Most ZIP codes in Las Vegas Valley see growth in home values

After spending years deep in the red, Las Vegas home price appreciation rates returned to the black in 2012 in all but three of the valley’s 58 ZIP codes, SalesTraq housing research firm reported.

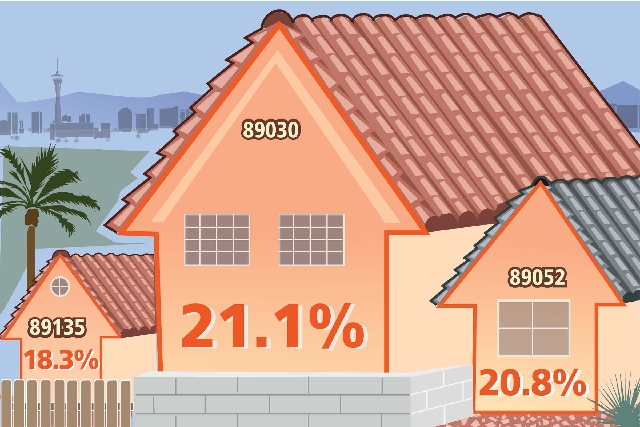

The largest gain was in ZIP code 89030, an area of North Las Vegas around Interstate 15 and Cheyenne Avenue, where median home prices increased 21.1 percent last year, to $45,000.

Ironically, 89030 was also one of the hardest-hit ZIP codes for foreclosures, not just in the Las Vegas Valley, but in the nation. That same turnabout is reflected in many of the ZIP codes that posted double-digit appreciation in 2012.

“In terms of rate of price appreciation, select areas that were hardest-hit have seen some pickup in the last year as prices over-corrected in those areas,” SalesTraq housing analyst Brian Gordon said. “They experienced greater-than-average depreciation and they now have some of the greatest demand and lowest availability, which have helped to drive prices north.”

The negative numbers came in outlying areas such as 89085, the northern-most ZIP code in the Aliante master-planned community of North Las Vegas. Prices dropped 3.5 percent there, from $168,000 in 2011 to $162,100 last year.

Buyers are less willing to pay higher prices for homes that are farthest away from their place of employment, shopping centers, parks and schools, Gordon said. Areas closer to the Beltway in Aliante, such as 89084 and 89086, showed 3.5 percent and 2.9 percent appreciation, respectively.

Home values in Boulder City (89005), which was not included in previous ZIP code reports, depreciated 8.5 percent to $151,000 in 2012.

“If you look at the Las Vegas Valley, you’d see that nearly every ZIP code showed positive appreciation,” Gordon said. “The areas that experienced the most significant growth are ZIP codes in and around master-planned communities like Summerlin and Anthem.”

ZIP code 89052, which includes Anthem, posted the second-highest appreciation rate at 20.8 percent, with a median price of $232,000. That’s up $40,000 from 2011.

Second to 89052 in absolute price gain was ZIP code 89135, in the southwest valley, where the median home price rose by $37,725, or 18.3 percent, to $243,725.

Some areas are sought out more than others because of accessibility and abundance of amenities in quality neighborhoods, Gordon said. Aliante was one of the hardest-hit neighborhoods during the downturn and was a little behind in terms of development. Most of those homes were sold at the peak of the market, and recovery in values is lagging other portions of the valley, he said.

Prices are calculated as a median over all 12 months of the year, Gordon noted. Appreciation rates reflect median prices of homes sold during the respective period, and may not reflect actual appreciation for a single property as the mix of properties sold can affect median price.

“It’s how you look at the data,” the analyst said.

SalesTraq reported a median price of $130,000 for existing homes sold in Las Vegas in December, up nearly 24 percent from the same month in 2011. However, the median price taken for the entire year was up by a more modest 10.7 percent.

Mark Boud, principal of Irvine, Calif.-based Real Estate Economics, said Las Vegas has definitely seen a positive year, though he’s keeping a watch on some “very severe” signs of caution.

“The average home price has gone up about 25 percent. It’s not appreciation. It’s more a reflection of the drastic drop in distressed inventory,” Boud said. “That’s been cut in half.”

Foreclosures, which once accounted for nearly half of all home sales in Las Vegas, are now about 15 percent of the market. The number of foreclosures remains negligible relative to past levels with 253 units returning to the bank in January, according to SalesTraq. Bank repossessions for the last 12 months are down 60 percent to slightly more than 5,000.

While foreclosure activity has come to a near-standstill, Las Vegas ranks among the highest in the nation with 10.5 percent mortgage delinquency, according to the Mortgage Bankers Association.

Boud is forecasting a 5.7 percent annual increase in Las Vegas home prices over the next five years, which is healthy and reflects the undervalued market and continued burn off of distressed inventory.

Bryan Lebo of ReMax Benchmark Realty sees prices rising another 10 percent in 2013. With a limited inventory of existing homes for sale, properties are drawing multiple offers for well above list price, often from cash investors, he said.

“With the offers I’m seeing out there, I don’t see how it (median price) won’t rise 10 percent or more,” Lebo said.

Even if the Legislature amends Assembly Bill 284, Nevada’s robo-signing law that throttled the foreclosure process, inventory won’t improve this year, he said.

One thing to keep in mind is that while prices bounced back in 2012, they’re still far below their peak, said Monte Kane, an accountant for condo and homeowners associations in Las Vegas. When a $200,000 home drops in value to $100,000, that’s a 50 percent decline. When it goes back up to $200,000, that’s a 100 percent increase.

Some 197,000 Las Vegas homeowners remain underwater on their homes, owing more than current market value, according to a fourth-quarter report from Zillow.com.

“So it looks much more favorable on the upside than the downside,” Kane said.

He handles accounts for Lake Las Vegas and Red Rock Country Club and said they’re going through a transition in financial conditions compared to four or five years ago.

“You look at those appraisals ... they’ve been way too low because they’re looking at the lowest of sales,” he said. “Once we see a nice improvement in values, the appraisers are looking at those now, so that’s also favorable.”

Some ZIP codes will continue to show price appreciation, but not at the same level as 2012, said Mark Stark, broker and owner of Prudential Americana Group in Las Vegas. It depends on their location, amenities, product type and current price range.

Stark said his company got “obliterated” during the housing downturn, with his average sales price dropping from $477,000 to $125,000.

By any measure, Las Vegas has entered the early stages of a recovery cycle, Gordon said. He’s seen fairly consistent price increases over the past two years and home sales remain elevated at 3,000 to 4,000 a month.

“There continues to be demand for housing,” he said. “Some of that activity is investor-driven, which is artificially increasing our economy. At the end of the day, we need end-users to stabilize the market.”

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.