Realtors group reports more homes are for sale

Slow home sales and declining prices haven't stopped owners from putting their properties up for sale in Las Vegas.

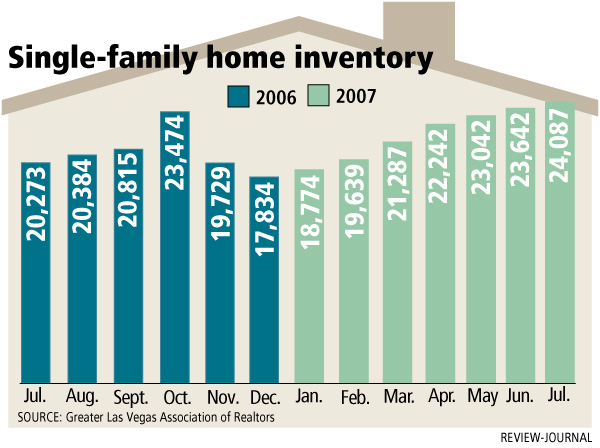

More than 5,600 single-family homes were added to the Multiple Listing Service in July, bringing the inventory to a record 24,087, the Greater Las Vegas Association of Realtors reported Monday. That's up 1.9 percent from June and 18.8 percent from a year ago.

"We knew inventory would climb in the summer," association President Devin Reiss said. "That's typically when people buy and sell."

Sales activity dropped 34 percent from a year ago to 1,318 transactions in July and the median price fell 4.8 percent to $295,000, the first time it's gone below $300,000 since April 2005.

Robin Camacho of Direct Access Lending said her statistics show that Las Vegas housing prices have dropped further than the median price suggests.

"I believe sales will remain slow for about another year and that prices will drop another 4 (percent) to 5 percent over the next year, not nearly as bad as the gloom-and-doomers are predicting," she said. "Any drop is terrible for the homeowner, and uncertainty is a terrible feeling, but I don't think we're going to see prices tumble as some folks seem to think needs to happen."

Reiss said the numbers are further proof that the housing market has tilted toward buyers and that sellers will have to adjust.

"Obviously it's extremely competitive. You need to do everything you possibly can to get your home exposed," he said. "You need to get the home looking as best as possible. Buyers have lots of options. Of course, most important is price. You can price it at the one-year price, the six-month price or the one-day price."

More than half of all single-family homes and 46.8 percent of all condos and townhomes sold within 60 days. Sales volume totaled nearly $500 million in July, a 33 percent drop from a year ago.

The median sales price for condos and townhomes was $195,000 in July, down 3.2 percent from a year ago. Listings increased 28 percent to 6,269 and sales decreased 40 percent to 303 units.

Association statistics are based on data collected through the MLS and do not account for new homes sold by local builders and other transactions not involving a Realtor.

Debi Averett of Phoenix-based Housingdoom.com said she's especially concerned about the credit crunch that continues to worsen. Not only are subprime mortgages gone, but so are most of the so-called Alt-A loans, she said. These are loans in which the borrower possesses a strong credit history but needs nontraditional underwriting and processing.

"Mortgage brokers are complaining that it's hard to write anything that is not a conforming loan. What's left of the nonconforming market is seeing big interest rate increases, so my best guess at this point is that it just got a lot tougher to buy a home with a mortgage over $417,000," Averett said.

"Mortgage brokers are expecting even more credit tightening in the next week, so it's impossible to say just how much of a squeeze this is going to put on home sales."

Preforeclosure filings and homes lost to foreclosure are up on both a per-capita basis and in sheer numbers for the year's first seven months, California-based Foreclosures.com reports. About nine preforeclosures were filed for every 1,000 households through July, compared with 4.9 filings per 1,000 households for the same period a year ago.

"The numbers are dismal, but we had better get used to it because the blood-letting likely will continue for another 12 to 18 months," Foreclosures.com President Alexis McGee said. "It's a tough reality, but many more overextended homeowners not even in default yet won't be able to refinance because of tightened credit markets and will eventually lose their homes to foreclosure."

Reiss said it's hard to tell when the number of foreclosures in Las Vegas will peak as a result of subprime mortgages. Most of them adjusted after a two-year period, so they may have already gone through the cycle, he said.

"As far as lenders, everyone's a lot more stringent. They're pulling back the reins and being more cautious. It'll be a while before they start feeling comfortable, but eventually they'll relax," Reiss said. "Meantime as properties come on the market for sale and continue to add to the inventory, we'll continue to see a drop in prices."

Housing in Las VegasMore Information