New areas hit hardest by home losses

Most foreclosed homes in the Las Vegas Valley are concentrated in newer subdivisions and have average home ages of less than 10 years, a local housing market analyst shows.

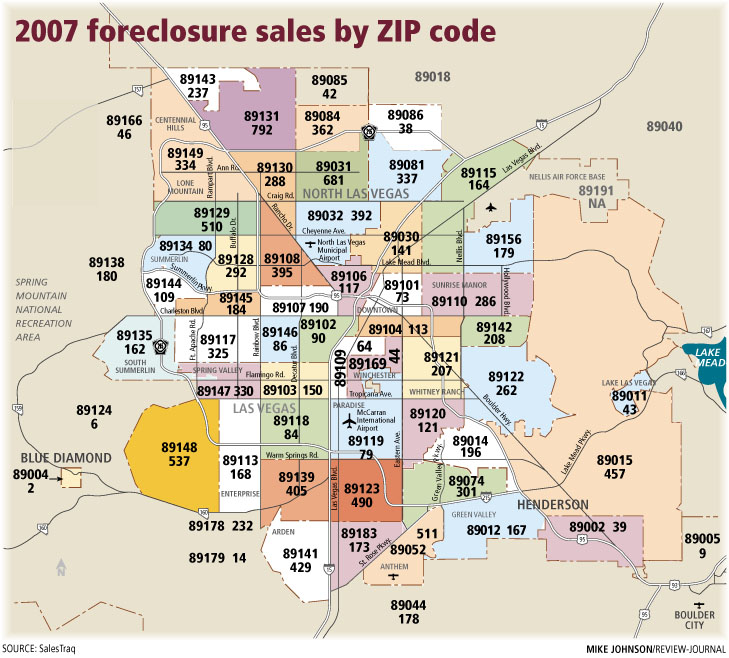

ZIP codes 89131 and 89031 had 792 and 681 foreclosure sales in 2007, respectively, according to Las Vegas-based research firm SalesTraq. The average age of those foreclosed homes was 5.8 years in the 89131 area and 8.2 years in 89031.

The average age of homes in the top 10 foreclosure ZIP codes in Clark County ranged from 4.5 years in 89148 (537 foreclosures) to 25.1 years in 89108 (395 foreclosures). The median was eight years.

"I think that was where the amateur investors and flippers were going because they could get a loan there," SalesTraq President Larry Murphy said. "I can get a new home and it's easier to get a loan. Don't get me wrong. It happened in older areas too, but people flocked to sales offices in 2004 and 2005, they got their houses delivered in 2006 and in 2007 they basically gave it back to the bank."

The average age taken from Clark County assessor's records is calculated from when a building permit was pulled, not the sales date of a home, Murphy noted.

Most of the Las Vegas foreclosure problems are being caused by unaffordable mortgages rather than local economic conditions, said Chris Biaggi, president of All Western Mortgage. Unlike some areas around the country, Southern Nevada continues to show modest employment growth and median household income above the national average.

Biaggi said high foreclosure rates in newer subdivisions are in large part because of out-of-state speculators who bought in those areas with the intent of flipping the property or selling it for a profit in a relatively short period.

"Obviously, that didn't pan out," he said. "That, combined with the exotic financing they were able to obtain, is the issue."

Subprime mortgages, which offer low introductory interest rates that reset at much higher rates, were particularly prevalent in appreciating housing markets such as California and Las Vegas. The median price of an existing home in Las Vegas appreciated 40 percent in 2004 to more than $235,000, SalesTraq reported. Prices in ZIP code 89131 were up 56 percent that year.

Older neighborhoods such as 89108 have their foreclosure problems but to a much lesser degree, SalesTraq data showed.

ZIP code 89004 in the Blue Diamond area had just two foreclosure sales last year, with the average age of the homes at 67 years. A rural area near Blue Diamond, 89124, had six sales, with the average age of the houses at 39 years.

Murphy said he started looking at when homes were built as he searched through sales codes for foreclosures and trustee sales and noticed that newer ZIP codes were the hardest hit.

"Let's face it, when you buy a new home, there's a certain amount of security and peace of mind," he said. "You've got zero maintenance. You know you're not going to have to replace the roof or the air conditioner. The plumbing's covered by the warranty."

The rise in "mortgage walkers" is a new phenomenon for Las Vegas, Realtor Steve Hawks of ReMax Platinum said.

Home prices have dropped to 2004 levels, so most homeowners who bought into communities built after 2005 are going to owe more than their house is worth, he said. Many are "short-selling" their home, selling for less than the mortgage balance or simply giving the property back to the bank.

"When they try to sell for whatever reason, they either have to do a short sale or get foreclosed on. In addition, many investors purchased in these new areas and now are so upside-down they don't see the break-even point," Hawks said.

"Meanwhile, they're paying on a loan that's probably going to adjust, or even if it's fixed, they can't get the rent to cover the mortgage when their new neighbor just purchased the same house for $220,000 when they paid over $420,000. The person who bought for $220,000 can rent it out for far less, obviously, and the snowball continues."

Homeowners are concluding that the smartest economic decision is to walk away, even if they can afford the payment, Hawks said. It's common to see homes that sold for $350,000 to $650,000 in those high foreclosure ZIP codes now going for $220,000 to $400,000, he said.

Nevada is No. 1 in the nation with 18,087 preforeclosure filings through the first three months of 2008, or 2.42 percent of total households, according to Sacramento, Calif.-based Foreclosures.com. Clark County accounts for nearly 16,000 of those filings.

Contact reporter Hubble Smith at hsmith @reviewjournal.com or 702-383-0491.