Report on home prices shows mixed signals for national recovery

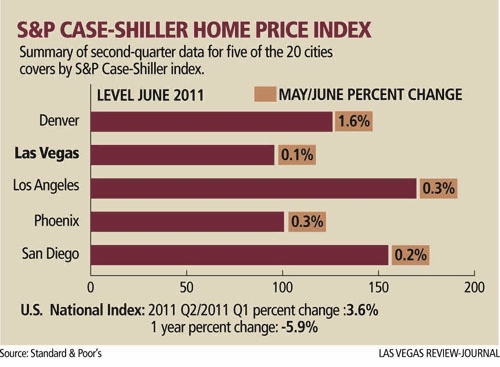

Home prices rose 3.6 percent nationally and 0.1 percent in Las Vegas during the second quarter, the S&P Case-Shiller Home Price Index showed Tuesday.

Nineteen of the 20 metropolitan statistical areas covered by the Case-Shiller Index were up in June from May. Las Vegas had an index reading of 95.67 in June.

With the second quarter's non-seasonally adjusted data, the national index recovered from the first-quarter low, but still posted a 5.9 percent decline from second-quarter 2010.

"This month's report showed mixed signals for recovery in home prices," David Blitzer, chairman of the S&P Index committee, said in a statement from New York. "No cities made new lows in June, and the majority of cities are seeing improved annual rates."

Looking across all cities, eight bottomed out in 2009 and have remained above their lows, including all of the California cities. At the other extreme, those cities that set new lows in 2011 include four Sun Belt cities -- Las Vegas, Phoenix, Miami and Tampa -- as well as the weakest market, Detroit.

"These shifts suggest that we are back to regional housing markets, rather than a national housing market where everything rose and fell together," Blitzer said.

Cleveland has improved enough that average home prices are back above January 2000 levels. Only Detroit and Las Vegas remain below those levels.

Median home prices continue to fall in Las Vegas and probably will for another year, analyst Dennis Smith of Home Builders Research said Tuesday.

"I don't see any reason for prices to show any significant increase for the next six months to one year, at least," Smith said.

Home Builders Research showed the median existing-home price dropping to $109,900 in July, a 10.9 percent decrease from a year ago, but only $100 below the previous month.

Smith said Case-Shiller uses a different method to measure home prices, but the index is still susceptible to the same month-to-month variations as his statistics, which are based on actual escrow closings recorded at the Clark County assessor's office.

"You're going to see one month go up, two months go down,'' Smith said. "Most people in the industry don't pay much attention to month-to-month change.

"The reality is the inventory is what it is,'' he said. "We all know there's excess inventory and we all know the banks are holding onto homes and not releasing them into the marketplace."

The Greater Las Vegas Association of Realtors reported 22,442 single-family homes available for sale on the Multiple Listing Service in July, a 3.2 percent increase from a year ago. About 45 percent of monthly home sales are real estate-owned, or bank-owned.

Las Vegas-based research firm SalesTraq shows a bank-owned inventory of 10,478 homes in July, down from 13,290 a year ago.

Many REOs have been on the market in Las Vegas for six months to a year. If they don't sell within 30 days to 60 days, there's something wrong with them, Smith said. They're probably in such bad condition that they don't "pencil out," or make financial sense, for investors, he said.

Radar Logic predicted in its June RPX housing price report that the Case-Shiller Index would show its largest month-over-month increase in at least a year.

"We expect RPX values to decline in coming months due to seasonal factors and we expect similar declines to be visible in the unadjusted S&P Case-Shiller Composite indices," Quinn Eddins, research director for New York-based Radar Logic, said in an e-mail Tuesday. "However, the declines in the indices are likely to be delayed by one or two months relative to the declines in the RPX due to the smoothing inherent in the Case-Shiller methodology. Housing appears poised to take another leg down. RPX prices will reflect this sooner than other indices, but the others will catch up."

Twelve of 20 MSAs in the Case-Shiller Index have now risen for three straight months, a sign of seasonal strength in the housing market. The strongest gains in June were made by Chicago and Minneapolis, each at 3.2 percent.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.