Officials in every state launch joint foreclosure probe

WASHINGTON -- A joint investigation by every state and the District of Columbia could force mortgage companies to settle allegations that they used flawed documents to foreclose on hundreds of thousands of homeowners.

It could take months, at least, for any settlement to be reached. But legal experts say lenders could be forced to accept an independent monitor to ensure they follow state foreclosure laws. The banks could also be subject to financial penalties and be forced to pay some people whose foreclosures were improperly handled.

For banks, "the most efficient way for them to get out from under this is to settle across the board," said Kathleen Engel, a law professor at Suffolk University in Boston.

Employees of several major lenders have acknowledged in depositions that they signed thousands of foreclosure documents without reading them as required by state laws.

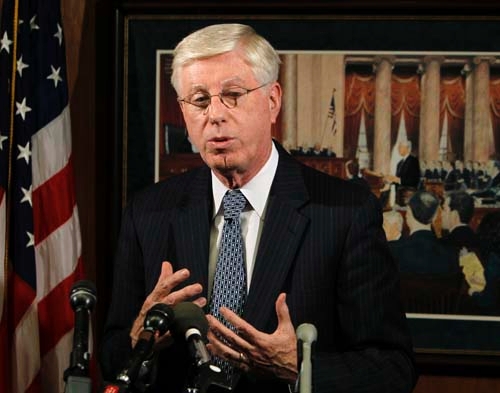

"This is not simply about a glitch in paperwork," Iowa Attorney General Tom Miller, who's leading the probe announced Wednesday, said in a statement. "It's also about some companies violating the law and many people losing their homes."

"This issue affects people's homes as well as the economy," Nevada Attorney General Catherine Cortez Masto said in a statement Wednesday. "This probe will be thorough, expeditious, and fair to both homeowners and lenders."

At a news conference, Miller said the states might be open to alternatives to financial penalties for the banks. They might, for example, agree instead to have lenders step up their efforts to help people reduce their loan payments so they can avoid foreclosure.

The document problems could prolong the housing downturn if many homebuyers become unwilling to purchase foreclosed homes. But for a few months anyway, the problems could help prop up prices, because fewer low-priced foreclosed homes will be for sale.

Analysts don't expect many people who lost homes to foreclosure to recover them.

The industry has begun to respond to pressure from state and federal officials. JPMorgan Chase & Co. said Wednesday it would extend its review of its foreclosure cases to 41 states -- doubling the number of its cases under review to 115,000. JPMorgan had previously said it was halting foreclosures in the 23 states where foreclosures must be approved by a judge.

This week, GMAC Mortgage, a unit of Ally Financial Inc., said it had hired legal and accounting firms to review its foreclosure procedures in all 50 states. GMAC has halted some foreclosures in 23 states. Bank of America has done so in all 50.

And Wells Fargo & Co. has said it would review pending foreclosures for potential defects. Wells says it's discovered no problems.

In their announcement Wednesday, the state officials said they would review evidence that documents were signed by mortgage company employees who didn't verify the information in them. They also said many documents appeared to have been signed without a notary public witnessing that signature -- a violation of state law.

Attorneys general have taken the lead in responding to the revelations. State officials, not the federal government, enforce foreclosure laws, which vary by state.

Not all attorneys general have identical powers to investigate. Without clear evidence of a crime, they usually file lawsuits to force businesses to stop actions or to pay damages to wronged consumers.

The filing of false documents in court can be prosecuted as perjury. Any lawyers involved in improper foreclosures could suffer sanctions or lose their law licenses for unethical activity.

As part of their probe, state officials will be able to issue subpoenas to extract potentially incriminating documents from the industry. Such evidence could be used in lawsuits or to force settlements with lenders.

A key question is whether state investigators can persuade bank employees to divulge some of the industry's secrets, said Ray Brescia, an Albany Law School professor who has tracked the mortgage crisis. Some mortgage company workers could have a powerful incentive to do so rather than face criminal charges, he noted.

"It's quite possible that there will be insiders who come forward to reveal the inner workings of these "boiler room" foreclosure mills, which likely won't be good for the banks," Brescia said.

Also Wednesday, federal regulators said all mortgage companies that work with Fannie and Freddie will have to review foreclosure documents and refile them if they spot problems. That will affect most of the industry, because Fannie and Freddie own or guarantee about half the nation's home loans.

In cases where no problems turn up, foreclosures "should proceed without delay," the Federal Housing Finance Agency, the agency that regulates Fannie and Freddie, said.