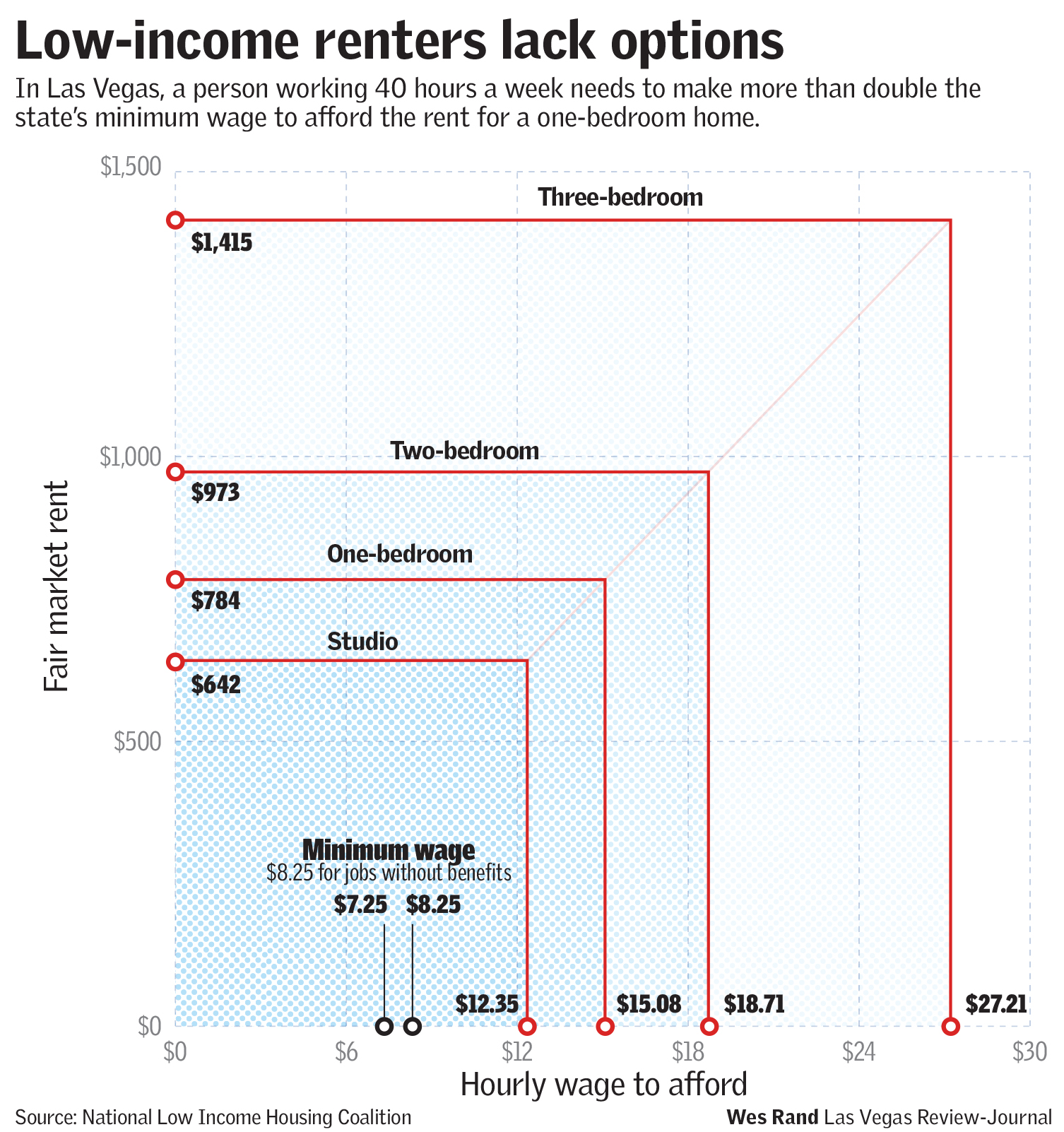

Minimum-wage workers can’t afford Las Vegas rents, study shows

To afford renting a typical one-bedroom apartment in the Las Vegas metropolitan area, a minimum-wage worker without health benefits would need to clock 73 hours a week.

That’s according to annual report released this month by the National Low Income Housing Coalition. The “Out of Reach 2018” study assumes housing is affordable if it costs no more than 30 percent of a person’s income.

Nevada’s minimum wage is $8.25 per hour for employees who are not offered health benefits, and $7.25 an hour for those who do receive benefits.

“It’s clear that the minimum wage is not a livable wage,” said Andrew Aurand, vice president for research at NLIHC. “When you look across the country, in only 22 counties out of more than 3,100 counties in the U.S. could a full-time minimum wage worker afford a one-bedroom apartment.”

CLICK TO ENLARGE

State Sen. Julia Ratti, D-Sparks, chairwoman of an interim legislative committee focused on affordable housing, agreed.

“The only way we will ever fully solve the affordability issue is see growth in wages,” she said.

The study also found that in no state, metropolitan area or county can a worker earning minimum wage and working 40 hours a week afford to rent a two-bedroom home at “fair market rent,” which is calculated by the Department of Housing and Urban Development.

In Las Vegas, a resident working 40 hours a week would need to make an hourly wage of $18.71 to afford a two-bedroom apartment. The study found that the average renter here makes $17.12 an hour.

The study is one of several underscoring Nevada’s statewide affordable housing shortage.

The state’s Annual Housing Progress Report found 210,000 low-income households in Clark and Washoe counties need assistance obtaining affordable housing.

In March, the National Low Income Housing Coalition released a separate study that named Las Vegas the country’ worst metro area for providing affordable rental housing for its poorest families. Nevada ranked last among the states.

Mike Mullin, whose nonprofit Nevada HAND builds and manages low-income housing, said there’s not much appetite from developers to build housing priced for low-income families.

“The market would indicate that in order to build apartments with the rising costs of both land and labor, it is necessary to charge much higher rents in order to provide an appropriate return on the investment and the risk,” he said.

Contact Michael Scott Davidson at sdavidson@reviewjournal.com or 702-477-3861. Follow @davidsonlvrj on Twitter.