LV home prices fall to level not seen since 2003

After showing improvement in December, the Las Vegas housing market relapsed in January with a drop in sales and a steeper slide in prices.

The Greater Las Vegas Association of Realtors reported 2,224 single-family home sales in January, a 126.2 percent increase from the same month a year ago, but down 11 percent from December. Sales began trending up in May, topping 2,000 and staying there for the rest of 2008.

The median home price fell to $160,000, a 36 percent decrease from a year ago and an 8.6 percent decrease from December. Median home prices were last at that level in 2003, according to Home Builders Research.

Condos and townhomes experienced similar trends. Sales increased 161.9 percent to 440 units, while median prices dropped 50.6 percent to $80,000.

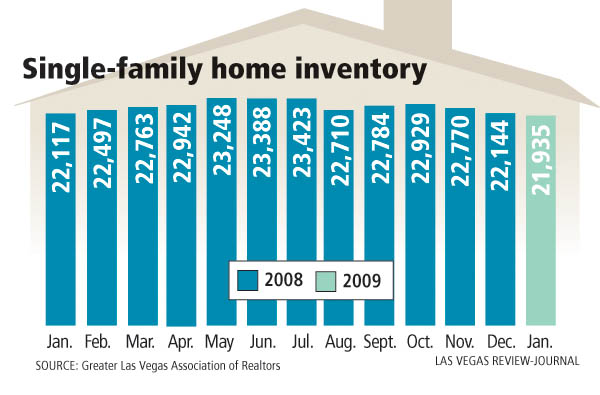

Inventory of homes for sale remained steady at 21,935, down 0.9 percent from a year ago.

The $15,000 tax break for homebuyers approved by the Senate last week should help to revitalize the downtrodden housing market, said Sue Naumann, president of the Realtors association.

A bigger issue, she said, is for banks to release their stranglehold on lending practices.

"We'll have to see what transpires. Just like everything, when the government tries to get in the middle with intervention, they don't know the business," Naumann said. "I don't see how they could stop a foreclosure. That would be contractual interference. The only thing they can do is make it easier to refinance at a fixed rate and keep more people in their homes."

Excessive inventory, foreclosures, job layoffs and tough financing will keep prices down this year, said Ken Lowman, owner of Luxury Homes of Las Vegas.

Home-builder confidence is at a record low. Builders have dramatically reduced housing starts, pulling just 6,129 new permits in Las Vegas in 2008, a 58 percent decrease from the previous year, according to Home Builders Research.

But that's a good sign for the local housing market, Lowman said.

"The market is telling all the home builders that we have too much inventory," he said. "There is a massive overhang of unsold homes, including new homes and foreclosure homes. The market doesn't need any more new homes to be built when there are so many still waiting for a buyer."

Rob Jenson of ReMax Central said the market gave back some of the gains it made in December.

January showed a decline in total sales, including the number of distress sales. Average sales price fell 7.3 percent, the biggest monthly drop in more than a year, he noted. The supply of single-family homes crept up to 10.9 months.

There were no sales of million-dollar condos and only three sales of single-family homes over $1 million, compared with five the previous month.

Lower interest rates and a drop in average prices are attracting more bargain hunters to Las Vegas, Jenson said. Foreclosures and short sales accounted for 88 percent of monthly sales.

That presents buying opportunity, Naumann said. She sold a home in January to a young couple looking to start a family. The home was previously purchased as a foreclosure and was resold after remodeling.

"We looked at bank-owned homes and they're not all that much of a bargain because so much work has to go into it," Naumann said. "If we're not at the bottom, we're pretty dang close. We're seeing a lot more investors come in and buy homes and put them in the rental pool."

Applied Analysis research firm showed a dip in the number of resale homes on the market to 21,868 homes in the first week of February, a decline of 263 units from the previous week. About 35 percent of homes listed for sale were identified as repossessions or bank-owned.

The number of homes listed as contingent or pending sale increased for the fourth consecutive week to 6,989 units. Compared to the prior year, the number of contingent and pending units is up 142 percent, a reflection that sales figures have increased during the same period. About 8 percent of pending units are classified as short sales, which must be approved by the lender.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

+126%-- Amount the median home price has fallen from a year ago

-36% -- Increase in single-family home sales in January from the same month a year ago