extend the recovery time in the residential sector."

Flexibility on the part of banks will also play a big role, he said. With about 2,000 short sales awaiting bank approval and 6,210 short sale listings, continued softness will likely prevail in the short run, Gordon said.

The vast majority of subprime adjustable-rate mortgages were originated in 2005 and tended to be two years to three years in length, sales director Mark Carrington of San Francisco-based First American Core Logic said.

"So right now, we're definitely feeling the peak in all of those subprime ARM resets," Carrington said. "We haven't done an analysis to show the correlation between resets and foreclosures, but it's safe to say as long as housing is in this depreciation path, when some of these loans reset, some are not going to be able to refinance and some are going to go bad."

The number of subprime mortgages in foreclosure rose from 4 percent last year to 14 percent this year, Carrington said. What seems to be coming next is prime loans going to foreclosure, which increased from 0.4 percent last year to 1.8 percent this year, he said.

"We're starting to see a ramp-up of prime foreclosures in our analysis," he said.

Realtor Steve Hawks of Remax Platinum in Las Vegas said he's seen a sharp increase in homeowners needing to do a short sale because of ARM resets, job loss or a drop in income.

"We will know for sure in about three to six months because of the lag time, but if you add the slowing economy, rising unemployment, lower visitor count, existing foreclosures and rising interest rates, I would say it's a very strong and likely chance we will start to see Alt-A and prime mortgage foreclosures increase dramatically," Hawks said.

President Bush recently signed legislation to help lenders and homeowners with foreclosure issues. The bill would replace existing mortgages with new mortgages at 85 percent of the current market value, guaranteed by the Federal Housing Administration.

One of the main "workout" policies for homeowners in foreclosure is called "Hope Now," in which lenders voluntarily postpone the resetting of interest rates about to take place in the coming months.

The Bush administration estimates that more than 500,000 mortgages have been modified through the policy and another 500,000 are in the process of being modified.

California, Florida, Arizona and Nevada combined represent 62 percent of all foreclosures on prime loans and nearly half of all subprime ARM foreclosures started in the first quarter, the Mortgage Bankers Association reported.

"While the foreclosure start rates were up for all types of mortgages, a reflection of the decline in home prices, the magnitude of the national increases is clearly driven by certain loan types and certain states," said Jay Brinkman, vice president of research and economics for the association.

For example, while subprime ARMs represent 6 percent of outstanding loans, they accounted for 39 percent of foreclosures in the first quarter. In comparison, prime ARMs represent 15 percent of outstanding loans and 23 percent of foreclosures.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.