Retirees’ income dried up when high-flying investments crashed

A couple of years ago, Bonnie and Clyde Petersen were living the good life. The retirees were pulling down $150,000 in interest payments yearly on $1 million invested with hard-money lender OneCap Mortgage.

Today, the Petersens, who are now divorced but remain friends, expect to lose their separate homes.

Clyde Petersen, a 79-year-old chemist who owns several patents, is struggling to live on $14,400 a year in Social Security benefits. His ex-wife, 67, returned to work, becoming an airline ticket agent to supplement her $8,400 in yearly Social Security benefits.

They are among many local retirees who are struggling to cope with personal financial problems after Southern Nevada and the nation slipped into recession.

Like people who are still working, retirees have seen the values of their homes plunge. Their investment holdings have grown tiny and the yields on their bank savings and certificates of deposit have shrunk.

Unlike workers, however, retirees often cannot replenish their investment holdings with savings from earned income.

And many retirees are wondering if they will live long enough to see their stock and other investment holdings regain previous highs.

Investment analysts say there are no simple, pain-free ways to deal with the worst economic slump in decades; but they say retirees and those nearing retirement can take steps to protect their remaining investments and to prepare for future financial security.

With few exceptions, the recession has stung people at almost every income level.

"I don't think anyone has avoided this recession," said Russell Price, director of private banking at Nevada State Bank.

Low-income retirees struggle to pay bills for electric power, health care and other essentials, said Barbara Grostick, Clark County's senior advocate program supervisor.

"We're getting more and more folks saying they are facing foreclosure and they don't know what to do," she said.

Price said his clients range from individuals with $1 million in investments to those who once were on the Forbes 400 list of wealthiest Americans.

"I've advised clients to mothball the private jets that they own," Price said.

The banker doesn't recommend selling the aircraft in the current environment, because prices are depressed, but he suggests their owners fly commercial to save money.

Price often suggests clients who are near retirement consider working longer and saving more.

Others have come to the same conclusion.

William Corney, a 65-year-old divorced man, originally planned to retire this year.

Not any more.

With the financial markets in turmoil and the economy struggling, Corney said he will work until the economy stabilizes, maybe a couple of years, maybe longer.

"I like teaching. I'm going to keep on teaching," said the professor of management at the University of Nevada, Las Vegas.

Those who already are retired face fewer choices.

"It's tough out there," said Verlia Hoggard, retired former director of Clark County Social Services. "Everything has gone up. Bread is higher. Milk is higher. Everything is more expensive in the market."

The only things that aren't going up are the interest payments the 70-something widow gets on bank savings, the market value of her stock and bond holdings in her retirement account, and the value of her house.

Her retirement account is gone, and her house in Bonanza Village has lost value. Houses in the neighborhood that sold for $350,000 to $500,000 a few years ago now go for less than $300,000, Hoggard said.

She would like to move to a smaller house but is waiting for the housing market to improve.

However, she has good health coverage including Medicare.

"I can manage. I'm not ready for the cross," she said. "I'm a lot better off than a lot of other people."

Many people lost money in the stock market and stock mutual funds. The S&P 500 Index of the largest publicly held domestic companies fell by about 35 percent over the past 12 months.

Others were lulled into thinking Southern Nevada real estate was bulletproof.

While some investors hold raw land or income-producing properties, many retirees found another way to play the real estate market. They bought into the sales pitches of so-called hard-money firms, private lenders that solicit investor money to make short-term loans to developers.

Lenard Schwartzer, a trustee for individuals in bankruptcy and an attorney for failed hard-money lender USA Capital, had a ringside seat for the unraveling of the hard-money lending business.

USA Capital filed for bankruptcy in 2006 while handling $962 million in investments for about 6,000 individuals around the country. Papers filed in the bankruptcy case alleged that USA Capital defrauded many investors.

Schwartzer said a typical investor in USA Capital was a retired couple with $1,800 monthly income from Social Security.

The couple learned that hard-money lenders, such as USA Capital, would help them supplement Social Security with interest on short-term loans secured by real estate. Developers were willing to pay 12 percent and more for the loans.

So the couple invested all of their $100,000 in savings in those short-term loans. For years, the retirees earned another $1,000 a month from these investments, boosting their income by more than a half.

"The reason you're getting high interest is you're assuming risk," Schwartzer said.

The typical retiree investing in the loans either ignored the risk or was satisfied with assurances from sales people.

It sounded good. If the lender fails to pay, the retired couple could expect to recover when the hard-money lender foreclosed on the property and sold the collateral for cash.

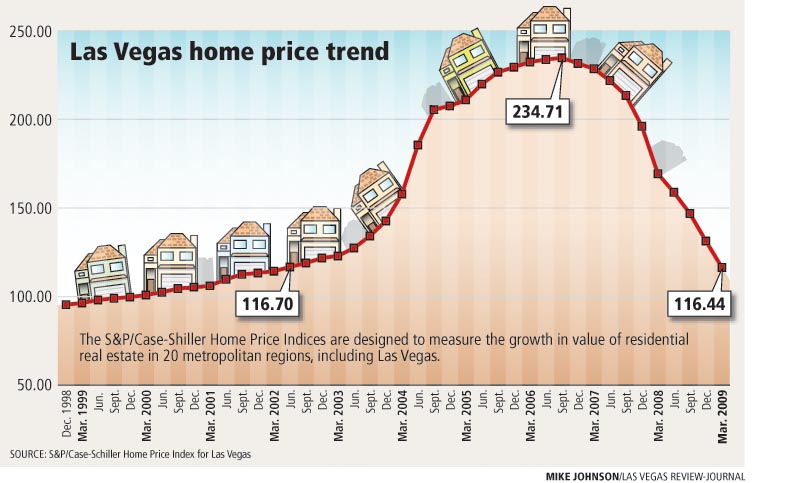

The Las Vegas area had short, temporary slowdowns, such as the one following the Sept. 11, 2001, terrorist attacks; but generally the graph of Southern Nevada real estate prices has been sloping upward for years.

"Since 1992, property in Clark County has gone up in value, except for the last two years," Schwartzer said.

About two years ago, adjustable-rate loans made to residential borrowers with poor credit led to a boom in the housing industry.

Many new homeowners got low teaser rates initially but then could not pay higher mortgage bills when the lenders raised the rates later. They lost their homes, and thousands of recently built Las Vegas homes sat vacant, declining in value and pulling down the value of other properties.

Since then, Las Vegas has become ground zero for the mortgage and real estate debacle.

Clyde Petersen, a retired chemist from Mission Viejo, Calif., started investing in hard-money loans during the boom days. He and his then-wife, Bonnie, had $1 million in liquid assets when they heard about OneCap Mortgage, a hard-money lender.

The Petersens ultimately invested the $1 million in nine loans originated by Vince Hesser's OneCap Mortgage and a OneCap Mortgage fund.

Clyde Petersen liked the fact that the loans were backed by real estate that could be foreclosed on if the borrower defaulted on the loan.

He invested in loans with interest rates ranging from 13 percent to 18 percent that typically matured in about a year.

"When the real estate market turned around, all hell broke loose," Clyde Petersen said.

OneCap started asking investors to grant borrowers forbearance agreements, meaning they would refrain from foreclosing on delinquent loans.

OneCap started billing the Petersens for more service fees and attorneys' fees.

As their income from loans dried up, the Petersens could not make mortgage payments on their homes.

While unhappy, the couple are not in a rage like some who lost fortunes in hard-money loans.

"My attitude is I'd rather collect some of the money that's due me than to vent my anger," Petersen said.

The state's Financial Institutions Division and Mortgage Lending Division fined OneCap Mortgage for multiple law and regulation violations, but OneCap Mortgage has not closed or filed for bankruptcy.

Clyde Petersen is frustrated that state officials have not done more to address problems at OneCap.

Looking back, Petersen acknowledges that he made investment mistakes.

He wishes they had hired a lawyer to read the contracts with OneCap, because he believes he and his wife gave up too many rights to OneCap.

Professional advisers routinely urge investors to divide their holdings into different kinds of investment -- such as stocks, bonds and cash -- so that they may avoid huge losses with any one type of holding.

Clyde Petersen thought holding interests in nine separate OneCap Mortgage loans provided diversification, but he realizes now that it did not.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.

View interview video