Resales provide only good news in housing

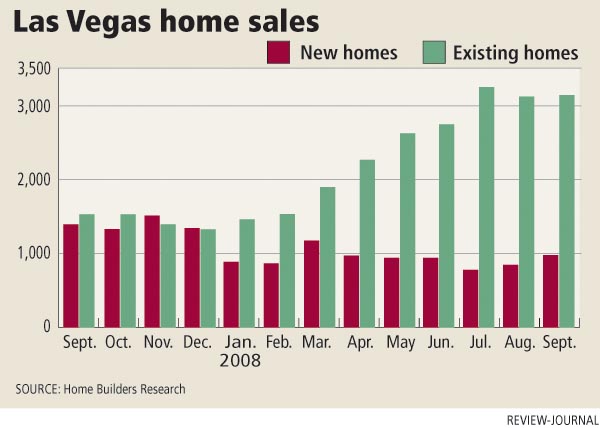

The housing outlook continues to be bleak for Las Vegas, with lagging new-home sales and falling prices, but existing-home sales topped 3,000 for the third straight month, Home Builders Research reported Thursday.

The data showed 976 recorded new-home sales in September, bringing the year-to-date total to 8,292, a 46.7 percent decline from a year ago.

There were 2,545 new-home sales in the third quarter, a decrease of 2,546, or 50 percent, from a year ago. The new-home segment peaked in the fourth quarter of 2005 with 11,198 sales.

"In our opinion, during the fourth quarter, we will see further weakening before finally settling at the bottom of the quarterly new-home sales activity," Home Builders President Dennis Smith said.

The median price of a new home dipped to $251,000 in September, down 2 percent from August and down 20 percent, or $62,480, from the same month a year ago.

Smith counted 3,125 resales in September. The nine-month total of 21,845 resales represents a 6.3 percent increase from a year ago.

"Even if 80 percent of the existing-home sales are now foreclosures and short sales, that's OK," Smith said. "We are moving inventory and that is important for a recovery."

The median existing-home price in September was $189,000, a decrease of $73,377, or 28 percent, from a year ago.

New-home building permits remain at their lowest levels in decades. There were 461 permits pulled in September. The year-to-date total is down 53 percent at 5,452.

October home sales will probably come down, Debi Averett of Housingdoom.com said.

"My best bet is that a lot of buyers rushed to take advantage of down-payment assistance before it was no longer available," she said. "The bump in September sales will probably take away from October sales, so I expect sales to be down quite a bit month to month."

What's missing from the Emergency Economic Stabilization Act is a "stay of execution" for the death of down-payment assistance, housing analyst Lisa Jackson of John Burns Real Estate Consulting said.

Despite some initial traction from a last-ditch, grass-roots effort to preserve seller-funded down payment assistance, the financial crisis engulfed the momentum, she said.

Elimination of down-payment assistance is going to hurt demand for housing as almost all buyers will need a 3.5 percent down payment. While some builders may have seen a recent uptick in sales, long-term demand will certainly fall, Jackson said.

"In other words, R.I.P. You'll be missed by many," Jackson said.

The housing slump has taken its toll on home builders, the latest being Concordia Homes of Nevada. The Henderson-based builder closed its sales offices at subdivisions in Southern Nevada and Arizona.

"Concordia Homes has taken an action that was necessary to reflect the realities of today's home building market," Concordia President Gidget Graham said Thursday in a company statement. "The main factor that led to this decision was the rapid decline in real estate values."

Graham said Concordia's main office remains open and the intention is to reopen sales centers when market conditions improve.

Smith said he's talked with two other smaller home builders who reported losing residential lots to creditors.

"Hopefully, the credit markets will loosen soon, before more home builders are victims," he said. "Home builders are a very resilient group. Some are hibernating, waiting for the market to turn before re-emerging in an atmosphere of pent-up consumer demand."

Despite falling prices, Averett said, it looks like the housing market is experiencing a bit of a recovery, "if the credit crisis and cooling economy don't kick the legs out from under it."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.