LV new-home sales hit new low

The housing market is so down in Las Vegas, it's got the analysts depressed.

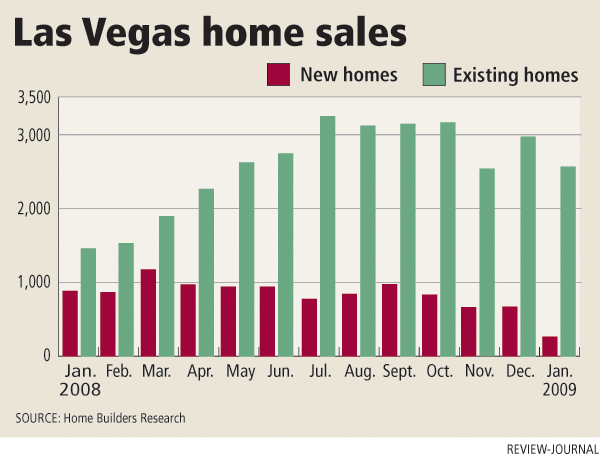

Dennis Smith of Home Builders Research and Larry Murphy of SalesTraq both reported 284 new-home sales in January, the lowest monthly total on record and a fraction of the number sold during the market's boom in 2005 when nearly 40,000 new homes closed escrow.

"They're not good," Smith said of new-home sales. "I anticipated the number to be very low, but when you see the number, it's very shocking."

Homebuilders are not going to start new projects unless they can make a profit, which is difficult if not next to impossible in today's business environment, Smith said. They have to compete not only with foreclosures, but with other builders selling homes for less than $100 a square foot.

"I can't wait for it to change because it will get better," Smith said. "I'm tired of talking to people who are losing their jobs. It's depressing. I'm sure it's astounding many economists how broad this recession is that started with housing."

Concerned that he may have missed something in his tabulations, Murphy said he counted new-home sales three times to make sure the number was correct. It's down 66 percent from the same month a year ago.

The median closing price for new homes was $233,000 in January, down 15.3 percent from a year ago, SalesTraq reported.

Sales of existing homes continue to post huge increases from the year-ago period, largely due to foreclosures, which account for about two-thirds of resales.

Home Builders Research showed 2,536 resales in January, a 70 percent increase from 1,488 in January 2008. The resale median price is $155,000, the lowest price since January 2003, Smith said.

"There's a number that's also shocking," he said. "Anybody who stops and thinks about it says, 'Holy cow, it's a mess.' Half the homes are priced under $155,000."

Again, foreclosures are putting downward pressure on home prices. Murphy said a key statistic is that 67 percent of existing-home closings in January were bank-owned homes with a median price of $139,000. The remaining closings had a median price of $170,000.

Although some analysts have said the Las Vegas housing market is near the bottom, the data suggest it could sink further, Murphy said. The job picture is cloudy and there's no way to reasonably forecast the market with any degree of certainty, he said.

He thinks new-home sales could drop to 6,500 for the year, while existing-home sales pick up to 32,000. Banks are still taking back more homes than they're selling, so foreclosure inventory has yet to peak, Murphy said.

Nevada Assemblywoman Barbara Buckley, D-Las Vegas, presented a plan to the Legislature to encourage banks to work with distressed homeowners. President Obama has announced a $50 billion package to help homeowners avoid foreclosure. Citibank is considering a 30-day moratorium on foreclosures.

"Maybe there's relief on the way, but I'm skeptical," Murphy said. "Everybody agrees that the first $350 billion we gave to the banks was used to shore up their balance sheets. They didn't loosen lending and help stop foreclosures."

Brian Gordon, a principal at Las Vegas business advisory firm Applied Analysis, said low home prices in Las Vegas are not sustainable in the long term. It's a function of supply and demand, he said.

"The market's sitting on a ton of inventory that sellers are looking to unload," Gordon said. "New construction has all but halted. Their ability to compete in price is limited when you look at the resale market. Bank-owned prices are approaching $75 a square foot."

The combination of falling home prices and low mortgage rates has created an environment in which housing affordability is now better than average in most areas, California real estate consultant John Burns said.

Pulte Homes is offering 4 percent fixed-rate financing on several communities in Las Vegas this weekend, with new-home prices starting in the $120,000s.

"Phoenix is the most unique market in the country right now," Burns said. "Any renter with a stable job and the desire to become a homeowner and live in Phoenix for a long time should be buying a home right now because affordability has never been better."

In 2006, owning a typical detached resale home in Phoenix cost $600 more a month than renting a nice apartment, Burns said. Today, owning is $118 a month cheaper.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.