New-home sales slip in November

Reports of an improved housing market are starting to trickle into the national media, but that's not happening yet in Las Vegas, a local housing analyst said Tuesday.

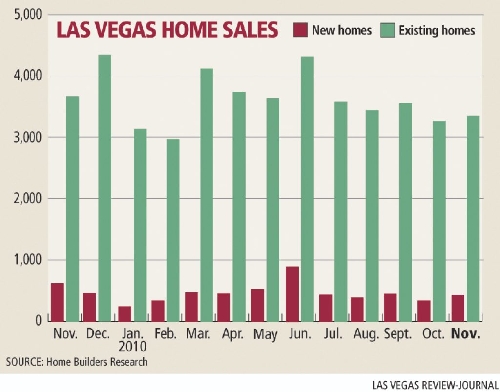

There were 408 new-home sales in Las Vegas in November, a dramatic drop from 604 in the same month a year ago, Home Builders Research reported. It brought the 11-month total number of sales to 4,976, a 3.6 percent increase from last year.

The median price of a new home rose less than 1 percent to $200,850.

The Las Vegas-based research firm counted 3,354 recorded resales in November, bringing the annual total to 38,838, a 4.2 percent decrease from a year ago. The median resale price also declined 4.8 percent, or $6,000, to $120,000.

Housing analyst Dennis Smith said he expects the number of resale closings to decline during the fourth quarter as foreclosure issues work their way through banks and servicing companies.

"It's just a continuation of what we've been seeing," the president of Home Builders Research told the Review-Journal. "Don't expect much of a change in resales until after the first of the year when the banks decide to resume releasing foreclosures. And when I say 'banks,' I mean Freddie Mac and Fannie Mae. They own or control 50 percent of the mortgages."

A separate report from Las Vegas-based SalesTraq showed 391 new-home closings in November, down 42.9 percent from November 2009, at a median price of $200,850, up 1.2 percent from a year ago. New-home prices were boosted slightly by 28 high-rise and midrise condo closings at a median of $305,000.

Existing-home closings totaled 3,916, an 11.6 percent decrease from a year ago, while the median price dropped 6.3 percent to $115,000.

New-home sales peaked at 983 in June, about twice the monthly average for the year, largely because of the $8,000 first-time homebuyers tax credit that expired in April, SalesTraq President Larry Murphy said. It usually takes 30 days to close escrow, longer if it's a short sale.

Short-sale listings, or homes offered for less than the mortgage balance, broke the 50 percent mark for the first time, suggesting that banks are showing a preference for short sales over foreclosures, Murphy said.

He counted 951 bank foreclosures in November, half of the 1,900 average for the first 10 months of this year. That's likely a result of the much-ballyhooed but short-lived foreclosure moratorium caused by the "robo-signing" scandal, Murphy said.

"Does that mean we can expect bank foreclosures to snap back to their normal level of about 1,900 next month? Probably not," Murphy said.

For one, it's the Christmas season and "apparently even the Scrooge banks have some heart," he said. Foreclosures hit their lowest monthly level last year in December. There's also some lingering effect from the robo-signing scandal.

The main reason for the falloff in November is that banks are finally realizing they're better off pursuing short sales than foreclosures, Murphy said.

SalesTraq reported 824 short sales at a median price of $125,000; 308 auction sales at $91,000; 1,595 real estate-owned, or bank-owned, sales at $111,000; and 1,187 nondistressed sales at $119,000.

Murphy said he sees another year or two of distressed properties coming on the market, which means prices are likely to remain suppressed for a while.

However, the "tsunami" of foreclosures did not hit Las Vegas in 2010, just as Murphy had predicted earlier in the year.

"We noted that the banks at that time appeared reluctant to foreclose on homes expeditiously and that many people were still living in their homes many months, even a year or more after they stopped making their payments," Murphy said. "Why? Because banks sensed the very precarious nature of the housing crisis. They realized that aggressively proceeding with foreclosing as their first remedy would be self-defeating, driving prices down both lower and faster. That's the reasoning underlying the short sale. Leave the homeowner in the home, let him maintain the home, and help him out of his underwater condition."

Data firm CoreLogic found that about 10.8 million households, or 22.5 percent of all mortgaged homes, were underwater in the third quarter, down slightly from 11 million in the second quarter.

The decline happened because more homes had fallen into foreclosure, not because home prices had increased, CoreLogic emphasized in its report.

Smith of Home Builders Research said it's good to hear consumer confidence is improving in other parts of the country and that it's pretty obvious that much of the country has seen the bottom of the recessionary cycle.

"This is encouraging for Las Vegas," he said. "Anything happening as a positive around us is good for us. It means people's confidence is improving and they're spending more money and that's good for Las Vegas."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.