Rent here? Who can afford it?

Las Vegas housing, unaffordable?

It's been a while since we've heard that one.

But an affordability problem is exactly what Las Vegas has, according to a new study. The National Low Income Housing Coalition's "Out of Reach 2011" report says the city's average apartment rent outstrips the average wage earner's income by a significant amount.

Local observers quibbled with the coalition's figures, saying their numbers show a substantially better balance between rents and wages.

Regardless of whose statistics you follow, one thing's for sure: A multitude of demographic and economic trends will shape the Las Vegas apartment market -- and the rents people pay -- in coming years.

To understand the rental market's dynamics, start with those disputed figures from the National Low Income Housing Coalition. Using data from the U.S. Department of Housing and Urban Development, the coalition, an advocacy group that says it wants to guarantee decent, affordable homes for low earners, pegged the average monthly rent for a two-bedroom apartment in Las Vegas at $1,067. That means a local earning the city's average hourly wage of $14.52 would need to work 57 hours a week to swing the rent, utilities and other essentials. A renter earning the state's minimum wage of $8.25 would have to work 99 hours a week to afford the typical two-bedroom rent.

Danilo Pelletiere, research director and chief economist for the coalition, said the disparity between rents and incomes matters because pricey apartments mean unstable communities, as renters move from complex to complex looking for more affordable places. Expensive housing also drains discretionary income.

"We need to focus on these issues to keep neighborhoods alive, keep stores in business and keep that vibrancy that communities need to survive," Pelletiere said.

Housing and Urban Development officials said they obtain their rent information from a combination of sources, including 2008 Census data, 2009 phone surveys and adjustments for inflation.

But local experts said the report's average rents seem high.

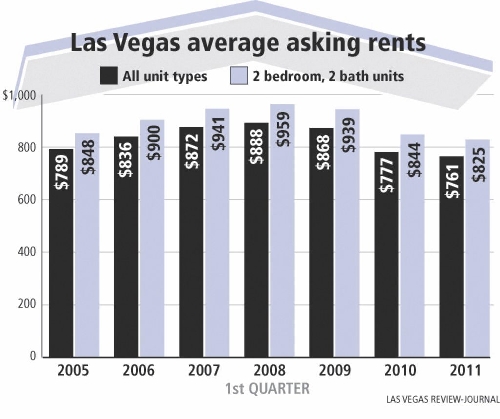

Brian Gordon, a principal in Las Vegas consulting and research firm Applied Analysis, said his company's first-quarter numbers show an average local two-bedroom rental rate of $668 to $825 a month, depending on the number of bathrooms. The market's average overall monthly rent for apartments of all sizes was $761 in the period. Applied Analysis gets its statistics through landlord surveys, conducted most recently in March.

Spencer Ballif, a senior vice president with the Las Vegas office of commercial real estate brokerage CB Richard Ellis, came up with a similar result. Ballif's numbers, which also come from landlord surveys, show an average monthly rent of $867 for two-bedroom apartments in Class A communities, which consist of newer properties with more features and upgrades. A typical two-bedroom Class B unit came in at $717 a month, while two-bedroom Class C units averaged $643 a month.

What's more, average rents are down substantially. Gordon's numbers show the average asking rent on a two-bedroom, two-bath apartment in Las Vegas falling 14.5 percent in the last three years, from $959 in the first quarter of 2008 to $825 in the same period of 2011. Ballif said the average monthly lease rate for all types of units fell from $932 in the fourth quarter of 2007 to $780 in the first quarter of 2011, a 16.3 percent drop.

And that's before you count the concessions landlords offer to lure residents. A standard concession is one month's free rent -- a sweet deal that didn't exist during the market's heyday three to four years ago. Factor in those giveaways, and rents have probably dropped in the 20 percent-plus range, Ballif said.

In fact, rents continue to drop for Camden Property Trust, the Texas-based owner of 29 Las Vegas Valley apartment complexes. Camden's monthly rents range from $399 to $1,300, are still trending negative and dropped 7 percent in 2010, said Myra Rega, the company's regional manager.

"We have a few communities with rents that have turned upward, but for the majority of our communities here, we haven't hit bottom yet. We're still seeing year-over-year decreases," Rega said.

Those drops could stabilize and reverse soon, though.

For starters, apartment occupancies are increasing. Local rental communities posted an occupancy rate of 92 percent in the first quarter, up from 90.1 percent in the fourth quarter of 2009, Gordon said, and the number of concessions is dropping.

Credit the rise in occupancy to the jump in home foreclosures. As homeowners surrender their properties, they move into rental communities, Pelletiere said. The burst housing bubble has increased the number of single-family homes for rent by underwater families looking to cover mortgages on homes they can't sell. But those rental homes haven't proven major competition for apartments because homeowners borrowed at the market's apex, so they have to charge significant rents to pay the mortgage.

Ballif said it's difficult to determine how many distressed single-family homes might end up in the city's rental pool.

What is clear: Few new apartment communities are planned or under construction, and that could constrain apartment supply in coming years. Las Vegas averaged 5,100 new apartment units annually during its prerecession boom; expect 1,200 units a year in the future, Ballif said.

That flat supply could run head-on into a growing demand for rental units, depending on the economy and demographics.

Incomes are stabilizing as average hours worked per week begin to bounce back from recession-era lows, Gordon said. There's also stabilization in the job market. Job creation jumped in March and unemployment fell to 13.3 percent, down from 14.9 percent in December.

Those trends will likely mean more renters in coming years, Pelletiere said, as roommates and extended families who doubled up to survive hard times can afford to strike back out on their own.

Rega said Camden officials expect occupancies and rents to stay steady through 2011, and move upward in 2012.

Marketwide, annual rent increases of 2 percent to 3 percent could return beginning in 2012 if local employers create more jobs, Ballif added.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512.